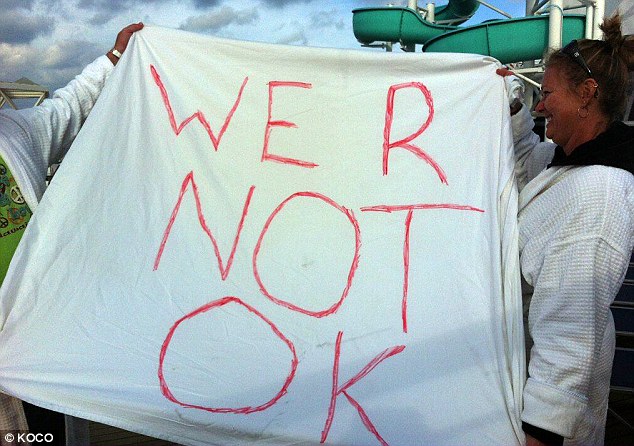

The ongoing calamity on the Carnival Cruise ship, ironically named “Triumph”, reminds me of an old movie called The Exterminating Angel.

‘People are fighting over food and stuff – that’s a bunch of savages. It’s ridiculous. Carnival has nothing at all in plan in case something like this happens.

source

In the movie, a fine assembly of aristocrats join for dinner–but for reasons unbeknownst to anyone–become “stuck” in a room, unable to leave. Soon enough, they turn into savage animals–killing each other along the way.

I reckon the same thing is occurring on the ship right now. 4,200 people went aboard, hoping for the time of their pathetic lives, only to end up on the receiving end of grave misfortune.

Human nature will never change. We always devolve to the lowest form of depravity, when adversity hits us hard. How many people are killed in nightclub fires– due to trampling and disorderly exits?

Panic is our #1 enemy. It is the very worst characteristic of man. It makes us do things we would never do under normal circumstances. When panic sets in, our brains turn off and we transform into cavemen, cannibals even, fighting for survival like stark raving mad lunatics. Pray tell me, if the majority of man believes in God and the afterlife, why do they become so desperate to save their lives?

Perhaps they are fighting for status quo, in order to see their family grow old, to enjoy the World Series and such.

Nevertheless, CCL is a short. Their accidents have become legendary and is bound to hurt business in the short term. Knowing American ingenuity, they will likely branch out to unsuspecting countries, like Nigeria, and offer cruises to see the Statue of Liberty. I am not touching the stock, either way.

Back to the subject of panic. How many times have you lost money or missed opportunities because you were scared, frightened to lose too much? More often than not, these feelings are a legitimate concern. What you should be asking yourself is “how can I avoid feeling panic in the future?”

The antidote is simple.

Never bet more than you can afford and be somewhat traditional with your allocations. The idea of turning $12k into a million is very nice indeed. But you cannot replicate lightening in a bottle. Anyone who tells you there is a formula for “quick get rich schemes” is simply lying to you for his own benefit.

A few years ago, I turned $100k into a million–but I was jumpstarted by a very large position of mine (FTK) tripling in value. I then proceeded to exercise leverage at 225% to play the ranges, using TNA and TZA as my tools. The PPT was my guide and I was impervious to defeat.

Then I took it to the next level and started to play options in a big way. I’d bet $250k on a single, short term, strategy–using greed as my vice. There was nothing remotely intelligent about this form of trading and eventually led to a 50% drawdown, before I closed out the account to finance the purchase of a new home. I didn’t need that money, per se. But it became a very big distraction for me, so I eliminated the distraction. Very simple.

If you are interested in longevity, especially if you are managing other people’s money, keep your position sizes below 20% and more regularly in the 5-10% range. Own a wide array of industries and never become fascinated with glamorous stories of stock market ascendency.

Like the lottery, only a select few will ever make money that way. The majority of people will lose their entire investment and more: their friends, families and retarded items of value etc.

Comments »