[youtube://http://www.youtube.com/watch?v=SozZHZAWS64#t=44 450 300]

Comments »Monthly Archives: July 2014

How Low Do the Markets Go ?

Point wise, today did not feel like a good day.

Volume wise, we seem to have nothing to worry about.

The DOW looks worse than the S&P partly due to the fact we have reached the level where the year began.

The next key level to watch is 1905ish on the S&P. Below that there is a lot of support at 1850ish S&P.

RSI, MACD, & Williams all indicate we have some more room to fall, but i would be surprised if we fall much further. I would bet on a intra day test of S&P 1905 and then some type of reversal.

If we have a stellar jobs report tomorrow then expect the market to fall a bit as the pundits of spin are creating fear over the fed rasing rates sooner than later due to some inflation and improving labor conditions.

Let’s face it, the employment scenario for many, many, many citizens is still terrible.

Also the smart money knows that off balance sheet losses for the big banks is still a major problem; so ZIRP should be in force and there should be no reason to fret about rates moving higher sooner over later.

A worst case scenario would be to see some heavy volume taking the S&P down to the 1815-1830 level. Chances are we do not see this level as the market has that teflon resilience in play.

To be safe, I’m taking half my money off the table hoping the S&P heads lower to give me a good buying opportunity. Luckily, i’m up around 42% for the year so taking some profits would not be a bad thing. If i do not get the buying opportunity i’m looking for then i get to redeploy funds into more issues creating more risk tolerance in a slightly volatile sketchy market.

May the markets be on your side.

[youtube://http://www.youtube.com/watch?v=hzqFmXZ8tOE 450 300]

Comments »

House Clears Way for Lawsuit Against Obama

“House Republicans voted to proceed with a lawsuit against President Obama on Wednesday, saying that his executive actions are so extreme that they violate the Constitution.

The nearly party-line vote — all Democrats voted against it, and all but five Republicans voted for it — further agitated an already polarized climate on Capitol Hill as both parties used the pending suit to try to rally support ahead of the November elections.

Halfway across the continent, Obama almost gloated at the prospect of being sued.

“They’re going to sue me for taking executive actions to help people. So they’re mad I’m doing my job,” Obama said in an economics speech in Kansas City, Mo. “And by the way, I’ve told them I’d be happy to do it with you. The only reason I’m doing it on my own is because you’re not doing anything,” he said of Congress.

The clash came a day before Congress is scheduled to begin a 51 / 2-week summer break and as must-pass bills on reshaping veterans’ health care and highway construction appeared headed for passage — while most everything else was not….”

Comments »Should You Really Be Concerned About Derivatives ?

“………SYSTEMIC RISK FROM CONTAGION

Apart from numerous background pressures, the system limps along deeply wounded and probably fatally so. When China wanted to exit the long-term USTreasurys, the USFed accommodated them. They launched Operation Twist without much clear explanation of its provisions. We are always led to trust the magic of their machinations. China actually transferred their long-term bond holdings to short-term holdings, in order to make possible their redemption at maturity, and soon, like before the implosion. The USFed accomplished the task by putting on an enormous swath of cleverly devised Int Rate Swaps, which in effect switched from LT bond to ST bond. There are a great many other types of derivatives, such as exotic swaps, and customized contracts.

The entire Euro Monetary Union has its foundation created upon swapped hidden debt into FOREX currencies, an illicit deed that to this day has not been resolved. The Maastricht Treaty was circumvented by means of heavy swap contracts, shifting debt onto currency obligations in the form of these derivative swaps. Many were the big investment banks eager to assist in the deception and illicit qualification process, and thus earn big fees. The nations of Italy and Spain, for instance, were able to qualify for the European Monetary Union by hiding their debt with the FOREX swaps. Prosecutions are laced all through the Deutsche Bank chambers here and now, the legal wheels of justice grinding slowly. Therefore, the Euro Currency has a phony fraudulent foundation, an illicit basis enabled by derivative abuse. The victim of the ongoing prosecution, if the USGovt chooses to impose yet more heavy fines, could be the German alliance. The Germans are ready to jump ship, away from the sinking USS Dollar.

Perhaps the ugliest derivative story is the IRS Tax secure stream contract very likely used by China as collateral, which is suspected by the Jackass to be the backend deal to secure a Gold Lease from China. It is related to the 1999 Most Favored Nation granted by US to China. The Chinese would receive gigantic direct foreign investment, and thus build an industrial base. The Wall Street criminal bankers would receive a vast hoard of gold bullion, leased from the Chinese Mao Era gold reserves. The Chinese distrusted the US bankers, after many past experiences, which might include several rafts of fake gold bars sent to Hong Kong banks by the Clinton-Rubin Admin. In the outcome, the Wall Street masters reneged on the gold lease, while the USEconomy entered a downward spiral of recession which accelerates downward. The Jackass suspects that the powerful recession made impossible the honoring of the IRS secure stream derivative contract held as collateral, forcing a national default. In the last few months, we see China busy securing US commercial property. The Chinese have taken control of the JPMorgan Chase headquarters in South Manhattan, the famed One Chase Plaza. In it is contained the largest private gold vault facility in the world. It has underground tunnels connected to the US Federal Reserve. Many are the rumors and suspicions that with the end of the Federal Reserve Act operational contract, following 100 years of hidden financial tyranny, that the Chinese might have taken over a strong interest in the Fed, maybe a controlling interest.

GOLD ON WHITE HORSE

The Western financial system is operating on fragile tenterhooks, on shaky pylons, on that same vaporous floating spinning illusory foundation. A few big banks have entered failure, like Banco Espirito Santo in Portugal. When big banks begin to fail, the belief has been, the risk of contagion will be the main focus. Since Lehman, the major Western banks have lashed themselves together for safety and security. They have done so with financial derivatives, the rope to connect them together. Thus no repeat of Lehman failure, a big financial firm failure to put the entire system at risk of breakdown. So the next failures will put the entire system at risk of collapse. This is the oft-described nuclear outcome, which has been brought upon by the overusage of derivatives. Their total in usage is somewhere between $700 trillion and $1.4 quadrillion, depending on the definition and the team doing the calculation. Claims of big reductions in derivative overall usage are a lie, since new derivatives are put on quickly. They offer short-term security but long-term systemic risk. The world faces a guaranteed systemic implosion caused by derivatives. Bank failures and contagion will lead to the widespread connected failures, and lost control by both governments and central banks to manage them. Gold will be the secure port during the stormy outcomes.

The derivative cost will be revealed as obscene, in high multiple $trillion suddenly. The public will ask questions like how we could have permitted the situation to go out of control. To be sure, derivatives assure the equivalent of a financial nuclear explosion. The answer to the question posed is that the Rubin Doctrine has been used after the Rubin thefts of the USGovt gold reserves at Fort Knox. The doctrine dictates the sacrifice of tomorrow for a few more todays. Well, tomorrow has arrived. The return to the Gold Standard is the answer, but the clean-up crews will be busy for a long time. The Gold Price will reach incredibly high levels when the derivative implosion occurs, which should occur when the East introduces a legitimate gold-backed new BRICS currency for trade settlement. The fallout will be tremendous, as the USDollar is rejected on the global stage.

A solution must also come for the ancillary devious devices like secret weapons on weather, virus, espionage, and more. Gold will continue to draw capital away from the dying corrupted sinking system. Then finally the Gold Standard will be installed, but by the Eastern nations. It will be led by Russia, China, and Germany. The United States will be indescribably isolated. The US Fascist leaders have attempted to isolate Iran, but Tehran will be integrated into the Eurasian Trade Zone. The US Fascist leaders have attempted to isolate Russia, but Moscow will be integrated into the Eurasian Trade Zone. The US Fascist leaders have attempted to coerce Europe to join a deadend insane war with an absurd basis, but the core powers of the NATO will move away and be integrated into the Eurasian Trade Zone. The United States is a hair away from losing both Germany and France to the Eastern Alliance. They will embrace gold, and walk away from the USDollar, with a certain absorbed cost. Great changes are coming like a fierce new storm……”

Comments »Argentina Faces Default Again

“Argentina faces default Wednesday for the second time in 13 years if it doesn’t meet a deadline to make payments to a small group of bondholders. WSJ’s Matthew Cowley explains Argentina’s dispute with these creditors and the long-standing battle that stems from the country’s default in 2001. (Photo: Getty Images)

Argentina teetered on the brink of its second default in 13 years after talks with bondholders collapsed late Wednesday.

The setback, after glimmers of hope in recent days that a last-minute agreement could be reached, immediately sent Argentine stocks plunging in after-hours trading.

Still, there remained the possibility that talks could resume and a deal could eventually be reached.

At a news conference after talks with a court-appointed mediator ended Wednesday, Argentine Economy Minister Axel Kicillof, who had led the country’s delegation to New York, said “we won’t sign an agreement that would compromise Argentina’s future.” A spokeswoman later said negotiations would continue, without giving a timetable.

“Default is not a mere ‘technical’ condition, but rather a real and painful event that will hurt real people,” said Daniel Pollack, the mediator, in a statement late Wednesday. He added, “The full consequences of default are not predictable, but they certainly are not positive.”

The development is the latest turn in a yearslong battle between Argentina and a small group of hedge funds that have demanded full payment for bonds the country defaulted on in 2001. Argentina has refused to pay, despite an order by a U.S. District Court judge requiring it to pay the hedge funds. The issue came to a head Wednesday as Argentina missed a deadline to make a payment it owed to other bondholders, because the court order had prevented such a move.

Mr. Pollack, who had been trying to broker a deal between the two sides, said the country would “imminently” be in default. Standard & Poor’s Ratings Services had earlier Wednesday declared Argentina in default on some of its bonds.

A default would pressure an economy already mired in recession, potentially leading to higher inflation and a weaker currency. The breakdown of negotiations also complicates President Cristina Kirchner‘s efforts to stabilize the economy ahead of elections next year…..”

Comments »Greenspan: Stocks Will See a Major Correction

“Equity markets will see a decline at some point after rising for the past several years, former Federal Reserve chairman Alan Greenspan said in an interview on Bloomberg TV.

“The stock market has recovered so sharply for so long, you have to assume somewhere along the line we will get a significant correction,” Greenspan said on Wednesday.

Greenspan’s comments come amid growing concern that interest rates near record lows are creating asset-price bubbles….”

Jobless Claims Come in at 303k vs Estimates of 301k, Employment Costs Surge

Where the World Stands

“Americans – living in a huge country which has never really been invaded, and as the sole superpower – are famous for being out-of-touch with how the rest of the world thinks.

So my fellow Americans will probably be surprised to learn that the U.S. is more or less the only country in the world which has a favorable view of Israel.

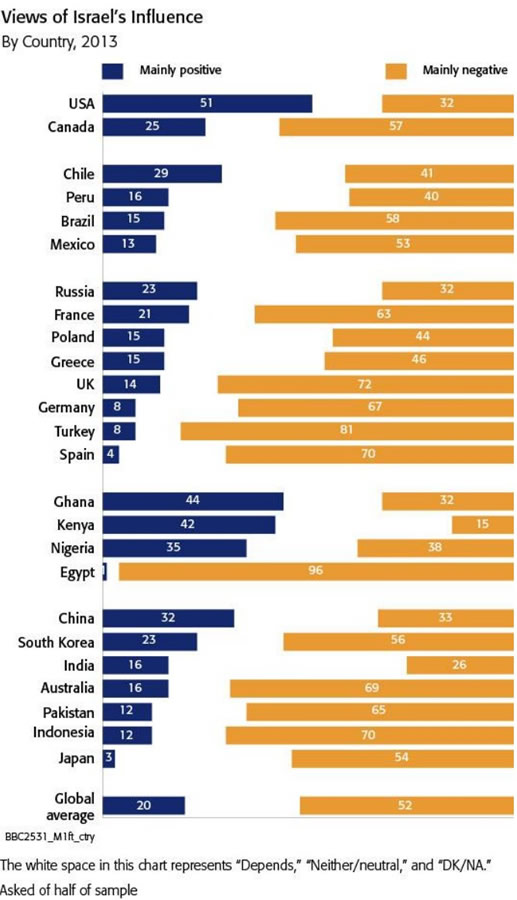

Specifically, a 2012 BBC poll found that the U.S. and Nigeria were the only countries of those polled in which the majority of people had favorable views of Israel:

But Nigeria swung negative in the 2013 BBC poll, leaving the U.S. alone of all countries polled:

Indeed, the 2013 poll shows that Israel is the fourth least popular country in the world, trailing only Iran, Pakistan and North Korea:

Iran is once again the most negatively viewed country, with negative ratings climbing four points to 59%. Most people also give negative ratings to Pakistan (56%, up five points), North Korea (55%, up three points) and Israel (52%, up one point).

Israel Has Violated United Nations Resolutions More than Any Country In the World

Another measure of world opinion on Israel is that the United Nations has condemned Israel’s violence towards its neighbors again and again.

Haaretz noted in 2002:

Israel holds the record for ignoring United Nations Security Council resolutions, according to a study by San Francisco University political science professor Steven Zunes.

***

Israel leads the list. Since 1968, Israel has violated 32 resolutions that included condemnation or criticism of the governments’ policies and actions.

***

Zunes specifically avoided counting resolutions that are vague or unclear so that governments could claim different interpretations to the meaning of the resolutions. Thus, the famous UN Security Council resolutions 242 and 338 are not included in his study. He also did not count resolutions that only included condemnations. Instead, he focused on those that included specific calls for changes in the subject governments’ policies.

The resolutions Israel violated were either about its annexation of East Jerusalem or settlements in the territories. Israel also ignored UN Security Council resolutions that called for Israel to cease using harsh measures against the Palestinian population and to cease expelling Palestinians.

Pulitzer prize winning journalist Chris Hedges points out that Israel has broken nearly a hundred UN Security Council resolutions regarding Gaza alone.

Here is a brief sampling of UN Security Council resolutions against Israel:

Resolution 106: The Palestine Question (March 29, 1955) ‘condemns’ Israel for Gaza raid

Resolution 111: The Palestine Question (January 19, 1956) ” … ‘condemns’ Israel for raid on Syria that killed fifty-six people”

Resolution 127: The Palestine Question (January 22, 1958) ” … ‘recommends’ Israel suspends its ‘no-man’s zone’ in Jerusalem”.

Resolution 162: The Palestine Question (April 11, 1961) ” … ‘urges’ Israel to comply with UN decisions”

Resolution 171: The Palestine Question (April 9, 1962) ” … determines flagrant violations’ by Israel in its attack on Syria”

Resolution 228: The Palestine Question (November 25, 1966) ” … ‘censures’ Israel for its attack onSamu in the West Bank, then under Jordanian control”

Resolution 237: Six Day War (June 14, 1967) ” … ‘urges’ Israel to allow return of new 1967 Palestinian refugees”. and called on Israel to ensure the safety and welfare of inhabitants of areas where fighting had taken place

Resolution 248: (March 24, 1968) ” … ‘condemns’ Israel for its massive attack on Karameh in Jordan”

Resolution 256: (August 16, 1968) ” … ‘condemns’ Israeli raids on Jordan as ‘flagrant violation”

Resolution 258: (September 18, 1968) … expressed ‘concern’ with the welfare of the inhabitants of the Israeli-occupied territories, and requested a special representative to be sent to report on the implementation of Resolution 237, and that Israel cooperate

Resolution 259: (September 27, 1968) ” … ‘deplores’ Israel’s refusal to accept UN mission to probe occupation”

Resolution 262: (December 31, 1968) ” … ‘condemns’ Israel for attack on Beirut airport“

Resolution 265: (April 1, 1969) ” … ‘condemns’ Israel for air attacks on Salt“

Resolution 270: (August 26, 1969) ” … ‘condemns’ Israel for air attacks on villages in southern Lebanon”

Resolution 279: (May 12, 1970) “Demands the immediate withdrawal of all Israeli armed forces from Lebanese territory”

Resolution 280: (May 19, 1970) ” … ‘condemns’ Israeli’s attacks against Lebanon”

Resolution 285: (September 5, 1970) ” … ‘demands’ immediate Israeli withdrawal from Lebanon”

Resolution 298: (September 25, 1971) ” … ‘deplores’ Israel’s changing of the status of Jerusalem”

Resolution 316: (June 26, 1972) ” … ‘condemns’ Israel for repeated attacks on Lebanon”

Resolution 317: (July 21, 1972) ” … ‘deplores’ Israel’s refusal to release Arabs abducted in Lebanon”

Resolution 332: (April 21, 1973) ” … ‘condemns’ Israel’s repeated attacks against Lebanon”

Resolution 337: (August 15, 1973) ” … ‘condemns’ Israel for violating Lebanon’s sovereignty and territorial integrity and for the forcible diversion and seizure of a Lebanese airliner from Lebanon’s air space”

Resolution 347: (April 24, 1974)” … ‘condemns’ Israeli attacks on Lebanon”

Resolution 444: (January 19, 1979) ” … ‘deplores’ Israel’s lack of cooperation with UN peacekeeping forces”

Resolution 446 (March 22, 1979): ‘determines’ that Israeli settlements are a ‘serious obstruction’ to peace and calls on Israel to abide by the Fourth Geneva Convention”

Resolution 450: (June 14, 1979) ” … ‘calls’ on Israel to stop attacking Lebanon”.

Resolution 452: (July 20, 1979) … ‘calls’ on Israel to cease building settlements in occupied territories”

Resolution 465: (March 1, 1980) ” … ‘deplores’ Israel’s settlements and asks all member states not to assist Israel’s settlements program”

Resolution 467: (April 24, 1980) ” … ‘strongly deplores’ Israel’s military intervention in Lebanon”

Resolution 468: (May 8, 1980) ” … ‘calls’ on Israel to rescind illegal expulsions of two Palestinian mayors and a judge and to facilitate their return”

Resolution 469: (May 20, 1980) ” … ‘strongly deplores’ Israel’s failure to observe the council’s order not to deport Palestinians”

Resolution 471: (June 5, 1980) ” … ‘expresses deep concern’ at Israel’s failure to abide by the Fourth Geneva Convention”

Resolution 478 (August 20, 1980): ‘censures (Israel) in the strongest terms’ for its claim to Jerusalemin its ‘Basic Law’

Resolution 487: (June 19, 1981) ” … ‘strongly condemns’ Israel for its attack on Iraq’s nuclear facility”

Resolution 497 (December 17, 1981), decides that Israel’s annexation of Syria’s Golan Heights is ‘null and void’ and demands that Israel rescinds its decision forthwith

Resolution 501: (February 25, 1982) ” … ‘calls’ on Israel to stop attacks against Lebanon and withdraw its troops”.

Resolution 515: (July 29, 1982) ” … ‘demands’ that Israel lift its siege of Beirut and allow food supplies to be brought in”

Resolution 516 (August 1, 1982) demanded an immediate cessation of military activities in Lebanon, noting violations of the cease-fire in Beirut

Resolution 517: (August 4, 1982) ” … ‘censures’ Israel for failing to obey UN resolutions and demands that Israel withdraw its forces from Lebanon”.

Resolution 520: (September 17, 1982) ” … ‘condemns’ Israel’s attack into West Beirut”.

Resolution 573: (October 4, 1985) ” … ‘condemns’ Israel ‘vigorously’ for bombing Tunisia in attack on PLO headquarters

Resolution 592: (December 8, 1986) ” … ‘strongly deplores’ the killing of Palestinian students atBirzeit University by Israeli troops”

Resolution 605: (December 22, 1987) ” … ‘strongly deplores’ Israel’s policies and practices denying the human rights of Palestinians

Resolution 607: (January 5, 1988) ” … ‘calls’ on Israel not to deport Palestinians and strongly requests it to abide by the Fourth Geneva Convention

Resolution 608: (January 14, 1988) ” … ‘deeply regrets’ that Israel has defied the United Nations and deported Palestinian civilians”

Resolution 611: (April 25, 1988) “… condemned Israel’s assassination of Khalil al-Wazir as a ‘flagrant violation of the Charter

Resolution 636: (July 16, 989) ” … ‘deeply regrets’ Israeli deportation of Palestinian civilians

Resolution 641 (August 30, 1989): ” … ‘deplores’ Israel’s continuing deportation of Palestinians

Resolution 672 (October 12, 1990): ” … ‘condemns’ Israel for “violence against Palestinians” at the Haram al-Sharif/Temple Mount

Resolution 673 (October 24, 1990): ” … ‘deplores’ Israel’s refusal to cooperate with the United Nations

Resolution 681 (December 20, 1990): ” … ‘deplores’ Israel’s resumption of the deportation of Palestinians

Resolution 694 (May 24, 1991): ” … ‘deplores’ Israel’s deportation of Palestinians and calls on it to ensure their safe and immediate return

Resolution 726 (January 6. 1992): ” … ‘strongly condemns’ Israel’s deportation of Palestinians

Resolution 799 (December 18 , 1992): “. . . ‘strongly condemns’ Israel’s deportation of 413 Palestinians and calls for their immediate return

Resolution 904 (March 18, 1994): Cave of the Patriarchs massacre

Resolution 1322 (October 7, 2000) deplored Ariel Sharon‘s visit to the Temple Mount and the violence that followed

Resolution 1435 (September 24, 2002) demanded an end to Israeli measures in and aroundRamallah, and an Israeli withdrawal to positions held before September 2000

Resolution 1544 (May 19, 2004) “…‘calls on’ Israel to respect its obligations under international humanitarian law, and insists, in particular, on its obligation not to undertake demolition of homes contrary to that law”

Resolution 1860 (January 8, 2009) “…‘calls for’ an immediate, durable and fully respected ceasefire, leading to the full withdrawal of Israeli forces from Gaza; ‘calls for‘ the unimpeded provision and distribution throughout Gaza of humanitarian assistance, including of food, fuel and medical treatment”

Of course, America is the only country which consistently votes against such resolutions:

Older, White American Males Are Virtually the Only People In the World Who Unconditionally Support Israel

Even with the United States, there are only certain groups which support Israel.

A new poll by Pew this month shows that it is mainly Americans 50 years or older, males, conservatives and evangelicals who support Israel….”

Comments »The Fed Tapers 10B, Rates Remain Unchanged

“The taper continues.

The Federal Reserve’s Federal Open Market Committee just announced its latest monetary policy decision, and there were no surprises.

The FOMC said it would take another $10 billion off its monthly asset purchases and keep interest rates between 0%-0.25%.

In its latest statement, the Fed said, “a range of labor market indicators suggests that there remains significant underutilization of labor resources.”

The latest FOMC announcement, which is not accompanied by a press conference from Fed Chair Janet Yellen, also comes on the heels of a better than expected GDP report this morning.

Here’s the full statement from the Fed:

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators and inflation moving toward levels the Committee judges consistent with its dual mandate. The Committee sees the risks to the outlook for economic activity and the labor market as nearly balanced and judges that the likelihood of inflation running persistently below 2 percent has diminished somewhat.

The Committee currently judges that there is sufficient underlying strength in the broader economy to support ongoing improvement in labor market conditions. In light of the cumulative progress toward maximum employment….”

Comments »Q2 GDP Comes in at a Whopping 4% vs Estimates of 3.2%

“U.S. economic growth accelerated more than expected in the second quarter and the decline in output in the prior period was less steep than previously reported, which could bolster views for a stronger performance in the last six months of the year.

Gross domestic product expanded at a 4.0 percent annual rate as activity picked up broadly after shrinking at a revised 2.1 percent pace in the first quarter, the Commerce Department said on Wednesday.

That pushed GDP above the economy’s potential growth trend, which analysts put somewhere between a 2 percent and 2.5 percent pace. Economists polled by Reuters had forecast the economy growing at a 3.0 percent rate in the second quarter after a previously reported 2.9 percent contraction.

The economy grew 0.9 percent in the first half of this year and growth for 2014 as a whole could average above 2 percent. The first quarter contraction, which was mostly weather-related, was the largest in five years.

Employment growth, which has exceeded 200,000 jobs in each of the last five months, and strong readings on the factory and services sectors from the Institute for Supply Management underpin the bullish expectations for the rest of the year.

The government also published revisions to prior GDP data going back to 1999, which showed the economy performing much stronger in the second half of 2013 and for that year as a whole than previously reported….”

Comments »The IMF Warns of Shocks to Global Growth

“Sharply higher interest rates around the world could combine with weaker growth in emerging markets to slice as much as 2 percentage points off global growth in the next five years, the International Monetary Fund said on Tuesday.

In a report assessing how individual national policies could interact to undermine the world economy, the IMF also warned the conflict between Russia and Ukraine could reverberate to the rest of the region if sanctions against Russia escalate, hitting natural gas supplies to Europe and weakening European banks.

The resulting impact could prompt further gyrations in financial markets, in contrast to the recent period of market calm, the IMF said in its “spillovers” report.

Editor’s Note: New Warning – Stocks on Verge of Major Collapse

In its worst-case scenario, the IMF said the United States and United Kingdom could tighten monetary policy sooner than expected, leading to higher borrowing costs worldwide, even as key emerging market growth slows a further 0.5 percentage point over the next three years.

The two developments would reinforce each other, prompting slower growth and hurting in particular those emerging markets with large economic imbalances, such as Argentina, Brazil, Russia and Turkey.

As in past reports, the IMF said monetary tightening in rich nations would have limited negative impact on the rest of the world if it was well-communicated and prompted by better growth prospects. The impact could also be muted if higher U.S. and UK rates come as the euro zone and Japan continue monetary easing, though this “asynchronous” tightening could cause more global exchange rate volatility….”

Comments »ADP Misses by a Small Margin, 218k Jobs Created vs Estimates of 230k

“Private businesses created 218,000 jobs in July, a number that while solid and in line with trend fell below expectations, according to ADP.

The number also fell well short of the 281,000 created in June—the initially reported total was not revised—and could cause economists to tinker with their projections for Friday’s nonfarm payrolls report. Consensus has the economy adding 225,000 total for the month.

Employment growth fell across the spectrum, with service industries again leading the way with 202,000 new positions, down from 238,000 in June. Goods-producing businesses rose 16,000, off from 43,000, while construction gained just 12,000, less than half the previous months’ gain.

However, Mark Zandi, the top economist at Moody’s Analytics, which formulates the report along with ADP, said the overall direction of the jobs market is decidedly positive…..”

Comments »A Preview to the Fed Decision Today

“Here’s what to look for when the Federal Open Market Committee releases its policy statement at 2 p.m. today inWashington. Federal Reserve officials won’t provide new economic projections, and Chair Janet Yellen isn’t scheduled to give a post-meeting press conference.

— Steady tapering: The FOMC will probably trim monthly bond purchases for a sixth straight meeting, to $25 billion, said Joseph LaVorgna, chief U.S. economist at Deutsche Bank Securities Inc. in New York. That would keep the Fed on pace to announce an end to purchases in October, he said.

— Labor slack: At the same time, the panel will discuss signs of persistent labor-market weakness to maintain its view that interest rates should stay low for a “considerable time” after quantitative easing ends, according to Jonathan Wright, an economics professor at Johns Hopkins University in Baltimore.

— While the jobless rate is down to 6.1 percent, that’s partly because the proportion of working age people in the labor force is the lowest since 1978. “Unemployment is falling faster than expected, but they can still say that other labor-market indicators are mixed,” said Wright, an economist at the Fed’s division of monetary affairs from 2004 until 2008.

— Lagging wages: The FOMC’s most vocal supporters of continued stimulus will probably also cite weak wages, said Michael Feroli, chief U.S. economist at JPMorgan Chase & Co. in New York.

The FOMC wants “clear evidence of firming wage inflation” before determining that the U.S. is approaching full employment, LaVorgna said in a note to clients. After adjusting for inflation, average hourly earnings last month fell 0.1 percent from a year earlier.

Price Goal…”

Comments »What Right Do Zionist Jews Have To Palestine?

What title-deeds do the Jews of today actually have to the land of ‘Israel’? The idea that a people can possess some kind of ethnic ancestral right to a territory supposedly vacated by their forebears some millenia previously, implying a right in perpetuity, can have no legal basis. Or otherwise Americans of European ancestry, to name just one group of people, will have to pack their bags.

According to Dr Alfred Lilienthal in his book The Zionist Connection, “The Jewish population of Palestine [what is now Israel and the occupied territories, the West Bank and Gaza] at the time of the Balfour Declaration in 1917 was a mere 7 percent of the 700 000 inhabitants. The rest were Muslim and Christian Arabs·At the time of the (US-dominated UN) partition vote in 1947 there were only 650 000 Jews in Palestine while there were 1,3 million indigenous Palestinian Arabs, either Christian or Muslim. Under the partition plan, 56 % of Palestine was given for a Zionist state to people who constituted 33 % of the population and owned about 6 % [six percent] of the land· These UN figures have never been in dispute·”

But there is a further issue, which also (YET AGAIN!) demonstrates the fundamentally questionable foundations of Zionism.

Jews are actually not even the modern descendents of the Israel of the Biblical ÎOld Testamentâ:

According to both the early-20th-Century popular historian H.G.Wells and the Hungarian-Jewish intellectual and author Arthur Koestler, amongst numerous others, the people known today as Jews are primarily the descendents of a Turkish tribe known as the Khazars. The Khazars have no historical connection to Palestine. They converted to ÎJudaismâ between 620 and 740AD, and have no genetic connection to biblical Israel, and hence to the narratives of the Bible and the ÎHoly Landâ. Koestler actually devoted an entire book called The Thirteenth Tribe (1976) to the fact that the Jews of eastern European origin, who are known as the Ashkenazi Jews and who make up about 95% of the Jewish population of today, are of Khazar origin. In other words – virtually all of the Jews of the modern world have no Hebrew ancestry, and no ancient connection with Palestine.

Does it matter? Does world peace matter? Do the human rights of a violently oppressed people matter? Does anything but sport and television sitcoms matter?

Arthur Koestler was by no means the first to draw attention to this particular issue. He quotes from twentieth-century works on the subject by, amongst others, Professors A.N.Poliak of Tel Aviv University, D.M.Dunlop of Columbia University in New York, and J.B.Bury of Cambridge University. The courageous Jewish anti-Zionist commentator Dr Alfred Lilienthal raised the issue fifty years ago and has continued to do so for decades. In fact, the famous H.G.Wells in the early 1920âs in his popular Outline of History described the Jews as Îa Turkish peopleâ and stated that Î(to the) Jewish Khazars.. are to be ascribed the great settlements of Jews in Poland and Russiaâ (chapt XXXII:8) and ÎThe main part of Jewry never was in Judea, and never came out of Judeaâ (XXIX:1).

Lord Moyne the British secretary of state in Cairo declared on June 9, 1942, in the House of Lords that the Jews were not the descendants of the ancient Hebrews and that they had no “legitimate claim” on the Holy Land. A proponent of curtailing immigration into Palestine, he was accused of being “an implacable enemy of Hebrew independence.”(Isaac Zaar, Rescue and Liberation: America’s Part in the Birth of Israel, New York: Bloch, 1954, p. 115). On November 6, 1944, Lord Moyne was assassinated in Cairo by two members of the Stern Gang led by Yitzak Shamir, latter to become premier of ÎIsraelâ. (This assassination was not unique in the history of Zionism. In September 1948 Count Folke Bernadotte, appointed by the UN as mediator between the Zionist settlers in Palestine and the native Palestinians, was murdered on orders from the same Yitzhak Shamir. Count Bernadotte was the head of the Swedish Red Cross and had risked his life to save thousands of Jews from German concentration camps. This set a precedent and encouragement for the Zionist use of assassination as a convenient political instrument, which the US and European governments have in effect condoned since then.)

Much old documentary evidence exists on the subject of the Khazars dating from the ninth and tenth centuries and earlier – from Arab, Byzantine, Hebrew, Russian and other sources. The conversion of the Khazars to Judaism is described in the so-called ‘Khazar Correspondence’ dating from the tenth century between Hasdai Ibn Shaprut, the Jewish chief minister of the Caliph of Cordoba in Spain, and Joseph, the king of the Khazars. In this the king traces the ancestry of his people not to Shem, father of the Semites, but to Japheth, Noah’s third son. The Book of Genesis (10:2,3) itself also describes Ashkenaz as a descendent of Japheth, rather than Shem. In other words, the Jews are not a Semitic people, but their contempt for the Arab world and their bitter and violent war of dispossession against the Palestinian Arabs could be termed Îanti-Semiticâ.

Comments »

Do You Suffer from Learned Helplessness ?

“Why won’t America stand up for herself? Why is the country, once a country which possessed courage and conviction , now sitting idly while allowing itself to be taken to the slaughter without so much as a whimper?

The answer to the above question lies in the psychological concept known as “Learned Helplessness” as discovered by Martin Seligman.

“Learned helplessness” occurs when an animal is repeatedly subjected to an aversive stimulus that it cannot escape. Eventually, the animal will stop trying to avoid the stimulus and behave as if it is utterly helpless to change the situation. Even when opportunities to escape are presented, this learned helplessness will prevent any action”

Learned Helplessness

Phase One

In the first phase of the learned helplessness experiment, Seligman placed a dog on an electrical grid, shocked the dog and noted that the dog would demonstrate the ability to escape the aversive stimulus.

Phase Two

In the second phase, the dog was barricaded on the grid and was unable to escape the painful shocks. Eventually the dog laid down and passively accepted the shock.

Phase Three…”

Comments »Morici: Real Unemployment Rate is Runnung at 18%

“The Labor Department on Friday is expected to report the economy added 235,000 jobs in July, and the unemployment rate remained steady at 6.1 percent, but that hardly tells the story.

The jobless rate may be down from its recession peak of 10 percent, but much of this results from adults, discouraged by the lack of decent job openings, have quit altogether. They are neither employed nor looking for work.

Only about half of the drop in the adult participation rate may be attributed to the Baby Boom generation reaching retirement age. Lacking adequate resources to retire, a larger percentage of adults over 65 are working than before the recession.

Many Americans who would like full time jobs are stuck in part-time positions, because businesses can hire desirable part-time workers to supplement a core of permanent, full-time employees, but at lower wages. And Obamacare’s employer health insurance mandates will not apply to workers on the job less than 30 hours a week.

Since 2000, Congress has enhanced the earned income tax credit, and expanded programs that provide direct benefits to low-income workers, including food stamps, Medicaid, Obamacare, and rent and mortgage assistance.

Virtually all phase as family incomes rise, either by securing higher hourly pay or working more hours, and impose an effective marginal tax rate as high as 50 percent. Consequently, these programs discourage work and skills acquisition, and encourage single parents and one partner in two adult households not to work. Often, these motivate single people to work only part-time.

Undocumented immigrants face more difficulties accessing these programs, and lax immigration enforcement permits them to openly take jobs that government benefits discourage low-income Americans from accepting…..”

Comments »El-Erian: Don’t Be Fooled by the Fed’s Placid Facade

“One of the unwritten rules of modern central banking is that, unless compelled by events on the ground, officials should refrain from making big policy changes during the summer. With many traders on holiday, any sudden moves risk destabilizing markets.

Look for the Federal Reserve to abide by this rule when it meets Tuesday and Wednesday — and the European Central Bank to do the same in early August. Janet Yellen and her colleagues on the policy-making Federal Open Market Committee will maintain their well-telegraphed, gradualist approach, reducing monthly bond purchases by another $10 billion, signaling no urgency in raising interest rates, and reminding us of the importance of looking beyond the unemployment rate to understand what’s happening in the job market.

Still, behind this comforting “steady as she goes” facade, Fed officials will be dealing with five complex and inter-related issues, the resolution of which will be months in the making:

To what extent is the central bank’s policy approach increasing the risk of financial instability down the road? This question is preoccupying a growing number of regional Fed presidents…..”

Comments »1 in 3 Americans are in Financial Ruin

“Americans have a debt problem.

An estimated 1 in 3 adults with a credit history — or 77 million people — are so far behind on some of their debt payments that their account has been put “in collections.”

That’s a key finding from a new Urban Institute study.

It examined non-mortgage debt, including credit card bills, car loans, medical bills, child support payments and even parking tickets.

The debt in collections ranged from as little as $25 to a whopping $125,000. But the average amount owed was $5,200.

Geographically, no area of the country is untouched.

Among the states, Nevada had the highest percentage of residents with debt in collections — 47% – as well as the highest average amount owed – $7,198. That was helped in part by the Las Vegas metro area, where 49% of residents had debt in collections.

By contrast, North Dakota had the lowest percentage of residents with debt in collections at just 19%, while the District of Columbia had the lowest average dollar amount owed per person at $3,547.

At least with credit cards, debt won’t go into collections unless it’s more than 6 months past due. But time frames can differ from place to place when talking about debt like parking tickets and medical bills.

Once it is categorized as in collections, however, it can follow one of three courses, according to the Urban Institute report. The creditor can charge it off and sell it to a debt buyer, put the account into default, or seek to collect what’s owed through an in-house department or a third-party debt collector.

In any of those cases, however, the cost to the consumer is high and long-lasting…..”

Comments »Bund Yield Falls to Record, Surpassing Euro-Crisis Levels

“German 10-year government bonds rose, sending yields to thelowest on record, surpassing levels set at the worst of the European sovereign-debt crisis.

Unprecedented European Central Bank stimulus measures imposed to stave off deflation are boosting bonds across the region, with yields on debt from Finland to Italy falling to new lows today. Investors have been lured to the relative safety of German and so-called semi-core euro-area bonds as the U.S. and European Union prepare new sanctions against Russiafollowing the downing of a Malaysian airliner over Ukraine and as Israel steps up its bombardment of Gaza.

“Yields are going lower because the market expects the ECB to do more in the low-growth, low-inflation environment that we are in,” said Lyn Graham-Taylor, a fixed-income strategist at Rabobank International in London. “Month-end demand also helps. It’s a bit of a function of low inventories and everyone being careful about being short heading into month end.”

A short position is a bet an asset’s value will drop.

Benchmark 10-year yields fell two basis points, or 0.02 percentage point, to 1.13 percent at 9:45 a.m. London time after sliding to 1.119 percent, the least on record according to data compiled by Bloomberg dating back to 1989. The 1.5 percent bund due May 2024 rose 0.195, or 1.95 euros per 1,000-euro ($1,344) face amount, to 103.435.

Unsustainable Finances….”

Comments »Flight MH17 Update: What You’re Not Being Told

[youtube://http://www.youtube.com/watch?v=b67OGUsQC44#t=93 450 300]

Comments »