When Obama was elected in 2008, everyone on Wall Street said “oh well, the coal stocks are fucked,” sort of tongue in cheek. During the 2012 elections, at a time when Romney was up in the polls, coal stocks ran like canaries in the clean fresh open sky. After Obama won, I vowed to never buy a coal stock again.

The entirety of the industry is bankrupted, 100% thanks to the EPA. Now I struggle with this because I fucking hate coal, with every fiber of my being. I want to pelt coal executives in the heads with sharp coal digging shovels and blow up their harems with truckloads of their fucking byproducts. On the other hand, the good lads working in West Virginia, acquiring the black lung free of charge, will now need to find work elsewhere. Quite frankly, all of those people are too stupid to do anything else, other than pick rocks out from the mountains of Appalachia. And, by the way, “The Fly” never digresses, not even for a solitude second.

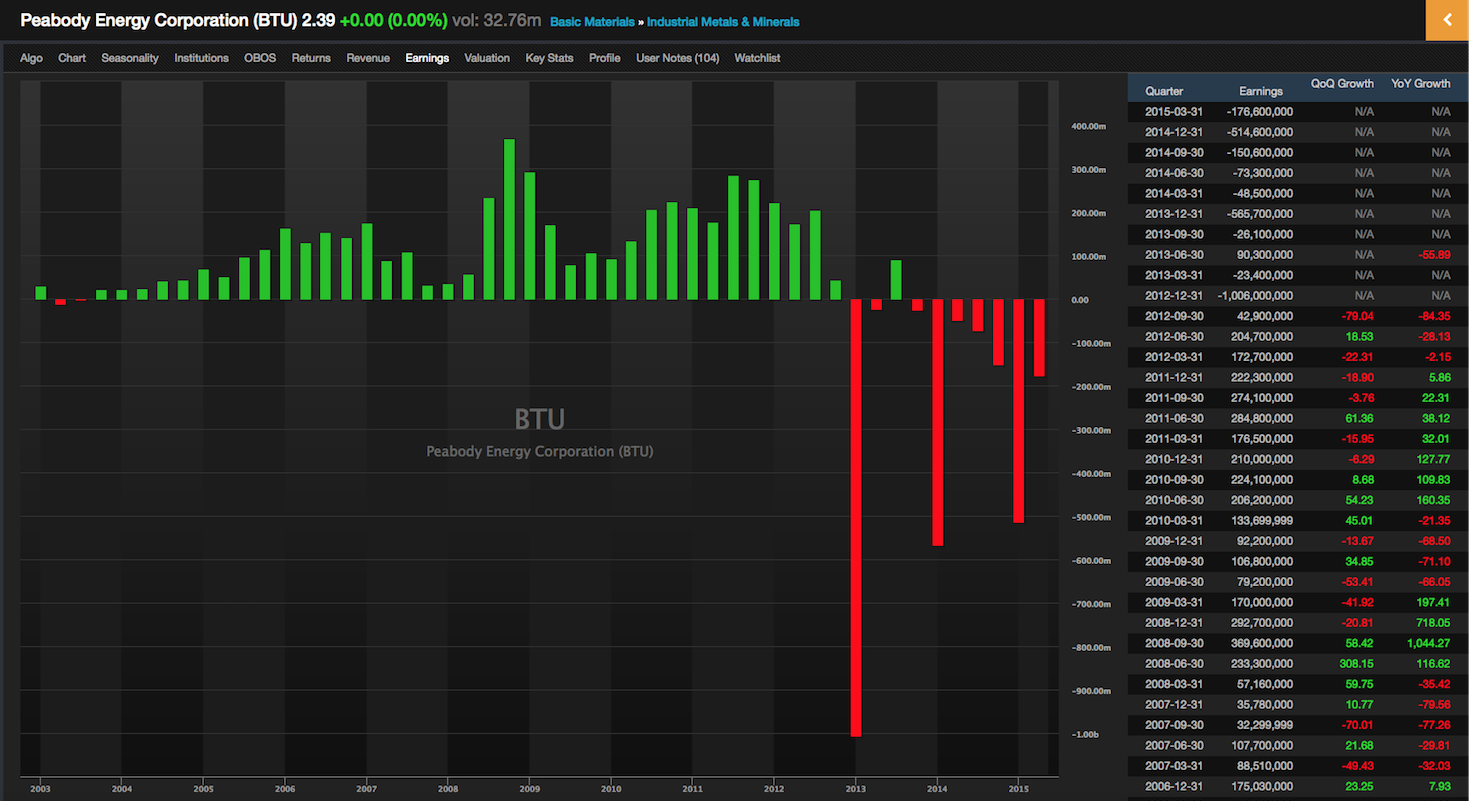

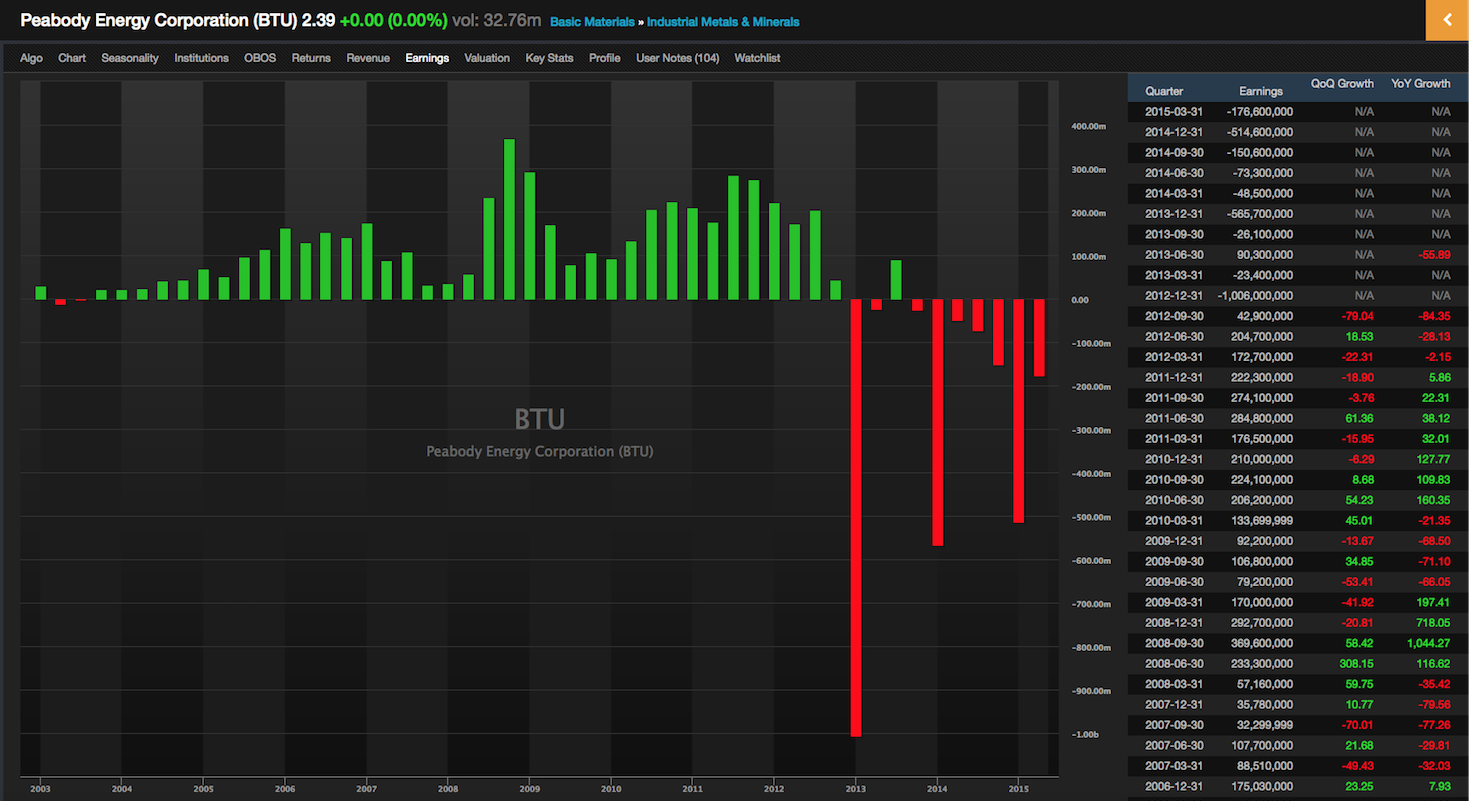

Perusing the masterpiece that is Exodus tonight, I am stunned by how fast and furious the dissolution of the coal industry has been. Once great names, like WLT, BTU, ACI and ANR, are now on the road to Valhalla. You should bear witness to this because it’s the beginning of the end of an ancient industry. A clownish industry that once tried to refurbish their dastardly product as ‘clean coal’, but now reduced to the ash from President Obama’s newport cigarette (extra menthol).

Now it’s just stupid coal.

https://www.youtube.com/watch?v=OqAlMItkV44

Comments »