“UBS AG UBSN.VX +0.92% ‘s trading floor in Stamford, Conn., once teemed with traders occupying a space equal to two football fields. The Guinness World Records recognized it as the biggest such facility on the planet. And the Swiss bank used it to showcase its Wall Street credentials.

Stu Taylor, a former UBS managing director in trading who now runs trading-technology company Algomi Ltd., remembers when guests were brought around the gallery regularly. “It was very much a showpiece,” he said.

Today, there are virtually no traders shouting into their phones or staring at terminals. UBS’s cavernous floor is taken up mostly by back-office, legal and technology staffers, according to people familiar with the bank.

A spokeswoman for UBS said the trading floor was built for 1,400 traders, but wouldn’t disclose the number of employees at the facility.

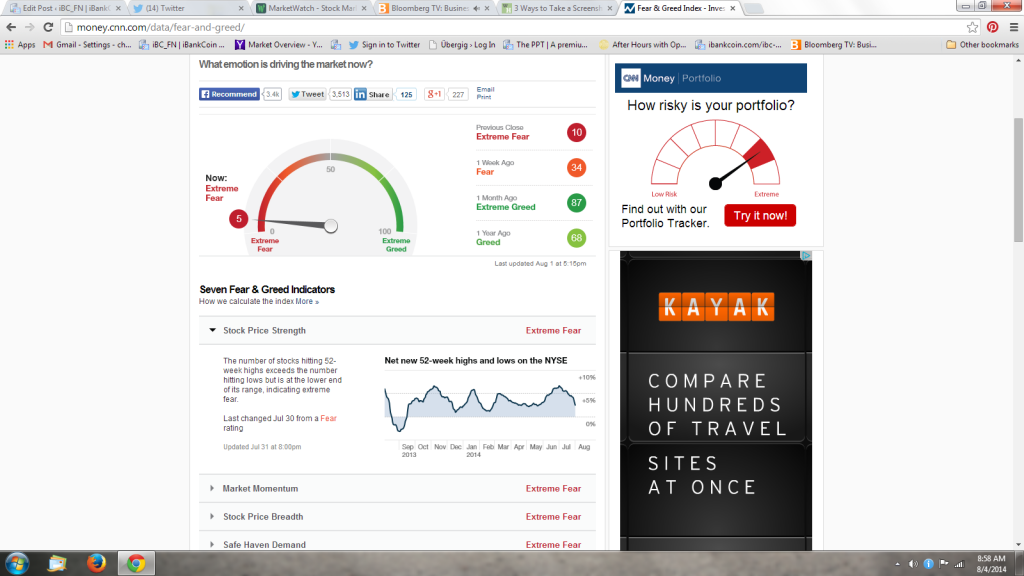

A deep slump in trading activity in everything from stocks and bonds to currencies is changing the face of Wall Street. Businesses that once contributed disproportionately to the revenues of the world’s largest banks are now bleeding jobs and sparking fears of a permanent decline.

Today’s markets are “boring,” said Thomas Thees, a former head of North American credit trading at Morgan Stanley MS -0.85% and a former co-head of fixed income at Jefferies Group. “This is affecting the opportunity to make money, and ultimately the earnings these [trading] businesses can provide.”

Global revenue from trading in fixed income, currencies and commodities, or FICC, dropped to $112 billion last year, down 16% from a year earlier and 23% from 2010, according to Boston Consulting Group.

As big banks with large trading operations such as J.P. Morgan Chase & Co., Goldman Sachs Group Inc. GS +0.84% and Citigroup Inc. report second-quarter earnings results this week, investors and analysts will be trying to find out whether the slowdown is a temporary funk or a lasting shift.

The forces arrayed against banks’ trading businesses are powerful. Since the financial crisis, regulators have limited their ability to take risks with their own money, and have made the process costlier, prompting many to dial back or push in different directions. At the same time, global markets have fallen into an unusually placid pattern that has damped clients’ desire to make trades.

“It’s been absolutely dead,” said Jarrod Dean, a municipal-bond trader at Sierra Pacific Securities in Las Vegas. Municipal-bond trading volumes are down about 30% since last August, he said, while profits are down more than 70%. “We’ve just got to keep toughing it out,” he said.

The malaise has prompted an Exodus of traders from big firms to smaller ones that are less subject to government oversight.

Late last year, Sound Point Capital Management LP, a $5.2 billion, credit-focused asset manager based in New York, scooped up five credit traders and analysts from UBS.

The rowdy atmosphere once celebrated on Wall Street already was on the wane when the crisis hit, as electronic-trading platforms began ushering in a quieter era. But the downturn and the new rules that followed have emptied desks and left fewer people to make sales calls and trade securities.

Down the road from UBS in Stamford, the U.K.’s Royal Bank of Scotland Group PLC has faced similar struggles. In 2005, RBS accepted $100 million of tax breaks in exchange for spending $345 million on a gleaming new headquarters in Stamford, creating 1,150 new jobs and retaining 700 employees in the state.

Two months ago, the bank, now majority-owned by the British government after a crisis-era bailout, said it planned to cut 400 jobs, in part to refocus the bank’s attention on the U.K. market.

A spokeswoman for RBS confirmed the intention to reduce staff and said it met the requirements under its agreement with the state of Connecticut, but otherwise declined to comment.

Among those no longer at RBS is Alan Osborne, who formerly sold fixed-income products for the firm ….”

Full article

Comments »