Dodd-Frank in One Graph

We read Dodd-Frank so you don’t have to

By Karen Weise

Big portions of the financial reform law are set to go into effect this year. Intended to make corporate practices transparent, the law itself is anything but. The government has yet to spell out the details of most of the 400 new regulations it imposes. A non-headache-inducing guide.

Go here for the guide. It is well worth a look.

Comments »Twitter and Facebook, Why Twitter Might Be Worth More In The Long Run

Posted by Jeff Carter

Was reading Fred Wilson’s blog on Twitter and started scrolling through the comments. It was pretty interesting to see people’s reactions to the video he posted and their thoughts on Twitter in general.

I have been called the “oldest man in social media” by some of my Stocktwits friends. Quite frankly, I am almost fifty but looking at the revolution I am witnessing in media I feel eighteen. Old media is going to be disintermediated and you can see the panic in their eyes. They know it, the market is starting to realize it and while the sharks aren’t swimming in circles yet, there is enough blood in the water for them to know sooner or later they will feast on some old whale carcasses.

In my home, we usually are pretty early adopters of certain technological things. We had iPods before anyone we knew. My kids had cell phones. They have 2.5 years in age difference, and when they were in high school we noticed there was already a generational gap in communication. With the older it was possible to call or text her. With the younger, only text.

My way to social media came honestly. My youngest daughter created a MySpace profile at the ripe old age of 12 that said she was a swimsuit model and Stanford swimmer! A freaked out father figured he better learn the ins and outs of this stuff and so I delved in. The evolution in social media has been fascinating.

Just to let you know a fun fact. Most economists gauge that it takes 30 years for a real revolution to become maximized in economic terms. The printing press, electricity, steam engines, factories and other innovations took that long to realize their full potential. The same will be said for social media when we look back on it in say, 2035.

Today, I am sensing another pretty major shift that I have been waiting for. Around three years ago, my friend Allan Schoenberg and I were talking about social media. We had just chatted with David Meerman Scott. We had a very stimulating conversation about the markets and Twitter.

Allan and I began having a much richer conversation targeted towards markets after David had left. Allan out of the blue remarked, “Facebook is flat.”. I had to really think about that for awhile. This was early 2009. But Allan was right. For trading purposes, Facebook was a pretty terrible place to try and get information. Twitter was immediate. Links posted could be researched.

Standing in a trading pit all those years, you learn a lot. People not in the know deride floor traders as a bunch of gorillas. But if there is one thing we know about it’s how to react to, find, call bullshit on, and value speedy information. All it would take is working through one unemployment number and you would get a sense of what I was talking about. (Screen trading has a different immediacy and feel by the way.) Twitter isn’t just a stream of information to me. Twitter is a marketplace of information.

Facebook is not a marketplace. It’s a flat place that you go to interact on your terms with people. It’s a great way to stay in contact. Twitter is a marketplace with depth and immediacy. It’s a two sided exchange with buy/sell indicators and an informational “price” that the people market can react too. Newsman are wondering why the electorate seems so volatile in this election cycle and I would simply point to Twitter.

Twitter creates even more transparency. Like one executive was quoted saying in Barron’s years ago, “it’s a river of information.”. That information has huge consequences to existing forms of communication. Any organization that doesn’t understand or harness it’s power opens itself up to attack. I doubt if there are more than a handful of Fortune 500 corporate boardrooms that have one person on their board that really understands Twitter. Most deride it, or fear it.

Why the derision and fear? They fear the transparency that Twitter brings. Because Twitter is a marketplace, it brings the same sort of clarity a financial marketplace brings. When you look at a price on a stock or commodity, and know some sort of history of that price, you draw conclusions about what is happening in the market and the broader world. Same with the information flow on Twitter.

Companies that in this day and age use old style means to counteract crisis find themselves especially vulnerable to the marketplace on Twitter. Their stock price can get dinged significantly. Deft use of the medium can save your shareholders billions. That doesn’t mean spin, it means being honest.

Twitter also distills complex problems into simple easy to understand bites that cause you to investigate deeper if you care. It’s flexible. The users determine the content, not a centrally planned hierarchy. The user determines who to follow, how to use the information they get, and if they want to tweet info or not. All Twitter Co has to do is improve the user interface and make sure it works.

What do you watch business or television news for anymore? Twitter has better more in depth stuff and in real time. Twitter is always five minutes ahead of breaking news. If a disaster strikes, Twitter is a great way to get immediate info, and by keeping one eye on the television you might get more details if they choose to report it. Otherwise, if it is truly important someone on Twitter will do it for the mainstream media, further pushing them into the ether.

Following politicians from either side of the aisle is a waste of time. They use Twitter as a megaphone which is sad. It has so many engaging uses that they could really use it more effectively to flatten and shrink the size of government. Someday maybe they will get it.

I have noticed a change in my kids in the last year. They have all kinds of social media at their disposal. But the way they are communicating with the people that they want to communicate with is Twitter. Now that brings about another discussion not on media giants, but telecommunications and industries associated with it. How are users going to affect change there?

Follow me on Twitter.

Comments »

Rumor of Rumors: Greek Deal a Few Hours Away

Invictus Consulting Group Puts Over 750 Banks at Risk of Failure

CBO: BUDGET DEFICIT TO DROP “MARKEDLY”, THREATENS ECONOMIC STABILITY

Home Ownership Rates Fall From 69.2 to 66%

Bogle, Volcker: Financial System Remains Broken

BILL GROSS: ‘We Are Witnessing The Death Of Abundance’

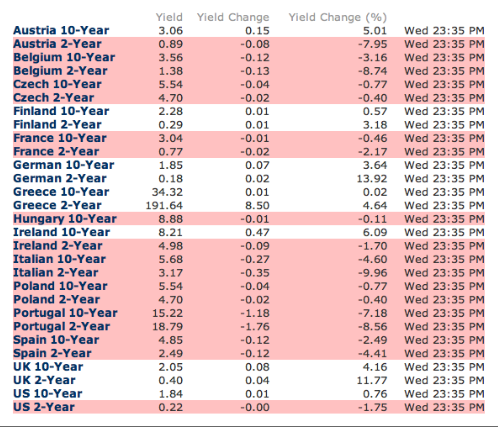

RISK ON: ITALIAN YIELDS UNDER 6%, SPANISH YIELDS UNDER 5%

Italy 5.75%

Spain 4.89%

The 12 Regional Fed Banks Reveal Assets Through FOIA Requests

Survivor Bias and Too-Big-To-Fail Tyranny

Author: London Banker

It’s time to write again about insolvency, as the MF Global failure and the Greek debacle raise new troubling concerns.

As I wrote in Ring Fences and Rustlers before Lehman failed in 2008:

The key to having a happy insolvency, if such a thing exists, lies in ensuring that when a globalised bank goes bust, all the best assets are inside your borders and subject to seizure by [your banks or] your liquidators on behalf of your creditors.

If one were cynical, and one believed that Lehman was going to be allowed to fail pour encouragement les autres one might wonder if Lehman was quietly bidden – or even explicitly ordered – to sell off its foreign holdings and repatriate the proceeds to asset classes within the US ring fence. This would ensure that US creditors of Lehman received a satisfactory recovery at the expense of foreign creditors. It would also contribute to a nice pre-election illusion of a “flight to quality” as US dollar and assets strengthened on the direction of flow.

If one were really cynical, one might even think that a wily bank supervisor might arrange to ensure 100 percent recovery for its creditors with a bit of creative misappropriation thrown in the mix. Broker dealers normally hold securities and other assets in nominee name on behalf of their investor clients. Under modern market regulation, these nominee assets are supposed to be held separately from a firm’s own assets so that they can be protected in an insolvency and restored to the clients with minimal loss and inconvenience. Liberalisations and financial innovations have undermined the segregation principle by promoting much more intensive use of client assets for leverage (prime brokerage and margin lending) and alternative income streams (securities lending). As a result, it is often very difficult to discern in a failed broker who has the better claim to assets which were held to a client account but reused for finance and/or trading purposes. The main source of evidence is the books of the failed broker.

On the wholesale side, margin and collateralisation in connection with derivatives and securities finance arrangements mean that creditors under these arrangements should have good delivery and secure legal claims to assets provided under market standard agreements. As a result, preferred wholesale creditors could have been streamed the choicest assets under arrangements that will look above suspicion on review as being consistent with market best practice.

The official report of the court appointed examiner confirmed my worst suspicions. We now know that the Federal Reserve Bank of New York and the SEC co-located staff inside Lehman from March 2008 to oversee the global repatriation of assets and cash in the run up to the insolvency in September. The Fed kept Lehman on life support during this period with more than $20 billion of liquidity which it paid back to itself from Lehman cash on the day Lehman filed for liquidation. In the meanwhile, from March 2008, Lehman looted its affiliates and client accounts worldwide by using prime broker and securities lending mandates to lend assets to the US affiliate which were sold (hence the sharp fall in Eastern Europe and Asian markets and growing volatility eleswhere from March 2008) and the proceeds streamed to US creditors as margin payments on derivatives and other obligations. The official receiver elected not to challenge the cash transfer to the Federal Reserve or any of the transfers of cash or securities made to major Lehman counterparties and creditors.

Those following the MF Global failure have noted a strikingly similar pattern of conduct by JP Morgan in advance of failure as occurred with Lehman, although without obvious official mandate. Yves at Naked Capital has been covering the parallels admirably. Carrick Mollenkamp, Lauren Tara LaCapra and Matthew Goldstein at Reuters have provided a very substantive story of how JP Morgan used its superior knowledge of MF Global’s trading and credit position to enrich itself at the expense of MF Global and its clients before precipitating the MF Global failure.

I am concerned that MF Global demonstrates that the too-big-to-bail banks have found a new and almost riskless way to make outsize profits. Because derivatives, repo and liquidity are so very highly concentrated now, and leverage is at pre-crisis levels again, these few players can rig the markets and liquidity to choose when and how their clients fail. Their top down view of clients’ trading and custody portfolios and cash positions and flows puts them in a position to exercise tyranny. They can game their clients, taking advantage of superior information, credit and liquidity to ramp or crash targeted markets as needed to precipitate a crisis. They can demand the choicest assets as collateral, setting very high over-collateralisation thresholds, and then exercise during post-failure turmoil to retain everything they hold at rock-bottom prices.

In today’s low volume markets, a crash or squeeze is even cheaper and less risky than ever before. Instead of working for their clients’ success, an unscrupulous clearing bank – or several operating in collusion – can profit on engineering market instability or turmoil.

If one were a conspiracy theorist, one might suspect that such games were being played now in global markets. Perhaps gold is being used as collateral for margin and cash liquidity, sold by counterparties to bring the price lower, leading to margin calls for even more. A crisis arising from a major default (Greece, Portugal, a huge bank) would force the price lower still, when the collateral would be exercised on default. Following on, the price might rocket again to enable the conspirators to seize outsize profits. Just a scenario, mind you! (Although, I note that Lehman’s counterparties reported record profits through much of 2009.)

What is left of the global markets becomes a game of engineered survivor bias. Only those operating outside the law and with unlimited regulatory forbearance can win while the rest of us lose. As I noted in 2008, after Lehman failed, in Financial Eugenics, “It’s not your survival they’re engineering.”

I don’t say absolutely that what I describe is actually happening. But it may be. Certainly market conditions are ripe for it, and MF Global reinforces the pattern.

Read the rest here.

Comments »Biggest Gains in 15 Years, Now What? (history lesson)

+4.7% on the S&P.

The last time the market went up this much in January was in 1997, when it soared 6.18%. It’s worth noting, the market followed through with strength in February of 1997, gaining 0.96%. But, in March of ’97, the market plunged by 4.38%.

The last time we had similar gains was in 2001, when the market moved ahead by 4.45%. In February of 2001, the market crashed by 9.54% and fell some more in March by 5.6%.

Comments »Federal Employees Owe $3.4 Billion in Back Taxes

CFTC Mulling Rules of Dodd Frank Bill for Derivatives

The Euro Strengthens As Debt Talks Progress

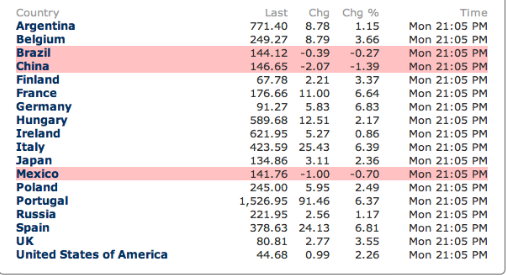

GLOBAL CDS SPREADS RISE SHARPLY

Today’s Biggest Winners

No. Ticker % Change

1 GTXI 49.24

2 ONCY 29.01

3 DHT 26.44

4 PNCL 23.46

5 PBY 23.34

6 TNB 23.07

7 FFN 20.22

8 YMI 19.88

9 RENN 19.24

10 AMLN 18.95

11 NGSX 17.58

12 SVVC 17.10

13 LZEN 16.45

14 MELA 13.73

15 MCOX 13.67

16 OTIV 12.93

17 DEJ 12.86

18 INVN 12.26

19 HTCH 11.88

20 PIP 11.28

21 VHGI.PK 10.77

22 MILL 10.28

23 ARNA 10.06

24 CT 9.13

25 IFON 9.09

> half of US banks who lend to Europe, tighten standards

Comments »WASHINGTON (AP) — A Federal Reserve survey has found that more than half of U.S. banks that lend to European banks have tightened their standards, a reflection of the persistent European debt crisis.

Of the 26 U.S. banks surveyed that make loans to European banks, five said they had tightened their standards considerably in the October-December quarter. Another 10 said that they had tightened them somewhat in the same period, according to the survey released Monday.

Many economists predict that Europe’s debt crisis will push the region into a recession this year. Many European banks are heavily exposed to government debt, making the banks more of a risk.

In the U.S., banks are seeing more small businesses apply for loans, according to the Fed’s quarterly survey of loan officers for large banks.

The percentage of banks reporting increased loan demand from companies with annual sales of less than $50 million rose to the highest level since 2005, the survey found.

That could mean more companies are confident in the economy and may be looking to hire more and expand.

How Poor are the Poor in America ?

They may not be liquid or jet setting to some island, but seemingly the poor in America are doing well compared to say third world poor.

Comments »