I’d like to take a break from dividing and conquering the readers of iBankCoin by moving away from the political jargon to remind you that doom is just around the bend.

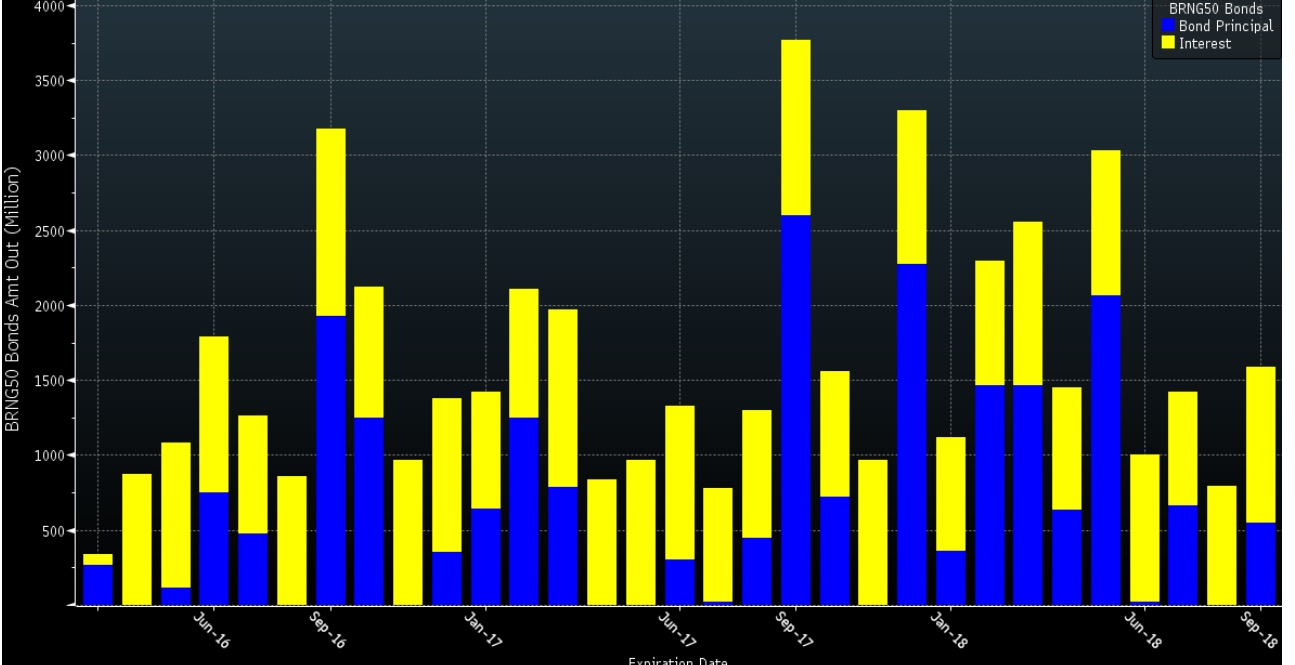

In spite of the fact that oil has been on an effervescent run higher, the balance sheets of scores of high cost producers are racked with an unsustainable amount of debt.

Crude oil at $28 or $40 isn’t enough to stop the inevitable.

Bondholders are paying dearly for backing a shale boom that was built on high-yield credit. Since the start of 2015, 48 oil and gas producers have gone bankrupt owing more than $17 billion, according to law firm Haynes and Boone. Fitch Ratings Ltd. predicts $70 billion of energy, metal and mining defaults this year, and notes that $77 billion of energy bonds are bid below 50 cents, according to a note Thursday.

A representative at Energy XXI declined to comment. Representatives for SandRidge and Goodrich didn’t respond to requests seeking comment.

“Absent a material improvement in oil and gas prices or a refinancing or some restructuring of our debt obligations or other improvement in liquidity, we may seek bankruptcy protection,” Energy XXI said in a March 7 public filing.

Restructuring Plan

Goodrich Petroleum is asking shareholders and bond investors to approve a restructuring deal that would convert its unsecured debt and preferred shares into common stock. For the plan to work, shareholders must approve it at a March 14 meeting and enough bondholders need to participate by the March 16 exchange deadline.

“Absent a successful completion of the recapitalization plan, the company will have no alternatives other than to seek protection through the bankruptcy courts,” Walter Goodrich, chairman and chief executive officer, said on a March 9 conference call.

Missed interest payments and potential defaults include:

Energy XXI, with $2.875 billion in debt, and SandRidge Energy, which owes $4.131 billion, both failed to pay interest due Feb. 16 and will default unless they reach agreements with their creditors by March 17.

Ultra Petroleum, which owes $3.197 billion, said last week it has until April 30 to hammer out a deal with its lenders.

Goodrich Petroleum, which owes $455 million, said this week that it won’t pay interest due March 15 and April 1, and that it’s asking bondholders and shareholders to participate in a restructuring plan.

Chaparral Energy Inc., with $1.798 billion in debt, missed a payment on March 1, starting the clock on a 30-day grace period.

Pacific Exploration & Production Corp., with $5.428 billion in debt, likewise has until the end of the month under an extension granted by its creditors.

Venoco Inc., facing $708 million in debt, skipped an interest payment last month. The company must cut a deal with creditors by March 17.

Warren Resources Inc., which owes $453 million, said last month that it may file bankruptcy without a creditor deal. The company faced a default on March 2, when a 30-day grace period for a missed interest period had been set to expire.

A representative at Pacific declined to comment, and one at Warren Resources said the company would release more information about its restructuring at a later time. Representatives for Ultra Petroleum, Chaparral and Venoco didn’t return calls and e-mails requesting comment.

“Asset managers bought the story that we’d have $100 oil forever,” said Tim Gramatovich, chief investment officer with Peritus Asset Management in Santa Barbara. “Bondholders are left holding the bag.”