How behavior effects the markets…

[youtube://http://www.youtube.com/watch?v=c4VPRYuPNE4 450 300] Comments »Harrisburg PA Expected to Default On Upcoming Muni Payments

“Harrisburg (9661MF), Pennsylvania’s insolvent capital, says it will miss general-obligation bond payments for the first time next week as its receiver seeks approval for a plan to sell assets.

The city, whose debt load of more than $300 million is five times its general-fund budget, will miss $5.27 million in payments due March 15 on two series of bonds, according to a notice its receiver posted on the Electronic Municipal Market Access system, a database for filings by debt issuers….”

Comments »A For Real Recovery: Average Real Income of the top 1% Grew by 11.6%, While the Bottom 99% Incomes Expanded Only by 0.2%

Your Tax Dollars @ Work: Vous Foutu

Americans sunk tens of billions of dollars into General Motors in 2008 and 2009, money which they won’t see any time soon, if at all. The Obama administration strongarmed senior creditors in an unprecedented politically-engineered bankruptcy to get taxpayers to eat the costs of old pension obligations and boost the UAW. All of this was done in the name of making GM a stronger company so that they could eventually pay back the bailout and make better decisions in the future.

So how did that work out? About as well as you’d imagine. As soon as GM had some cash, it decided to invest it — in another car company whose bonds had achieved le junk status:

Attention U.S. taxpayers: You now own a piece of a French car company that is drowning in red ink.

That’s right. In a move little noticed outside of the business pages, General Motors last week bought more than $400 million in shares of PSA Peugeot Citroen – a 7 percent stake in the company. …

Peugeot can undoubtedly use the cash. Last year, Peugeot’s auto making division lost $123 million. And on March 1 – just a day after the deal with GM was announced – Moody’s downgraded Peugeot’s credit rating to junk status with a negative outlook, citing “severe deterioration” of its finances.

In other words, General Motors essentially just dumped more than $400 million of taxpayer assets on junk bonds.

Oh, goody! Just what we US taxpayers need — another car company “drowning in red ink.” But there is some sort of secret synergy that the taxpayers who currently float GM must be missing … right? Right?

An analysis by auto industry consultants IHS said it is “somewhat baffling that GM is willing to get involved in an alliance that it frankly does not need for size or complexity, while still avoiding any public plan to rationalise its European production, cut costs, or deal with labour rates.”

So let’s get this straight. As soon as GM got freed up a little from its own irrational production costs and could deal a little more effectively with its own labor rates, it took cash that it still owes taxpayers and sunk it into a car company whose problems in the exact same areas are as bad or worse as GM’s was before the bailout. What a great investment! Why, that sounds amazingly like the kind of investment expertise that cost taxpayers $535 million in Solyndra.

ABC’s Jonathan Karl notes that while GM bought a big stake in Peugeot, the Peugeot family had an opportunity to buy a stake in GM. They passed on that “opportunity,” which just proves that the Peugeot family is smarter than GM.

This is what government bailouts buy. Instead of clearing the decks at GM and freeing their assets through normal bankruptcy so that more competent hands could put them to better use, the government intervention maintained the same status quo and funded it with taxpayer assets. It’s no great surprise, therefore, that the leadership at GM would toss away money owed to taxpayers to buy a stake in another failing enterprise.”

Comments »Goldman’s Cohen: Investors Flock to Buy Undervalued Shares

“Stocks are undervalued, and investors are coming back in to buy, despite the recent plunge in the Dow, says Goldman Sachs strategist Abby Joseph Cohen.

The Dow Industrials Index touched 13,000 for the first time since May 2008 then promptly plunged several hundred points before recovering ground.

Nevertheless, Cohen figures the S&P 500 at its current level has priced in a 7 percent decline in corporate profits in the coming five years, she told CNBC

“That’s possible but it’s not likely,” Cohen said, “but it gives you a sense of how nervous investors have been, and the sort of opportunities in equities if, in fact, the recession is over and profit growth continues.”

Jobs numbers seem to suggest that the sluggish, but steady, recovery will continue. Official numbers are due tomorrow, but the private ADP report says that employers added 216,000 jobs in February, in line with expectations.

A separate Associated Press poll of economists predicts that the government figure will show 210,000 jobs added, but that the unemployment rate will stay at 8.3 percent. They added that the rate would likely fall to 8 percent by Election Day and to 7.4 percent by the end of 2013.

Meanwhile, employers are laying off fewer workers, down 3.3 percent in February from the month before according to consultant Challenger, Gray & Christmas, and reports are surfacing that manufacturers are struggling to find talent, even paying signing bonuses, a huge shift in the market.

A more downbeat assessment comes from Trim Tabs Investment Research. Its figures are based on daily income tax deposits by salaried employees in the United States.

Their call: The U.S. economy added 149,000 jobs in February, down from a January estimate of 181,000.

“To bring down the unemployment rate, the economy needs to generate at least 250,000 new jobs every month,” says Madeline Schnapp, director of macroeconomic research at TrimTabs. “Job growth of 149,000 new jobs is not terrible, but it is also not a result worth celebrating either.”

Comments »Pacific Rim Economist/ Researcher Kelvin Lau: China Will Ease Cautiously (video)

BEHOLD: The Mark Haines Bottom Revisited (video)

Draghi Lays the Course to End Stimulus and Focus on Fighting Inflation

Update: Greece Reaches 95% Compliance on Debt Swap Deal; Markets Worry About a CDS Credit Event (video)

FLASH: GREECE FAILS TO CONVERT 90% for DEBT SWAP; CDS MAY BE TRIGGERED

FLASH: GMCR STRIKES BACK AT SBUX

Tech Stocks Expected to Love You Long Time

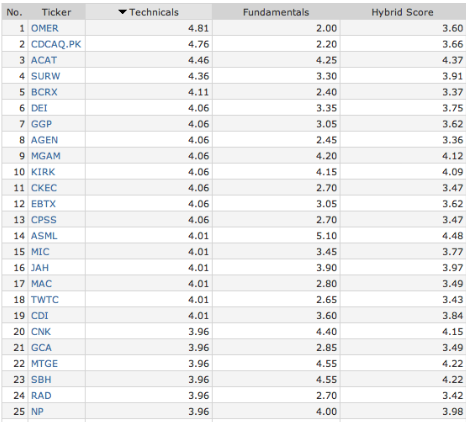

The PPT Top 25

Banks Begin to Offer Pay Day Loans

So Far The IIF Can Only Count on 39% of Greek Bond Holders

The problem with the latest hare-brained scheme in Europe, namely to organize Greek bondholders among the various institutions that for 2 years did everything in their power to dump said Greek bonds in the open market, is that said institutions end up having no Greek bonds in inventory just at the time when they are supposed to have Greek bonds, 24 hours ahead of the Greek PSI deadline. As a reminder, participation in the PSI has to be 75%, with a CAC threshold of 66%, and according to some interpretations even 50% of Greek bondholders voting for the PSI will be sufficient. Which means that with the PSI conclusion just around the corner, or 8 pm Athens time time tomorrow, the IIF, which is the consortium of entities that have every interest in perpetuating the status quo (i.e., do not have Europe ransom demands) and more than happy to “volunteer” for a 70%+ haircut, the IIF only has…

- IIF SAYS MEMBERS PLEDGING SECURITIES EQUAL TO 39% OF EU206 BLN

- IIF SAYS MEMBERS AMOUNTING TO EU81 BLN TO TAKE PART IN SWAP

So according to the IIF itself, 24 hours ahead of the deadline, it does not even have a majority of bondholders accounted for, let alone the plurailty needed for CAC trigger activation. Where are the other €145 billion in Greek bondholders? Why just call up Jeff Sabin at Bingham at 212.705.7747 and find out first hand….”

Comments »Italian and Spanish Bond Yields Fall on Hopes a Greek Debt Swap Goes Off Smoothly

“Italy’s bonds rose for the first time in three days as Societe Generale SA joined companies saying they would take part in Greece’s debt swap.

Spanish government securities also advanced after European Union Economic and Monetary Commissioner Olli Rehn was said to be confident that enough private investors will sign up to the bond exchange. German 10-year yields were within three basis points of a seven-week low after factory orders unexpectedly declined in January. Germany sold 3.3 billion euros ($4.33 billion) of five-year notes.

“The news related to the Greek deal isn’t fantastic but there’s nothing that looks like it might be derailing the whole thing,” which is helping higher-yielding assets, said Marc Ostwald, a strategist at Monument Securities Ltd. in London. “The German factory orders don’t make for great reading, there’s a loss of momentum and that means there are a lot of people who are a little bit wary, so trading will be choppy.”

Comments »Your Tax Dollars @ Work: Welfare Cards Being Used At Casinos, Strip Clubs, Amusement Parks, and Bingo Halls

“Debit cards issued to provide assistance to welfare recipients were used to withdraw cash at ATMs in strip clubs, casinos, bingo halls and amusement parks, a 9News investigation found.

As a result, more than $1 million in welfare funds goes to ATM owners and banks through transaction fees every year.

“When you see the type of obvious abuses that you’ve shown, it says there are people on welfare that should not be,” said Jon Caldara of the conservative watchdog group Independence Institute.

The 9News investigation included the review of 222,000 transactions involving Colorado Quest cards, the state-issued debit cards welfare recipients use to access cash at ATMs. The transactions occurred during a six-month period in 2011 involving a total of $8.1 million in ATM withdrawals…”

Comments »Ag Being Touted as The Next Big Asset Class

“Question for you: Which distinctly British asset class has offered the most attractive returns over the past decade? Central London property? Not even close, even if it has done rather well. UK farmland is the answer, having more than tripled in value over a decade which will otherwise not be remembered for its outsized returns (see story here). The rise in farmland values is not only a British phenomenon. All over Northern Europe and North America farmland values have responded well to higher commodity prices. Last year alone, farmland prices in the US Midwest appreciated by 22% on average (details here).

Now, if ‘rental income’ on farm land is going up as measured by higher crop prices, it is only logical that the value of the land appreciates, similar to the dynamics in the commercial property sector. However, I have long been puzzled by the fact that you find virtually no exposure to farm land in institutional portfolios despite the supremely attractive yields on offer when compared to commercial property. Pension funds happily buy office buildings, earning a return of 4-5%, maybe 6%, yet few have ventured into farmland where yields can be as high as 10% if the farm is big enough and run professionally enough.

In this month’s Absolute Return Letter we will take a closer look at agriculture. Should you be exposed to agriculture in the first place? Is it too late to buy farm land? Are there other and better ways to be exposed to agriculture? These and other questions I will address in the following.

Let’s begin with some numbers to set the stage. There are approximately 7 billion people in the world today. FAO (the food and agriculture organisation of the United Nations) expects that number to grow to approximately 8.3 billion by 2030. The average person consumes 2,780 kcal per day but the average masks a significant gap between the developed and the developing world. Whereas people in developed countries consume 3,420 kcal per day, people in developing countries consume no more than 2,630 kcal per day. By 2030 the average calorie intake is expected to have risen to 3,050 kcal per day, driven primarily by rising living standards in developing countries.

Adding these numbers up, global daily calorie consumption is approximately 19.5 trillion kcal, growing to an estimated 25.3 trillion kcal by 2030 – an increase of about 30%. An increase of that magnitude should, on its own, be quite manageable; however, things are not quite so straightforward. Here is the problem. Whereas diets in developing countries consist primarily of grains (rice, corn, wheat, etc.), diets in the wealthier parts of the world are dominated by protein, fat and sugar.

As the poor get wealthier, they will want more protein – mainly chicken, pork and beef. Converting a grain rich diet to a more protein rich diet will increaseoverall demand for grain significantly as livestock is inefficient in terms of converting grain to energy. It takes 2-3 kilograms of grain to produce 1 kilogram of chicken, about 4 kilograms of grain to produce 1 kilogram of pork and as much as 7-8 kilograms of grain to produce 1 kilogram of beef. Hence, if the average daily calorie consumption grows by 30% between now and 2030 as projected, demand for grain will grow by a multiple of that….”

Comments »France leans towards anti-inflation hawk in ECB board appointment

Comments »PARIS/FRANKFURT (Reuters) – France is prepared to switch allegiance from Spain to Luxembourg in the battle for a seat on the Executive Board of the European Central Bank, according to diplomatic sources, an appointment that would tilt the balance towards anti-inflation traditionalists.

Spain, Luxembourg and Slovenia are in a three-horse race to replace Jose Manuel Gonzalez-Paramo when the Spaniard leaves the ECB at the end of May.

Since the ECB flooded banks with cheap money for a second time last week, some of its policymakers led by Bundesbank chief Jens Weidmann have expressed alarm that the dramatic loosening of lending policy will fuel imbalances in the euro zone and stoke inflationary pressures.

The ECB hawks’ bargaining position could be further bolstered if Luxembourg’s central bank chief, Yves Mersch, wins the race.

French President Nicolas Sarkozy backed Spain to keep its seat on the ECB board before Madrid put forward the ECB’s top lawyer Antonio Sainz de Vicuna as its candidate.

Since then the veteran Mersch, who has one of the strictest anti-inflation stances among ECB policymakers, has entered the race for the post which manages the ECB’s day-to-day business.

Sources said France was now backing him rather than Sainz de Vicuna as part of a grand deal on top jobs at European institutions, which could see France bag the European Bank for Reconstruction and Development.

ECB board members are chosen by euro zone governments rather than the central bank itself. A decision may be made as soon as Monday at a meeting of euro zone finance ministers before being rubber stamped by heads of government at a later date.

Lehman Brothers emerges from bankruptcy

Comments »(Reuters) – Lehman Brothers Holdings Inc emerged from its record $639 billion bankruptcy on Tuesday and said it will start paying back creditors on April 17.

The move puts an end to the bankruptcy proceeding that began on September 15, 2008, when Lehman collapsed and rocked the foundations of the global financial markets, catalyzing the Great Recession.

Exactly 1,268 days later, the case’s end enables Lehman to start distributing $65 billion or so to creditors who had asserted more than $300 billion in claims.

Bankruptcy Judge James Peck approved Lehman’s creditor payback plan in December. Since then, the company has tied up loose ends: selling assets, litigating claims and settling disputes with affiliates and counterparties.

The company will continue to liquidate its holdings under a new board of directors, Lehman said in a statement.