Profits may stay strong, but….

Comments »BlackRock Releases a Detailed Report on Their 2012 Predictions

BI points out a miracle of sorts…indices higher while earnings come in. Perplexing indeud!

Comments »Investors Move Away From ZIRP and Try the Risk on Trade

While volume is anemic investor seem to be selling bonds and speculating in equities. Given yields in Europe and the Euro cracking key support equities have managed to claw back and go green.

Comments »The Fed is Looking for Congress to Assist Housing Despite Record Low Rates and Prices

The clam has sent a letter to congress to prescribe more policy intervention.

Comments »Who is Richard Cordray?

Comments »After months of pushback from Republicans in Congress, President Obama has finally decided to go over their heads and appoint former Ohio Attorney General Richard Cordray head of the Consumer Financial Protection Bureau without them.

So who is he?

We’ve written a lot about him at Business Insider. Partly because, no matter what side of the aisle you’re on, there’s no denying he’s incredibly impressive. Cordray is an undefeated, five-time Jeopardy! champion (he won $45,303), has a masters in economics from Oxford University, and was also editor-in-chief of the University of Chicago Law Review.

After law school he clerked for Supreme Court for a Reagan appointee, and represented the U.S. government before the Supreme Court there three times — once for George H.W. Bush and twice for Bill Clinton. That was all before running for AG of Ohio (a swing state) as a Democrat.

So what’s the problem with Cordray? There are two, one is an old Washington problem, and the other is purely Wall Street’s:

1.Republicans said they would never support anyone to head the CFPB — Period —that is, unless the White House made serious changes to the agency. (Politico)

2.He doesn’t just go after Wall Street Institutions. He goes after individual executives as well.

Let’s expand on point 2 with some more examples of how Cordray fought Wall Street as Ohio AG:•In 2009, representing several state public pension funds, he reached a settlement with Hank Greenberg and other AIG execs that blew the SECs settlement out of the water. Cordray got $115 million, the SEC got a mere $15 million.

•The following year he settled another suit against AIG itself (also for Ohio) for $750 million. Some reports said the insurance company would actually be paying out $1 billion.

•And then there was the Bank of America Merrill Lynch merger. Cordray sued on behalf of Ohio pensions on the grounds that BofAS concealed billions of dollars of Merrill Lynch losses from their clients before the merger. The case settled for $475 million.

When we talked to him about the Merrill/BofA case in 2009, he, of course, explained the why he was suing, but also revealed why he’s such a threat:My understanding of a bonus is that it’s a special reward for superior performance. There wasn’t any superior performance for special reward; nonetheless, they (BofA and Merrill execs) wanted the bonuses. They ultimately, as best we know, got approval to pay out somewhere between $3 and $4 billion in bonuses, which was a very material element to the value of the merger. That was not disclosed to investors.

…we’ve also pursued some of the top executives — not just the corporations themselves. We do think that they bear their share of the blame — we think that they need to be held accountable as well. We think that that’s a principle that sends a message to other corporate executives on Wall Street that is a further disincentive for this kind of thing in the future.There’s your new sheriff, Wall Street. As we reported earlier today, it’s likely Republicans will fight Obama’s appointment in Court. In the meantime, Cordray will be able to nice and comfy at the CFPB.

Citadel Posts 20.4% Gains for 2011 Leaving Competition in the Dust

Keep your eye on Citadel; while following smart money is not going to predicate future returns…it is good to keep tabs on the leaders of a tumultuous year.

Comments »Retail Sales Show a Wide Range of Results

FLASH: SHARES OF UNICREDIT PLUNGE AGAIN

-14%

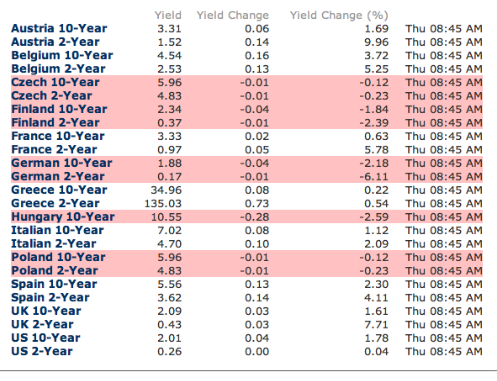

Comments »FLASH: European Sovereign Bond Yields are Higher

Hungary Suffers a Failed Auction as Yields Go Parabolic

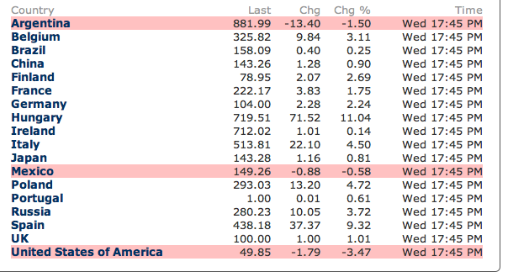

Global CDS Spread Summary

Does MF Global Spell Global Bank Run Down the Road ?

SEC Warns of Social Media Investment Scams

“Regulators are warning the public to be wary of social media sites that could be offering bogus investment schemes.

The warning follows civil charges filed by the Securities and Exchange Commission against an Illinois-based investment adviser who tried to sell fraudulent securities through Linkedin.

The SEC accuses Anthony Fields of offering more than $500 billion in bogus securities to investors through the popular social media site. No one bought the investments, the SEC says.

Fields couldn’t be reached for a response.

SEC officials say they have detected more fraud cases involving the use of social media.”

Comments »China Manages to Hold onto the Largest IPO Market Despite a Lack of Issues Going Public

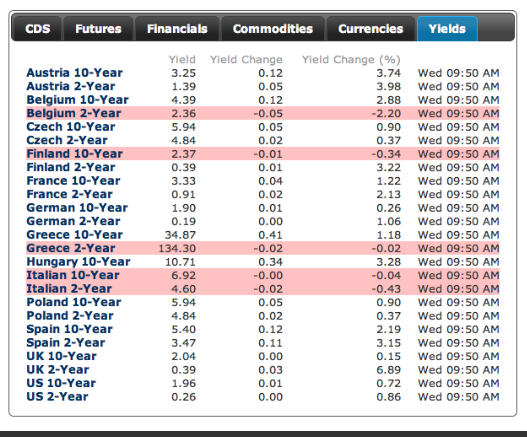

Update on Pan European Sovereign Yields

Kyle Bass Says a Sr. Obama Official States “Were Going to Kill the Dollar” (video)

[youtube://http://www.youtube.com/watch?v=OeIFcuVTS3U 450 300]

Comments »French Oat-Bund Spreads Blowout to Recent Highs

This is the widest spread since November….when everyone was freaking out about yields.

Comments »2011 Saw a Doubling of The Corporate Pension Funding Gap

Investors Clamor For Cash Pulling $5 Billion Away From Pimco

Bill Gross Skips the New Year and Goes Right to Halloween

In a new address to clients Bill Gross get’s scary describing a new normal for the world…

Comments »