Fitch Ratings-London-14 March 2012: Fitch Ratings has affirmed the United Kingdom’s (UK) sovereign ratings as follows:

–Long-term foreign currency Issuer Default Rating (IDR) affirmed at ‘AAA’

–Long-term local currency IDR affirmed at ‘AAA’

–Country Ceiling affirmed at ‘AAA’

–Short-term foreign currency rating affirmed at ‘F1+’

The Outlooks on the Long-term IDRs have been revised to Negative from Stable.

The affirmation of the UK’s ‘AAA’ ratings reflects the progress made in reducing the government’s structural budget deficit and the credibility of the fiscal consolidation effort. The UK’s ‘AAA’ rating is underpinned by a high-income, diversified and flexible economy as well as political and social stability. The UK sovereign credit profile also benefits from the macroeconomic and financing flexibility that derives from independent monetary policy and sterling’s status as an international ‘reserve currency’. However, the government’s structural budget deficit is second in size only to the US (‘AAA’/Negative) and indebtedness is significantly above the ‘AAA’ median, although currently broadly in line with France (‘AAA’/Negative) and Germany (‘AAA’/Stable).

Fitch judges the government’s fiscal consolidation plans to be credible, reflecting the strong political commitment and institutional capacity. The forthcoming Budget is expected to reaffirm the government’s commitment to deficit reduction as set out in the 2010 and 2011 budgets, the 2010 Spending Review, and the 2011 Autumn Statement. The adjustment is focused on permanent reductions in current spending underpinned by structural reform to public services and welfare. The front-loaded fiscal consolidation is proceeding broadly in line with the path set out by the government. The cyclically-adjusted primary deficit halved over the past two years, to 3.5% of GDP in 2011-12 from 7% of GDP in 2009-10, although the government’s plans include further reductions in spending beyond the term of the current parliament.

The mix of tight fiscal and ‘loose’ monetary policies allowed for by the flexible monetary and exchange rate regime, including ‘quantitative easing’ (QE), is supportive of the necessary rebalancing of the UK economy. Although Fitch recognises that the purpose of QE is to forestall deflationary pressures and promote the flow of private credit, it has also reduced the government’s cost of fiscal funding and its reliance on the market, at least over the short to medium term. Combined with an average maturity of government debt of over 14 years – around double that of its ‘AAA’ peers and a rating strength – on current policies the risk of a fiscal financing crisis is assessed to be negligible.

In Fitch’s opinion, the credibility of the government’s fiscal commitment was further enhanced by the announcement in the Autumn Statement of additional measures to ensure that the government’s target of a cyclically-adjusted current budget surplus by 2016-17 and public sector net debt (excluding financial sector interventions, PSND ex) is falling in 2015-16 in response to the Office for Budget Responsibility’s (OBR) substantial re-assessment of the UK’s economic growth potential and growth prospects. Nonetheless, general government gross debt (GGGD) and the government’s preferred measure – PSND ex – are forecast by the OBR to peak in 2014-15 at 93.9% and 78% of GDP, respectively, compared to its previous forecast of 87.2% and 70.9% in 2013-14 at the time of the March 2011 Budget and Fitch’s previous formal review of the UK’s sovereign ratings. Consistent with Fitch’s sovereign rating criteria and historical and international precedent, the projected peak for government indebtedness is at the limit of the level consistent with the UK retaining its ‘AAA’ status. With debt not expected to peak until 2014-15, three fiscal years from now, the risks and uncertainty surrounding the realisation of debt reduction by the middle of the decade are material.

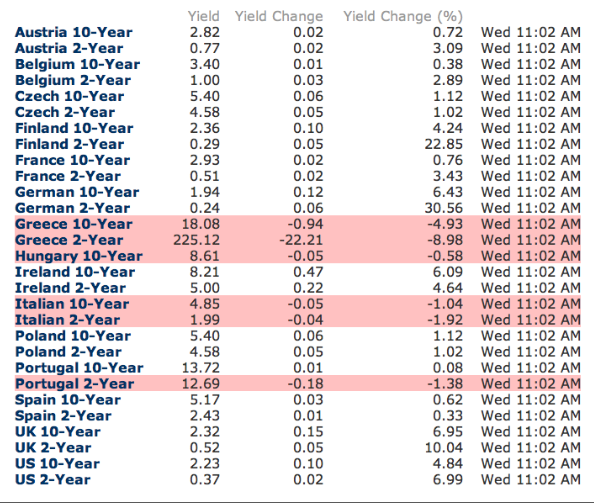

The evolution of the eurozone debt crisis has significant implications for the UK in light of the substantial trade and financial linkages between the two. The easing of financial market tensions in the eurozone in recent months has diminished the risks to the UK, but in Fitch’s opinion, the crisis is not resolved and could once more intensify. Fitch’s current assessment is that UK banks are relatively well placed to absorb future episodes of financial market turmoil and losses on eurozone exposures without additional recourse to the UK taxpayer for capital. UK banks have strengthened their capital positions in recent years and they have reduced their exposures to the weaker eurozone economies over 2011. In addition, the UK government has announced its intentions to reform the banking system to make future crises less frequent and costly. Both these factors should help reduce future fiscal risks. Of greater concern would be the broader economic impact of an intensification of the eurozone crisis on the UK government’s ability to meet its deficit reduction targets and place the debt to GDP ratio on a downward path in 2015-16.

The revision of the rating Outlook to Negative from Stable reflects the very limited fiscal space to absorb further adverse economic shocks in light of such elevated debt levels and a potentially weaker than currently forecast economic recovery. In light of the considerable uncertainty around the economic and fiscal outlook, including the risks posed to economic recovery by ongoing financial tensions in the eurozone and against the backdrop of a still large structural budget deficit and high and rising government debt, the Negative Outlook indicates a slightly greater than 50% chance of a downgrade over a two-year horizon.

The triggers that would likely prompt a rating downgrade are as follows:

— Discretionary fiscal easing that resulted in government debt peaking later and higher than currently forecast;

— Adverse shocks that implied higher levels of government borrowing and debt than currently projected; and

— A material downward revision of the assessment of the UK’s medium-term growth potential.

Conversely, economic and fiscal performance in line with Fitch’s baseline expectations with general government gross debt peaking at around 94% in 2014-15 would likely result in the stabilisation of the rating Outlook. In the absence of adverse shocks, Fitch does not expect to resolve the Negative Outlook until 2014. The agency’s medium-term economic and fiscal projections are set out in a new Special Report on UK Public Finances, available at www.fitchratings.com.

Fitch last formally reviewed the UK sovereign ratings on 14 March 2011 and has completed the current review in a manner consistent with its regulatory obligations.

Contact:

Primary Analyst

Maria Malas-Mroueh

Director

+44 20 3530 1081

Fitch Ratings Limited

30 North Colonnade

London

E14 5 GN

Secondary Analyst

David Riley

Managing Director

+44 (0)20 3530 1175

Tertiary Analyst

Gergely Kiss

Director

+44 (0)20 3530 1425

Committee Chairperson

Ed Parker

Managing Director

+44 20 3530 1176

Media Relations: Mark Morley, London, Tel: +44 0203 530 1526, Email: [email protected].

Additional information is available at www.fitchratings.com. The ratings above were unsolicited and have been provided by Fitch as a service to investors.

Applicable criteria, Sovereign Rating Methodology dated August 2011 are available at www.fitchratings.com.

Applicable Criteria and Related Research:

Sovereign Rating Methodology

ALL FITCH CREDIT RATINGS ARE SUBJECT TO CERTAIN LIMITATIONS AND DISCLAIMERS. PLEASE READ THESE LIMITATIONS AND DISCLAIMERS BY FOLLOWING THIS LINK: HTTP://FITCHRATINGS.COM/UNDERSTANDINGCREDITRATINGS. IN ADDITION, RATING DEFINITIONS AND THE TERMS OF USE OF SUCH RATINGS ARE AVAILABLE ON THE AGENCY’S PUBLIC WEBSITE ‘WWW.FITCHRATINGS.COM’. PUBLISHED RATINGS, CRITERIA AND METHODOLOGIES ARE AVAILABLE FROM THIS SITE AT ALL TIMES. FITCH’S CODE OF CONDUCT, CONFIDENTIALITY, CONFLICTS OF INTEREST, AFFILIATE FIREWALL, COMPLIANCE AND OTHER RELEVANT POLICIES AND PROCEDURES ARE ALSO AVAILABLE FROM THE ‘CODE OF CONDUCT’ SECTION OF THIS SITE.

Read more: http://www.businessinsider.com/fitch-revises-uk-outlook-to-negative-2012-3#ixzz1p7kmRAa0

Comments »