One of the best ways to lose money in the market is to believe in yourself more than what the collective opinions of the market and then acting upon them in a most heinous and egregious manner. Animals pretending to be humans walk upright as pigs and position size 20-30-50-100% of their money into “YOLO” trades and then wonder why they got blown up. If right, the rush feels great and that feeling of instant gratification will cause you to repeat that “one off” trade over and over again — until the house wins.

To help my fellow traders, I wanted to, on this pleasant Saturday, remind you of some things, the same things that have helped me trade well, so that you too could trade well.

Do not position size more than 5%. Do not bet against prevailing trends. Do not position size more than 5%. Do not bet against prevailing trends. Do not position size more than 5%. Do not bet against prevailing trends. Do not position size more than 5%. Do not bet against prevailing trends. Do not position size more than 5%. Do not bet against prevailing trends. Do not position size more than 5%. Do not bet against prevailing trends. Do not position size more than 5%. Do not bet against prevailing trends. Do not position size more than 5%. Do not bet against prevailing trends. Do not position size more than 5%. Do not bet against prevailing trends. Do not position size more than 5%. Do not bet against prevailing trends. Do not position size more than 5%. Do not bet against prevailing trends.

Also.

Stop out of trades when they go down on you, no more than 10% but really Sir, you should sell at -5%. I’d like to also add, you’re not smarter than the market.

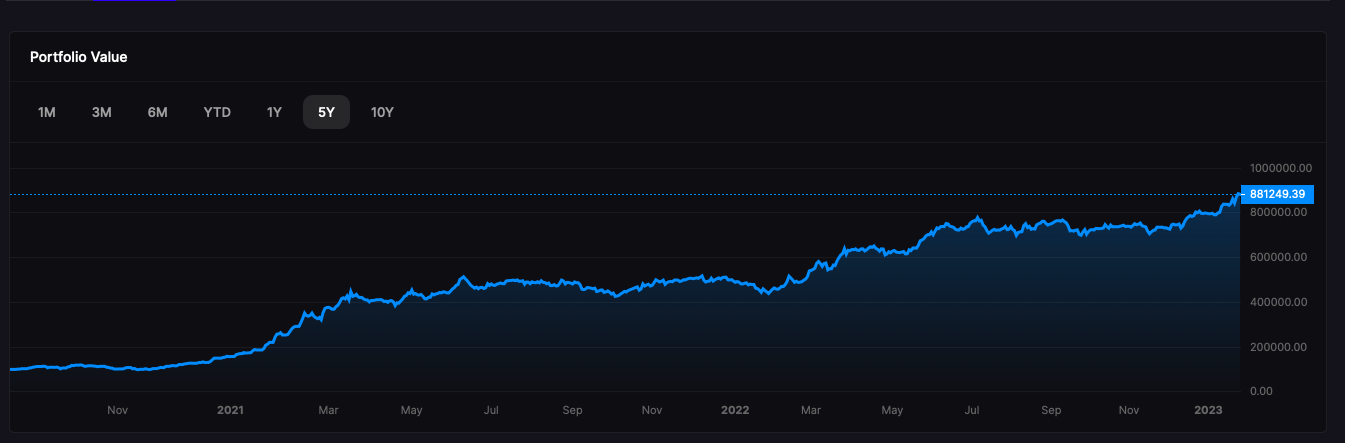

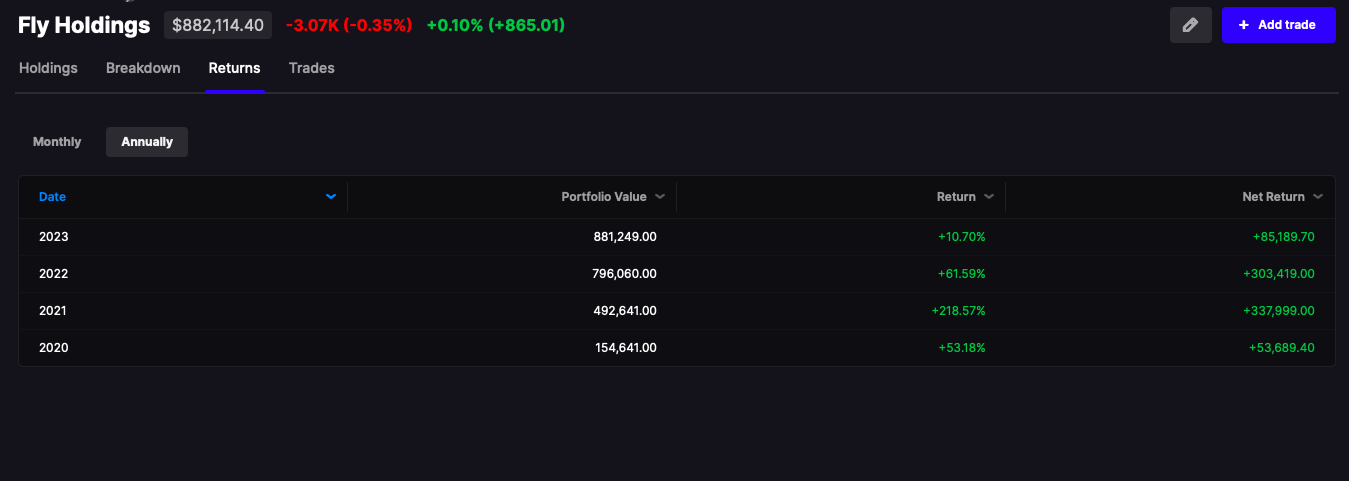

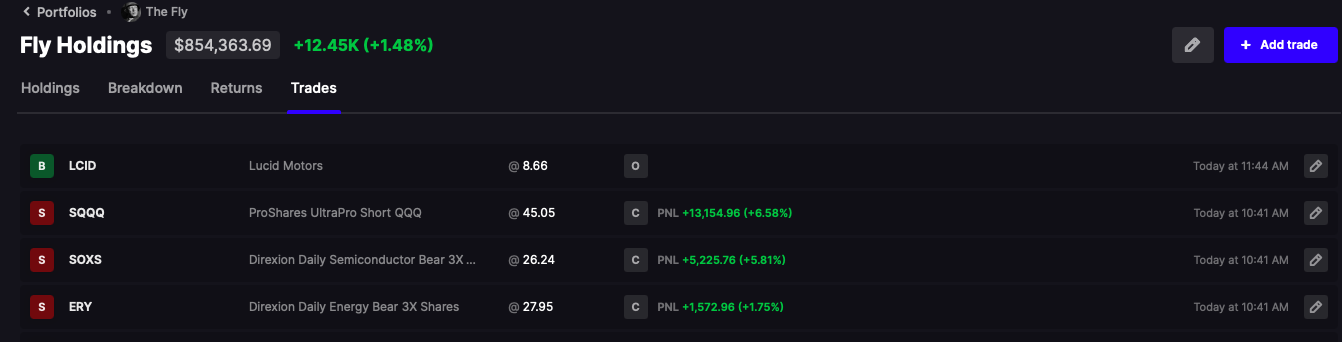

How did I turn $100k to $900k in two years? Simple.

I bought the COVID lows and never second guessed the market. My position sizes always started at 5% per stock and no more, at the very highest and for short durations 20%. I stopped out all the time, avoided large drawdown and would often have 50% of my account in cash. I went months without gains and FUCKERS would soon declare “so sad, The Fly lost it and is finished.” This happened all the time. I was declared a “bad trader” all the while producing 200% gains.

The reason why I suck from time to time is certain tapes do not conform with my personality. I am best during momentum trades, whether to the upside or downside. I can short into the hole like the best of them and ride trends until their wheels come off. I am not good in chop and do not like to trade chop and when I see my performance waning, instead of doubling down in stubborn egotistical trades, I recoil and trade light.

Do you know how I could’ve blown up and not be at record highs?

I could’ve thought I knew more about the market and obstinately shorted the market and when my trades lost money, I could’ve increased those positions and kept increasing them — because how could I, the smartest person that I know, be wrong?

HUMBLE YOURSELF.

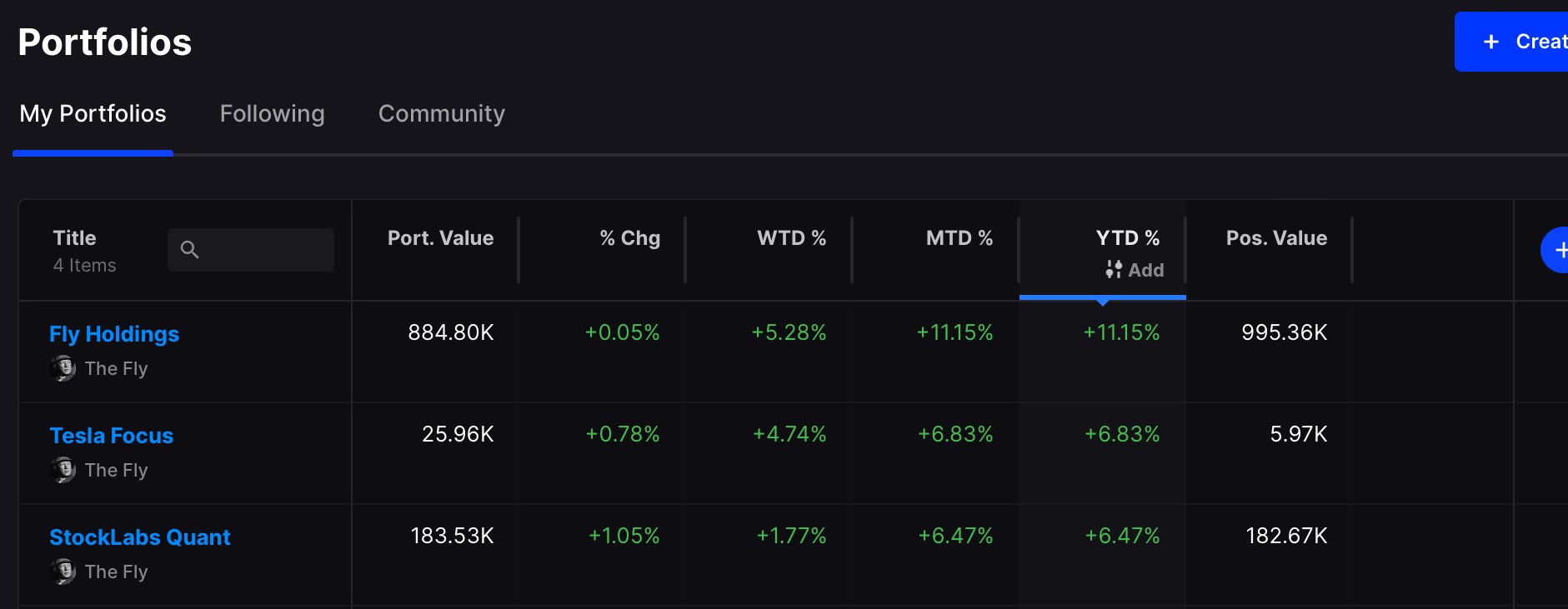

This is my usual routine, amended for current stratagem.

Keep book 100% long at all times via Stocklabs weekly quant picks. Trade around it and hedge closes if market looks sketch. Upon the open, CLOSE THOSE HEDGES — for the market tends to rip higher after 10am. Open screens and search for stocks within 2% of session highs on heavy volume (stocklabs does this) and buy STRONG STOCKS and take quick gains. The purpose of utilizing margin is to be in and out fast, not to accrue margin interest. If I am down 1% for the day and my hedges are up 1.5% — but I am still down 1% net, closing those shorts might be a good idea — since they in fact reduced my losses. That’s the whole point of them. They aren’t there to turn my entire account green in a down tape, but to reduce my losses.

On the flip side, when I leverage long to the tune of 150%, that additional exposure is only there to juice my returns and should be closed out quickly in order to reduce risk — should markets decide to trade lower again.

There is no worse trade than seeing a profit turn to loss and that loss turn into an emotional trade whereby you find yourself doubling down for the sake of protecting your ego.

When you are wrong, tap out. Do it often and before long it will be routine and you’ll never hesitate to admit when you get something wrong again.

Do you know what is a good return? Anything better than 10% per year. If you do not have time to trade often — use the Stocklabs quant picks (monthly allocations) and go yachting.

For those who don’t know me and think I’m just some bragging piece of shit know it all, I wrote two short stories about the time I blew the fuck up and out in magnificent fashion.

Comments »