“The deceptive Left-Right coalition to rewrite the Constitution by means of an Article V convention threatens our personal rights and freedoms.

Despite war, social upheaval, demographic shifts, and economic ups and downs, the U.S. Constitution has endured for more than two centuries, securing the blessings of liberty for Americans. Now, however, a new threat emerges that seeks to radically alter the Constitution under the guise of amending it. Those seeking radical change to the Constitution look to co-opt it by invoking an Article V “convention for proposing amendments,” otherwise known as a constitutional convention.

Given out-of-control spending by Congress and a national debt of $17.5 trillion — and another estimated $129 trillion in unfunded liabilities — many Americans, especially conservatives, believe that adding a balanced budget amendment to the Constitution would restrain federal spending. Having little confidence in the ability of Congress to correct these financial woes, advocates for a balanced budget amendment (BBA) have once more turned their efforts to what the states can do, specifically the Article V convention process.

However, conservatives seeking a constitutional convention to propose a BBA would be surprised to learn that others, including extreme leftists, also want a convention to advance their own agendas, proposing radical changes with which conservatives would vigorously disagree. Leading convention advocates from both the Left and Right are actually working together to bring about a constitutional convention, even as key advocates on the Left publicly call for a “runaway” convention in order to make multiple and far-reaching changes to the Constitution.

Amending the Constitution

Article V is a one-paragraph article in the Constitution that includes two methods for proposing amendments. The first and only method used so far empowers Congress to propose an amendment “whenever two thirds of the both houses shall deem it necessary.”

The second method for proposing amendments, which has never been employed since the original Constitutional Convention of 1787, is through a constitutional convention called by Congress “on the application of the legislatures of two thirds of the several states.” Once the applications from 34 states are received, Congress is constitutionally bound to “call a convention for proposing amendments.”

Article V also outlines two modes of ratification. The amendments proposed, either by Congress or at a constitutional convention, can only become part of the Constitution once they have been “ratified by the legislatures of three fourths of the several states, or by conventions in three fourths thereof, as the one or the other mode of ratification may be proposed by the Congress.”

Back to the Future

Well-meaning conservatives who advocate for a constitutional convention fail to recognize that once Congress convenes a convention it cannot be undone and no predetermined rules or limitations, adopted by either Congress or the states, will have any bearing on what the convention delegates may choose to do or propose. As the representatives of the sovereign will of the people-at-large in each state, convention delegates would have free latitude to propose any changes they see fit, including the writing of an entirely new constitution, along with changes to the mode of ratification, so as to guarantee the adoption of their amendments. This scenario is known as a “runaway” convention, and it is not without historical precedent.

The Continental Congress originally tasked the delegates assembled at the Philadelphia Constitutional Convention of 1787 with “the sole and express purpose of revising the Articles of Confederation.” At the time, the Articles of Confederation (AOC) was the law of the land. Article XIII of the Articles of Confederation specifically stipulated that “any alterations” made to them must be unanimously “confirmed by the legislatures of every State.” (Emphasis added.)

Both of these mandates were clearly exceeded. The delegates chose to replace the Articles with an entirely new federal constitution. They also altered the mode of ratification from being “confirmed by the legislatures of every State,” in Article XIII of the AOC, to “the legislatures of three fourths of the several states, or by conventions in three fourths thereof,” in Article V of the new Constitution. (Emphasis added.)

On September 13, 1788, with only 11 of the 13 states having ratified the new Constitution, the Continental Congress passed a resolution declaring that it “had been ratified.” North Carolina and Rhode Island had not yet ratified and would not do so until nearly a year and a half later. On May 29, 1790, Rhode Island became the 13th and final state to ratify the Constitution. The new Constitution replacing the AOC was adopted before being “confirmed by the legislatures of every State,” as Article XIII required. With such precedent, who can say it will not happen again?

Call a Convention….”

Full article

Comments »

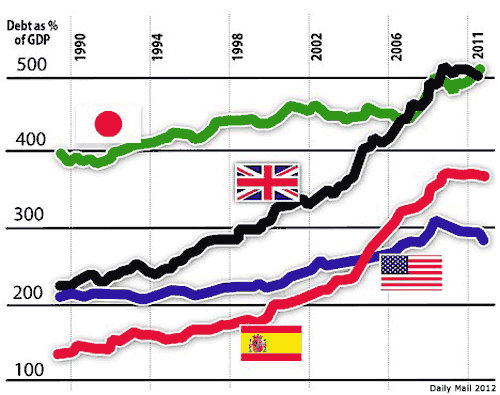

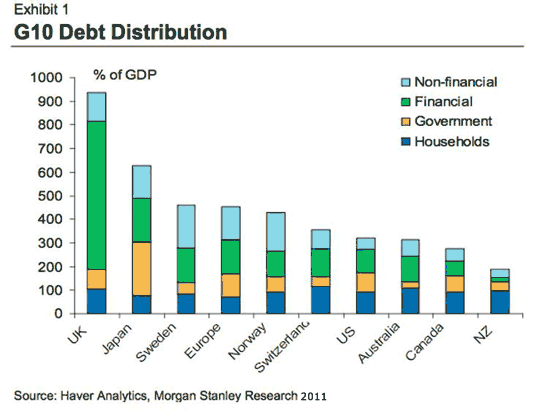

And if you think that looks bad (not that it doesn’t, mind you), there’s this 2011 Haver/Morgan Stanley one we’ve seen before here:

And if you think that looks bad (not that it doesn’t, mind you), there’s this 2011 Haver/Morgan Stanley one we’ve seen before here: In which total debt for the US, but even more for Japan and especially the UK, are much higher than in the first graph. This may largely be due to underestimating debts in the financial sector, though it’s hard to say. And for the argument I’m trying to make, it doesn’t even matter all that much. Though I would like to say that it’s crazy that we have no better insight in bank debt than we have. We’re asked to recognize that some of our banks are so big they could bring down our entire economies, but we’re not supposed to know how close they are to doing just that. Honesty would kill us, apparently. The 2nd graph shows a huge, 600% of GDP, debt for the UK, but only perhaps 100% for the US. Oh, really? Let’s see the books.

In which total debt for the US, but even more for Japan and especially the UK, are much higher than in the first graph. This may largely be due to underestimating debts in the financial sector, though it’s hard to say. And for the argument I’m trying to make, it doesn’t even matter all that much. Though I would like to say that it’s crazy that we have no better insight in bank debt than we have. We’re asked to recognize that some of our banks are so big they could bring down our entire economies, but we’re not supposed to know how close they are to doing just that. Honesty would kill us, apparently. The 2nd graph shows a huge, 600% of GDP, debt for the UK, but only perhaps 100% for the US. Oh, really? Let’s see the books. Let’s take the US as an example. There are 300 million Americans, so about 100 million families…..”

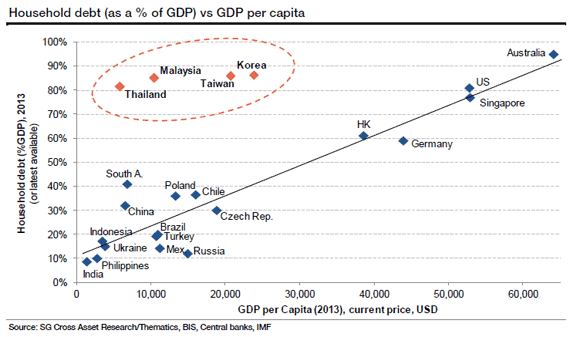

Let’s take the US as an example. There are 300 million Americans, so about 100 million families…..”