Many of you are surprised over the recent events and ponder for the future. Have you already forgotten 2022 and the suffering it brought to investors? It was a year that was supposed to kick off the beginning of the next great depression, only saved in 2023 by a stasis in Ukraine and reduction in inflation, causing people to go insane for shares of $NVDA.

But now we see the elite we permit to rule us have no idea what they’re doing, wasting and squandering away 250 years of American excellence for nations that 99% of people here couldn’t give a flying fuck about.

Markets were never supposed to come back in 2023 but they did and now we are here, seemingly at a crossroads. It’s worth noting, stocks are not supposed to fall in April. The $SMH is down 11.5% for the month and only 3 month’s in recent history did investors absorb such a vicious blow: 2022, 2004, and 2002.

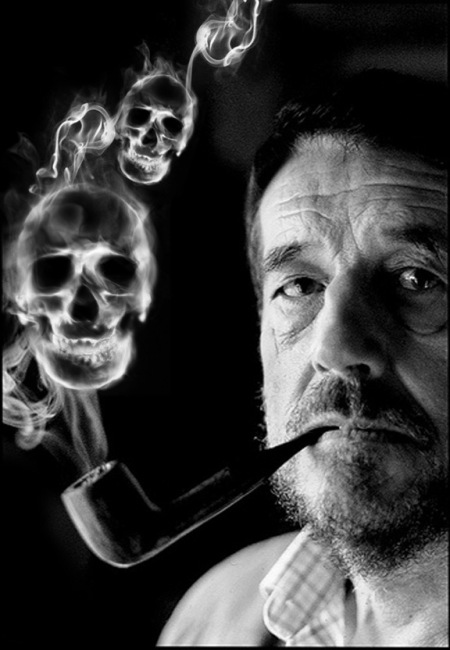

What worries me about this tape is the possibility of a 2022 redux, which would include an absolute collapse in all asset classes, including $BTC. Right now there isn’t any fear in the tape. Most traders are confident that prices will go up, predicated on what I do not know. For the past 6 months people were fixed on the FOMC lowering rates. Well, that isn’t going to happen.

So in this high rate environment, the following are chief concerns.

How the fuck are companies going to refinance their debt and now lay off workers at these high rates?

Normies cannot afford homes at 8.5% with prices at record highs.

Commercial RE is basically ridiculous.

Consumer spending will be affected; the math doesn’t lie.

We’ve had a good run and 2022 was the geopolitical and monetary policy warning of what could happen. Nothing has improved, other than inflation coming down from 10%. But it’s still elevated and the cost of money is at recent highs. I will keep an open mind for being wrong, but I think the possibility of a bear market for the remainder of the year should be considered, especially since stocks aren’t even down that much from their highs. In other words, you still have time to save yourselves.

Comments »