This is the worst short squeeze I’ve ever seen. Reason being: just Friday the company declared they were done, through, kaput.

Nov 13 (Reuters) – Drug developer KaloBios Pharmaceuticals Inc said it would wind down its operations and that it had engaged restructuring firm Brenner Group to help liquidate its assets.

The company said it was highly unlikely that exploring strategic options could generate a viable transaction within the time frame, given its limited cash resources.

Apparently, the Friday the 13th massacre was only delayed for shorts, which represent at least 10% of the outstanding shares.

I want you to put this story into real life perspective.

Imagine yourself to be a reasonably smart man, fairly liquid in the market. You see the KBIO news on Friday and you’re pleased because you’ve been short from the time the FDA said to “fuck off”, when the stock gapped down from $14 to $4, earlier this year. You were victorious and you celebrated this immense victory with your wife, over steaks, shrimp and champagne cocktails.

Monday swings around and the stock is percolating a bit. You chalk it up to wild eyed speculation, which normally accompanies companies that go bust. You had 10,000 shares short at $4, and decided to double that position to 20,000 shares, selling short MOAR at $2–giving you an average cost of $3.

After the market closed today, you felt confident that your $60,000 short position would pan out. The stock had been lower by 2.76% in an otherwise rip-roaring tape. After all, the company said they were done and that it was “highly unlikely” any strategic options would materialize, other than liquidation.

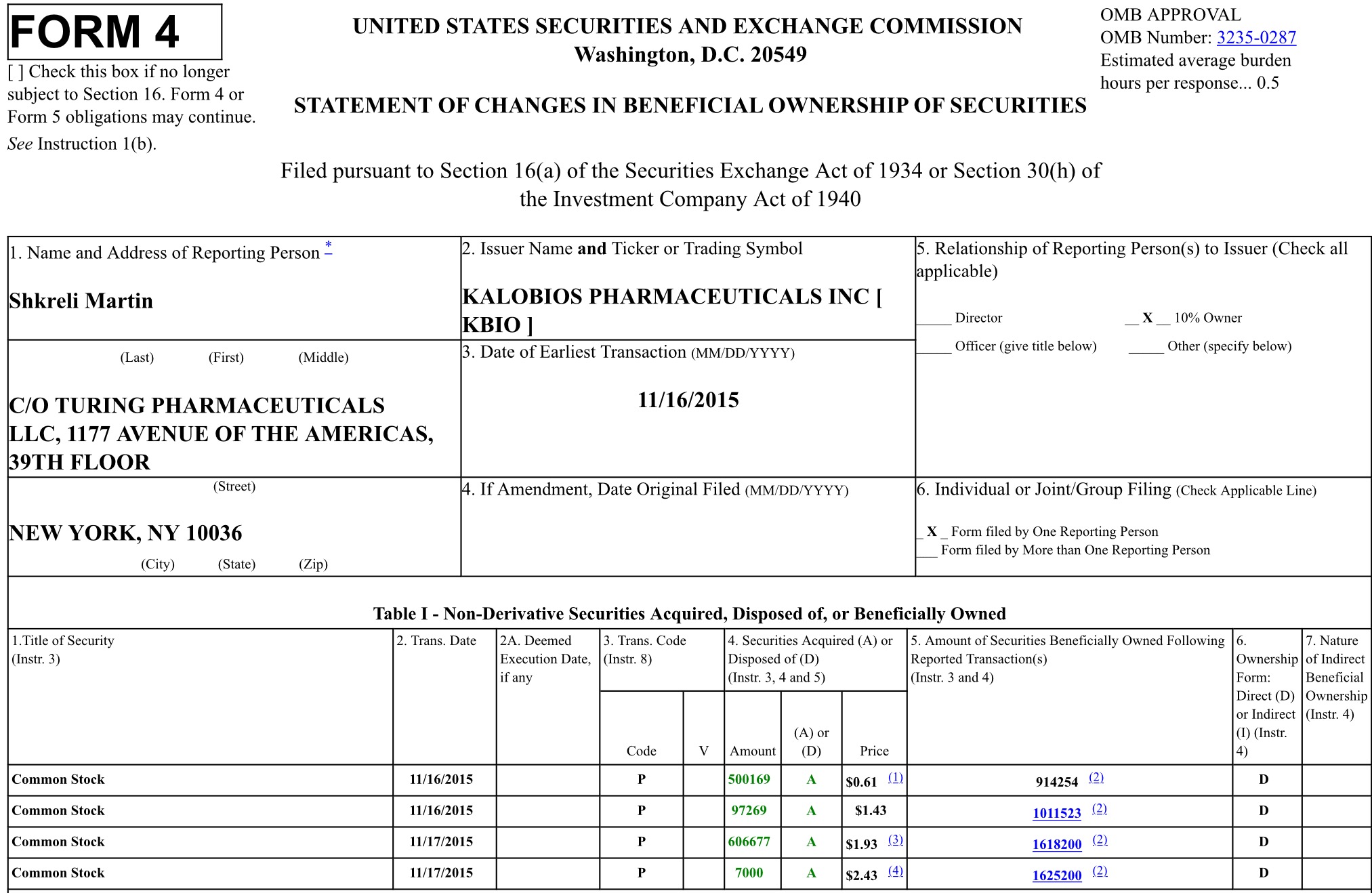

Then you get a news alert that Martin Shkreli bought 1.2 million shares, most likely due to his desire to reverse merger his company, Turing Pharmaceuticals, into KBIO’s lifeless shell. The internet buzz was enormous and the stock fucking took off. It leapt from $2 to $10, then $15, then $20. Your $60,000 position and $20,000 unrealized gain has morphed into an astounding $340,000 loss. Your entire account was only worth $250k, money that you had saved up over the years, set aside for retirement.

It’s all gone. All of it.

Tomorrow morning you stand at the mercy of the market. Ever point is an additional $20,000 loss. Your broker will liquidate all of your holdings to cover the losses, unless you’re able to wire in $90,000 to get back to zero and whatever funds necessary to hold your other positions. If they’re 50% marginable, you will need to wire in $215,000 before 10am.

Now if animal spirits jack KBIO to $25 or $30, the dynamics of your loss change, drastically. Total losses can quickly escalate into the $500k area–all because of one little man buying into an already defunct biotech company.

Fuckery at its finest. I feel for anyone who is short KBIO. You shouldn’t have to deal with this sort of curveball. But the market is cruel and unforgiving and mean-spirited.

Comments »