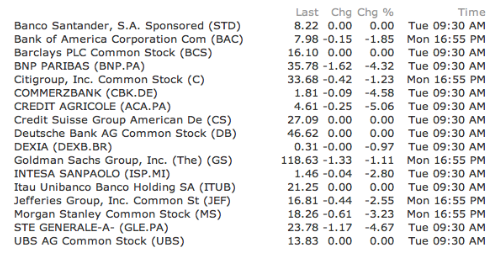

Down 4-5% across the board.

Comments »U.S. Insurers Face Up to $2 Billion in Claims From Tornadoes

“Tornadoes that slammed five states in the U.S. Midwest and South last week may generate as much as $2 billion in claims costs for insurers, risk-modeling firm Eqecat Inc. said.

Tornadoes have killed 49 people in the U.S. this year, according to a statement issued yesterday by Oakland, California-based Eqecat. The tornadoes will probably bring claims of $1 billion to $2 billion, the firm said.

More than 150 tornadoes touched down from Feb. 28 through March 3, most of them inTennessee, Kentucky, Indiana, Illinois and Alabama, Eqecat said. The U.S. has experienced 272 tornadoes this year through March 4, more than twice the seven-year average for the period, according to the statement.

“With basically a month’s worth of tornadoes last week, that doesn’t necessarily say that the rest of the year will be as bad as it has been so far,” said Jose Miranda, Eqecat’s director of client advocacy. Referring to conditions that increase the likelihood of tornadoes, he said, “You have to have all the ingredients come together.”

State Farm Mutual Automobile Insurance Co., the biggest U.S. home and car insurer, is among the top two providers of homeowners’ coverage by market share in Alabama, Kentucky and Indiana, according to data compiled by Bloomberg. The insurer received about 3,600 claims from the tornadoes for that line as of March 3, Holly Anderson, a spokeswoman, said in an e-mail.

“These are early numbers and we expect to know more early this week as our customers assess damage,” said Anderson….”

Comments »Portuguese Bond Yields Rise 2% in Less Than Two Weeks

UK Trader Drops 125k on Bottle of Champagne

High Yield Bond Fund Performance Just Another Signal a Correction May Be Past Due

Staggering Statistics on the Student Loan Debt Problem

“By Walter Kurtz, Sober Look

The mounting debt from student loans is quickly becoming a national problem in the US. The statistics are staggering.

“The Huffington Post: Bernanke’s son’s case is a high-profile example of what is a nationwide epidemic: mounting debt from student loans. College graduates from the class of 2010 carried an average of $25,250 in student loan debt, and the nation’s total student debt almost reaches $1 trillion: This is a 14-fold increase from 15 years ago and dwarfs the country’s credit card debt, which is just shy of $800 billion.”

But what’s more alarming is that over a third of that is funded directly by the federal government. The chart below (from the Fed) shows the growth in student loans held by the US government. In fact the bulk of the growth in consumer credit we’ve seen recently comes from these increases in federally held student loans.

|

| Student Loans Held by the Federal Governemnt |

The borrowers under these federal programs qualify for Income-Based Repayment, a system that allows repayment over an extremely long period of time – similar to a mortgage but with no assets to back it up. There are also provisions that allow for partial principal forgiveness.

Up-to-date student loan default rate data is hard to come by but the trend is not good.

For related content see here:”

Interest Payments Outweigh Entitlement Obligations

“These interest cost estimates assume Congress extends several current policies, such as the Bush-era tax cuts. They also assume reduced spending on overseas contingency operations.

NEW YORK (CNNMoney) — Interest rates on U.S. bonds may be ridiculously low, but that doesn’t mean the country’s future interest payments on the national debt will be.

Uncle Sam will shell out more than $5 trillion in interest payments over the next decade, according to the latest projections from the Congressional Budget Office…”

Comments »The IIF on a Greek Default: “It is difficult to add all these contingent liabilities up with any degree of precision, although it is hard to see how they would not exceed €1 trillion.”

It is Clear European Banks are Hoarding ECB Cash; Economy Will Suffer

Who Laughs Now ? Some Bears are Enjoying Major Purchasing Power

Speculators Increase Bets on The Agricultural Sector

Banks may lose commodity facilities within 18 months

Comments »NEW YORK (Reuters) – Wall Street’s biggest banks are locked in an increasingly frantic struggle with the Federal Reserve over the right to retain the jewels of their commodity trading empires: warehouses, storage tanks and other hard assets worth billions of dollars.

While the battle over proprietary trading and new derivatives regulations has taken place largely in public view since the 2008 financial crisis, the fight by JPMorgan Chase, Morgan Stanley and Goldman Sachs to retain or expand their prized physical commodity operations – most acquired in only the past six years – has remained hidden.

The debate is nearing an inflection point: Within 18 months, the Fed will likely either allow banks more freedom to invest in the physical commodity world than ever; or force them to sell off the assets that many banks are counting on to buttress their trading books at a time when they are already vulnerable because of intensifying competition and new trading curbs.

The banks are now locked in deep debate with the Fed, multiple sources involved in the discussions told Reuters. Goldman and Morgan Stanley argue the right to own such assets is ‘grandfathered’ in from their lightly-regulated investment banking days, or that at least they should be allowed to retain them as “merchant banking” investments, kept segregated from the trading desks.

But regulators and lawmakers may not be in the mood to give way. Banks are under pressure to reduce risk on their balance sheet; as commodity prices rise again, they may face more allegations that they could use these assets to drive prices higher or lower, squeezing them for trading profits.

“The Fed’s not going to be terribly accommodating,” said Oliver Ireland, a former associate counsel to the U.S. Federal Reserve and a partner with law firm Morrison Foerster in Washington, D.C. “There doesn’t seem to be a lot of sentiment in this town for people doing new things and taking new risk.”

Bove serves Geithner up hot

Read here:

Comments »Treasury Secretary Timothy Geithner should have done more to stop the financial crisis before it started, rather than try now to impose unnecessary reforms on the banking system, analyst Dick Bove said.

In a a much-discussed op-ed piece Friday for The Wall Street Journal, Geithner says a collective “amnesia” about what caused the crisis drives opposition to reform. He adds that “financial safeguards” during the crisis that exploded in 2008 “were tragically antiquated and weak.”

“Only four years after the financial crisis began to unfold, some people seem to be suffering from amnesia about how close America came to complete financial collapse under the outdated regulatory system we had before Wall Street reform,” he writes.

But Bove, who is vice president of equity research at Rochdale Securities, said the Treasury secretary’s memory may be a bit short as well.

Geithner, while at Treasury, supported the 1999 Gramm-Leach-Bliley law that helped unleash the too-big-to-fail institutions that required bailouts, and failed to flag any of the financial system excesses, particularly in the mortgage market, that drove the crisis, Bove said.

“Quite frankly, I find this article almost unbelievable in its lack of veracity in explaining the past, and even more outrageous in failing to understand what has been done to harm the future,” Bove wrote in an analysis.

When Geithner took over the New York Fed in 2003 he never protested excessive risk taking by banks, Bove said.

Individual Investors Use Rally to Hit Bids

Hilarious: Euro Banks Park a Trillion Dollars With the ECB

Fed Still Uneasy Letting Banks Pay Up to Shareholders

Italy’s Deficit Shrinks More Than Expected

The 9th Wonder of the World: Central Banks to Invest Currency Reserves In U.S. Equities

The Euro Finance Minister Approves EFSF Bailout for Greece

“Euro-area finance ministers authorized the European Financial Stability Facility to issue bonds for the Greek debt swap.

“Ministers authorize the issuance by EFSF of bonds to finance the euro area’s contribution to the PSI exercise and the repayment of accrued interest on Greek government bonds,” Luxembourg’s Jean-Claude Juncker, who leads the group of euro- area finance ministers, said today in a statement.”

Comments »Citizens for Tax Justice: Corporate Tax Rate Already @ 11.3% on Average; Not the 35% Claimed

“Indicative that something is amiss with the corporate income tax system, General Electric over the last 10 years paid only 2.3% tax on more than $81 billion in profits, according to the advocacy group Citizens for Tax Justice.

Comments »