Note I kept that exclamatory statement in check with just 3 exclamation marks. Anything more is indicative of acute mental illness.

Comments »A Clear Look at the Market, 2015

If you’re down more than 10% this year, you’re either underdiversified, leveraged, or retarded (no offense to the mentally addled).

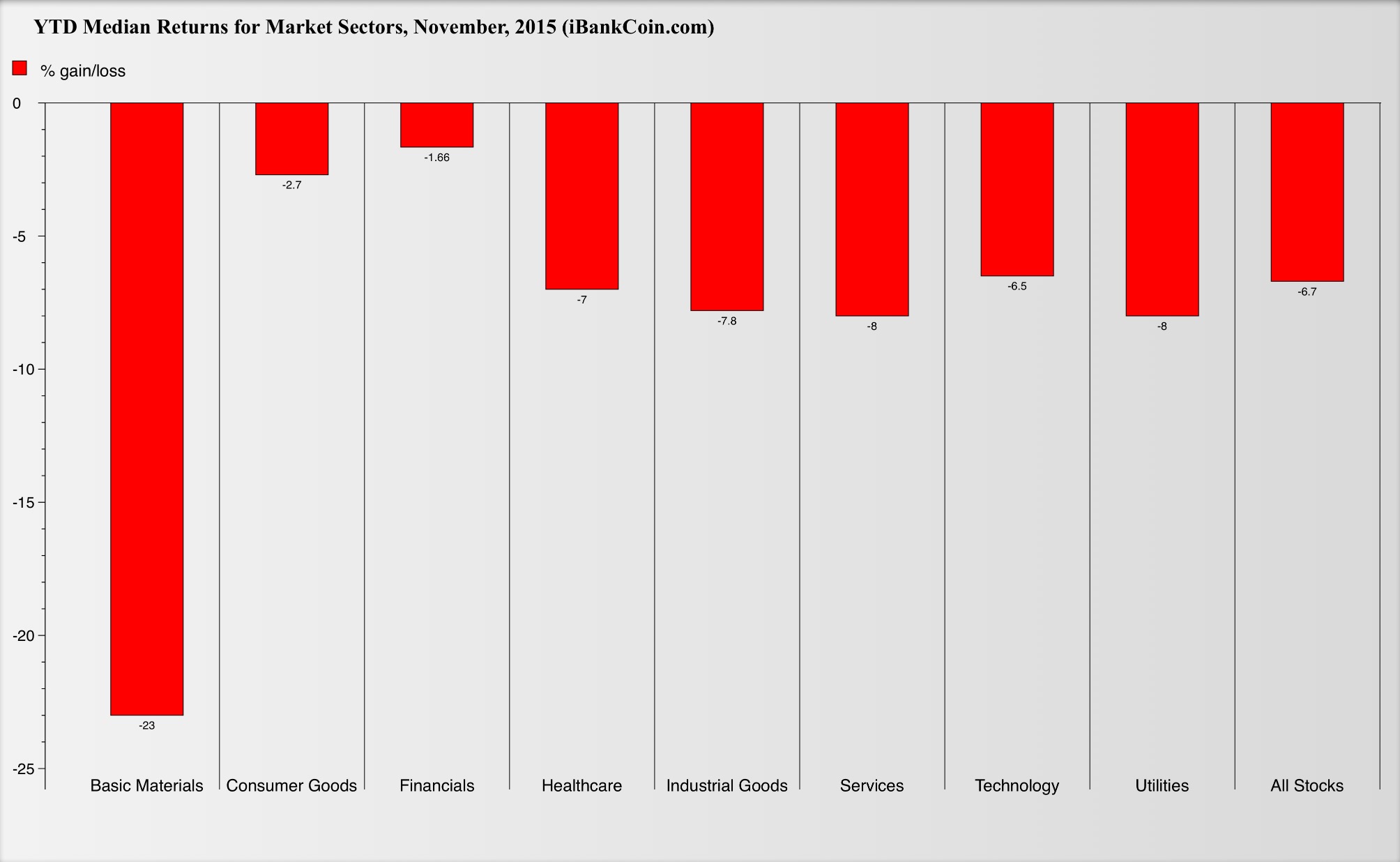

Running analytics in Exodus this evening, I compiled overall sector returns, YTD, and for all 4,335 stocks in the system, producing median returns for best representation.

As you can see by the chart above, all sectors are lower this year, which makes my 15% returns that much more impressive.

Is “The Fly” a genius? Categorically so.

Does this year’s outperformance grant him clemency for his abysmal 2014 showing? Definitively not.

I am aware there are losses much greater than 6.7% out there, especially amongst traders who live and die by the sword. If you happen to be one of them, sad saps about the school grounds drowining yourselves in styrofoam cups of beer, just know that you’re wholly unqualified to manage assets and should immediately recuse yourselves from the field, else open yourselves to heinuous karmic reprisals.

For all of the noise and tumult thrusted upon the markets in 2015, Le Fly stands supreme, imperially dominant amongst throgs of losers and catamites.

DEVELOPING…

Comments »This Market Will Make a Marlboro Man Out of You

We had a nice rally; but then it burned and turned to ash. Luckily, my book is smartly positioned to avoid murder holes. I am up 0.4% right now and happier than a pig in vomit. Sure, I’d like to be up more. Then again, I’d like to be up period. ‘Tis a time to reduce expectations. Do not anticipate to eat every day. One must forage about the plains and the woods for one’s meal. Out there, in the dark wilderness, are bears who rape and vultures who eat. I don’t know about you, but I’d rather remain indoors and avoid the whole ordeal altogether.

This market will harden you, make you dislike animals and children. It will cause you to dislike holiday’s and have a penchant for cynicism.

My top 3 positions are COST, CNC and PAH. Truth be told, COST is now more than twice the size of CNC. I am merely writing this blog to entertain you, as you teeter on the brink of absolute destruction.

“The Fly” has omnipresent skills and a sixth sense about these sort of things.

Expect nothing, from here until year end. Pagan holiday’s will be canceled and the New Year will come and go like any other day. The start of 2016 will mark the end of this facade of a bull market, castrating the anointed few who’ve blessed us with their bull market ways in the year of our Lord 2015.

NOTE: The Marlboro Man died of lung cancer. Actually, 4 Marlboro men died of smoking related ailments. As you were.

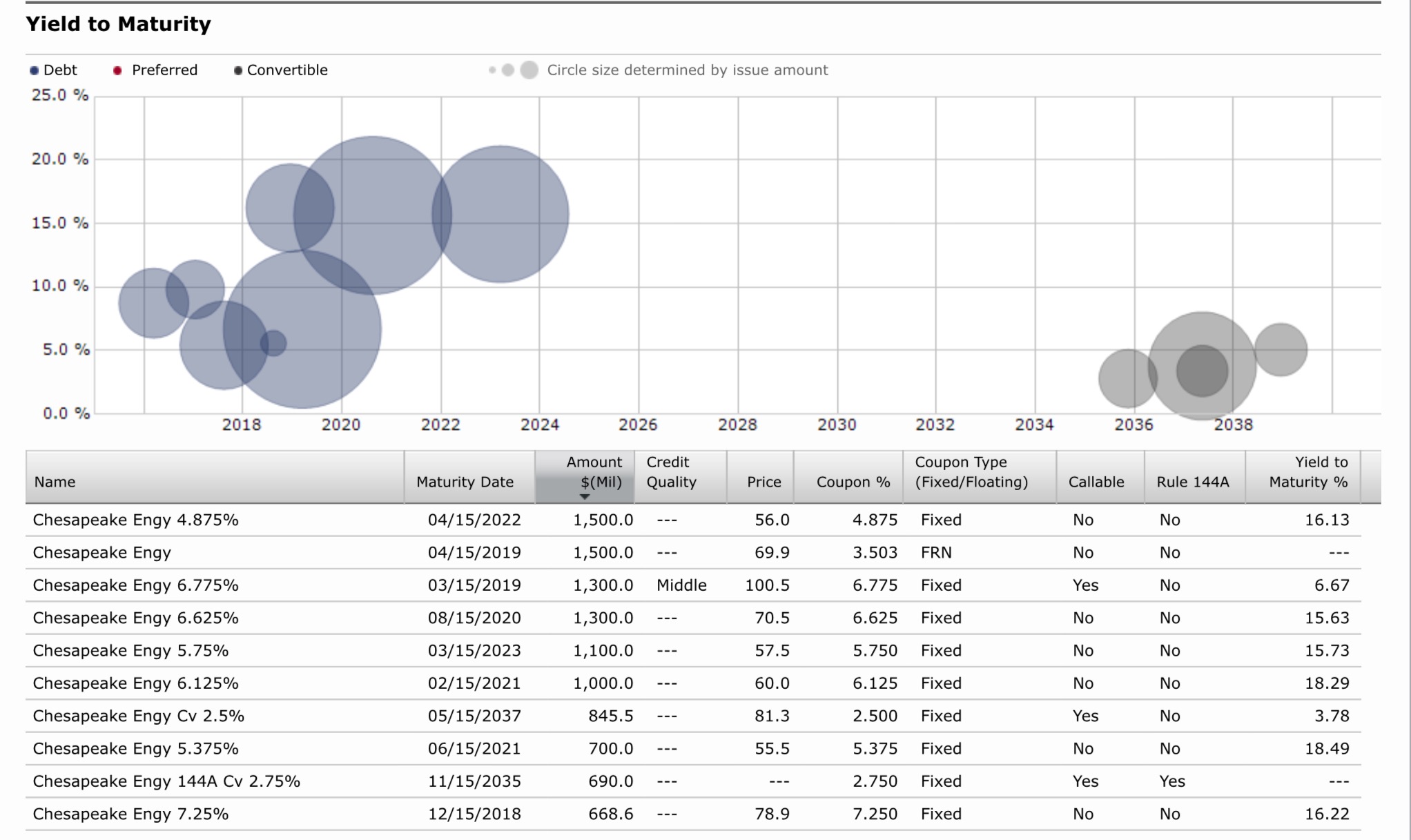

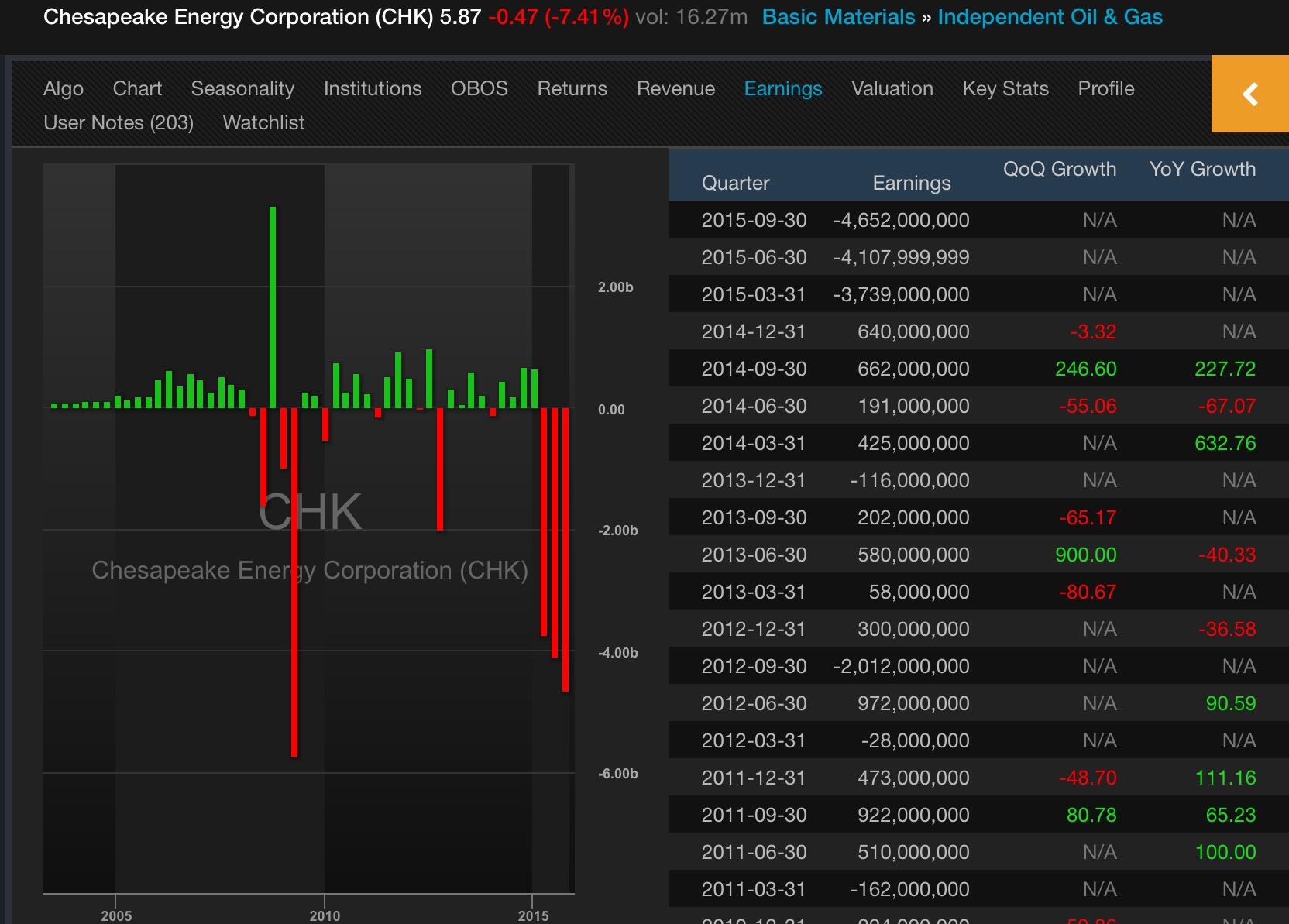

Comments »Chesapeake Enters the Danger Zone

CHK is the poster child for excess gone awry in the oil and gas space. It was the darling of the industry, until natural gas collapsed, leaving Aubrey McClellan’s acquisition strategy in tatters. The company was managed like a holding company, leveraging up the balance sheet to accumulate assets.

Unfortunately, the tide has turned in the commodity space and CHK’s late entry into the oil space has likely marked it for death.

I’ve always felt this stock would eventually go to zero. The bond market is suggesting there is something to worry about, with prices ranging in the 50’s to 70’s.

Quarterly reports are met with endless mark downs and losses.

And finally, its share price has collapsed to new lows, pushing debt/eq levels near 3–leaving the company fully exposed to the markets.

Should oil and gas remain at these levels or lower, I don’t see how CHK pulls through this in one piece.

Trading is fun. But sometimes people go about it without thinking. Just know, before you pull the trigger on that kick ass oil stock with the nice looking chart, something truly fucked up might be just beneath the surface, in the fundamentals.

Smart people look at all of the evidence, before making a determination. Don’t pigeon hole yourself as a chart guy, or a fundy guy, just because it’s in your comfort zone.

Comments »Gentlemen, Exodus Wins Again

Markets go up and down; SUNE circles the toilet bowl for its eventual demise. But Exodus has been consistently killing it.

The principal algorithm flagged OS on Thursday and Friday of last week.

Here is the track record over the past 36 months.

Any questions?

The holy grail? Probably not.

An edge? Most assuredly.

This message was paid for by The iBC Centre for Orbital Space Cannons (OSC), weapons built for offensive purposes only.

Comments »$GNC, $VSI CRATER ON DOJ INVESTIGATION

I view GNC and the Vitamin Shoppe as modern day retailers of snake oil. If you want protein, in the form of whey, I suppose these stores can provide you with an expensive alternative to what you can find on Amazon. However, the rest of the garbage that they retail there is the equivalent to 19th century snake oil, tonics designed to cure everything from obesity to cancer.

The other agencies involved are the Federal Trade Commission, the Department of Defense, the Anti-Doping Agency and the U.S. Postal Inspection Service.

GNC has been under scrutiny by state law enforcement authorities this year, and last month Oregon sued the company claiming it sold supplements made with illegal ingredients. At the time, GNC called those claims “without merit.”

GNC in March reached an agreement with New York Attorney General Eric Schneiderman on its Herbal Plus products, pledging to more stringently test its supplements and follow FDA manufacturing recommendations. Schneiderman’s probe, which was also focused on retailers including Wal-Mart Stores Inc., Walgreens and Target Corp., sought information about the origins of ingredients in supplements and the health benefits described on labels.

Both GNC and VSI are prey, not predators, in this new retail landscape. The great Amazon anaconda is coming for them, to swallow then whole (no homo).

The DOJ will be holding a press release at 3:30 to discuss these matters.

NHTC is down in sympathy too.

Comments »Copper Knew All Along

Even though Carl “fuck you, give me three seats on your board” Icahn is long FCX, the stock has been careening lower. It’s as if Devil’s were inside of it, driving it into the pits of hell. I had ample opportunities to exit at a profit. For my lack of intuition and foresight, I am now sitting with a loss.

My position is small and the loss means nothing to me. I spit on it and cast it away like a stone skipping over water. Nevertheless, that 1 yr chart of copper is rather telling of the economic climate that is gripping China now. All is not well and I am fairly certain the last thing we need are Federal Reserve rate hikes. But you don’t get what you want. You get what you’re given and you don’t make a fuss about it.

Stocks are higher today and respite is the word of the day. Market breadth is a tepid 55%; but most of my stocks are higher, including my largest position COST–which is one of the few stocks in retail that is doing well.

There are have’s and have nots in retail. The have’s take away from the others, causing hysteria and pain. The have nots are drowning in their own blood, caused by the debilitating effects of the have’s. I view COST, AMZN, AAPL, HD, WBA, CVS and LOW as part of the cabal that make up the core of the have’s. These giant corporations are insidious beasts whose sole purpose in life is to churn out profits, destroy competition, grab market share. I don’t see this trend reversing any time soon, which is why my COST position is 2x the size of my #2 position.

It’s been a hard, hard year, the type of year that turns your hairs gray. But I think 2016 is going to be harder, so enjoy this little respite while you can.

Comments »DICKS CRUSHED ON EARNINGS MISS

It has always been a desire of mine to write that title. It was on my bucket list. I’ve always felt DKS was too expensive. I’d leave that store, $500 less rich, mumbling to myself “why hasn’t the deflationary vortex stricken them dead?”

Alas, the vortex will get them all, one by one. If you have cash, you are King. Dick’s sporting goods has been chopped by a solid 15% guillotine in pre-market trading.

Reports Q3 (Oct) earnings of $0.45 per share, $0.01 worse than the Capital IQ Consensus of $0.46 vs. $0.45-0.48 guidance; revenues rose 7.6% year/year to $1.64 bln vs the $1.66 bln Capital IQ Consensus.

Consolidated same store sales increased 0.4% vs. +1 to 3% guidance.

Same store sales for DICK’S Sporting Goods increased 0.7%, while Golf Galaxy decreased 2.9%. Third quarter 2014 consolidated same store sales increased 1.1%.

Co issues downside guidance for Q4, sees EPS of $1.10-1.25 vs. $1.42 Capital IQ Consensus; comps -2% to +1% vs. ests above +1%.Lowers FY16 EPS to $2.85-3.00 from $3.13-3.21; lowers comps to +0-1% from +1-3%.

“Our positive same store sales for the quarter reflected a strong back-to-school selling season tempered by slowing trends later in the quarter. Strength in athletic footwear, accessories and athletic apparel was moderated by the impact of record warm weather in more seasonal categories.”

“As we look to the fourth quarter, we anticipate a more promotional environment.”

These numbers just fucking suck. I’m actually putting together a buy list of my favorite ravaged retail names. I’m basing my analysis on current valuations v historical norms. The ones with the greatest variance are of elevated interest to me. Case in point: GPRO.

I know the fucker is acting like coal; but at these levels, you have to be interested–trading 1.6x sales down from 8x. This is a staggering drop in the way Wall Street perceives the company.

I am optimistic for certain retailers, after seeing shares drop by a third over the past 3 months. Let’s see if the market can mount a rally today and build upon yesterday’s momo.

Comments »Europe Booms Higher, Led by France

European markets are ripping to the upside, up more than 20%–led higher by France’s CAC which is up 2.38%. As such, Dow futures are up 90, as traders fix their bayonets and prepare to impale the bears and kick them back into hell.

Dollar v Euro is continues to gain, heading towards parity, now with a $1.06 handle. Oil is lower by 0.5%.

Today’s rally isn’t contingent upon oil or currencies. Apparently, people are wholly interested in buying stocks, which makes me wonder about traps being laid out by the evil muppeteers of this market.

Nevertheless, I look forward to a fun filled day of higher equity prices, even if they’re fleeting.

Comments »Look Who’s Been Buying Valeant

This is more of a matter of gawking at the sheer ferocity of the market than mocking fund managers for making really bad investments. The events that have transpired in VRX over the past 3 months, with shares dropping 70%, is nothing short of spectacular fuckery on a grandiose scale.

Andreas Halvorsen’s Viking Global Investors, long a top performing fund, bought 376,615 Valeant shares sometime between July and the end of September to own 4.9 million shares at the end of the quarter, according to a filing made on Monday.

Brahman Capital raised its stake by 958,300 shares to own roughly 4 million shares while Hound Capital bought an additional 1.2 million shares, making Valeant the fund’s biggest position with nearly 4 million shares, the filings show.

Marble Arch, Blue Mountain, Farallon and Adage also spent more money on Valeant during the summer months after Valeant became one of the market’s best performers during the first half of the year, notching gains on an aggressive acquisition strategy.

The notable fund missing from this pastiche, of course, is William Albert Ackman’s Pershing Capital. He made sure to buy more, upping his stake to 21 million shares–because 19 million simply wasn’t enough.

Comments »