A few days following Mark Zuckerberg’s release of Threads, an obvious declaration of war against Twitter and Musk, Elon released revenues shares with content creators — much to the delight of everyone who bothered to upgrade to Twitter blue and produce popular content.

?BREAKING: Twitter Monetization For Creators Is REAL?

I just received my first ad revenue payment from Twitter.

1st check = $10K (!!!)

I would typically never share personal financial info but creators need to know that @elonmusk means BUSINESS supporting the creator economy pic.twitter.com/JliTBR2LkG

— Benny Johnson (@bennyjohnson) July 13, 2023

FULL TRANSPARENCY

Minutes after Twitter announced ad revenue payouts, I received this saying I’ll be paid $7,153

For reference, I had 328 million tweet impressions in the last 28 days

These are awesome payout numbers & I encourage every single creator to share their content… pic.twitter.com/BD4O2QaVXE

— Ashley St. Clair (@stclairashley) July 13, 2023

Twitter starting to share ad revenue with creators is a big deal! Looking forward to seeing the evolution of the program over time. https://t.co/WWj2WaRzWo

— Rob Maurer (@TeslaPodcast) July 13, 2023

The net result has been nothing short of euphoria and I’d love to have a look at the Twitter Blue upgrades today, as Zuck melts into a pool of feces and sweat — training for his match to come with Elon at the Roman Colosseum.

It was a colossal asshole move of Meta to enter into the specific space of Elon. These people tend to be spiteful and I suppose that Twitter’s new policy of permitting free speech is a bit too much for those bastards and they’ll do whatever they can, within the means of their influence, to derail Musk.

I am not naive. Elon isn’t perfect. He is just a man and not a God. But he must be protected and supported — because the right to express opinions in a public square that isn’t checked by deranged leftist scum should be a God given right.

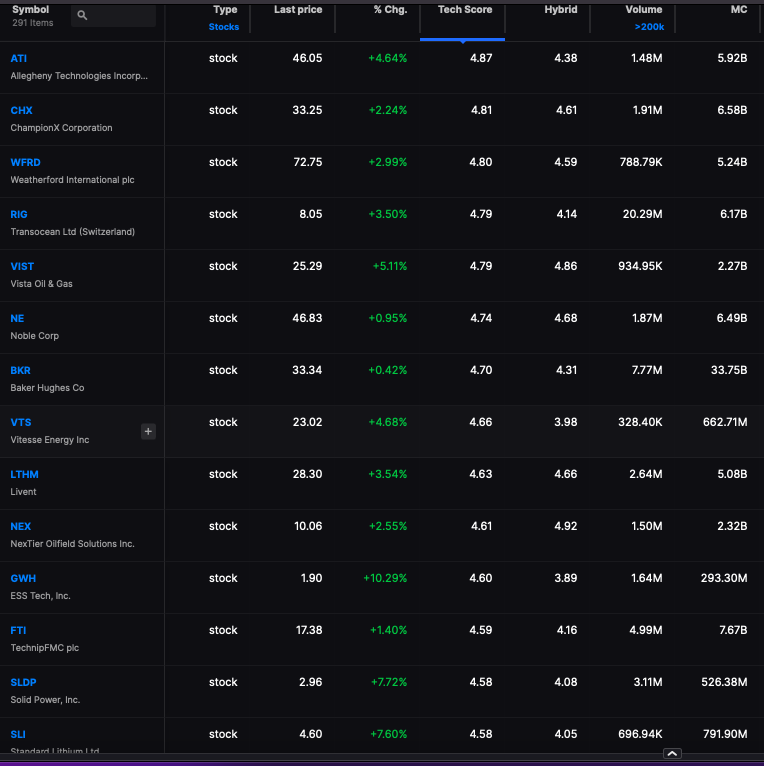

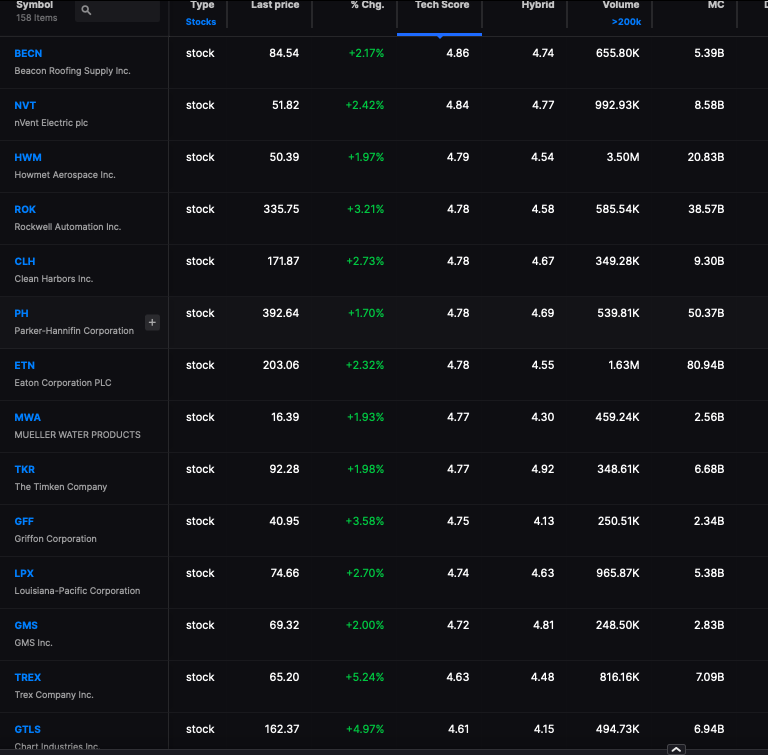

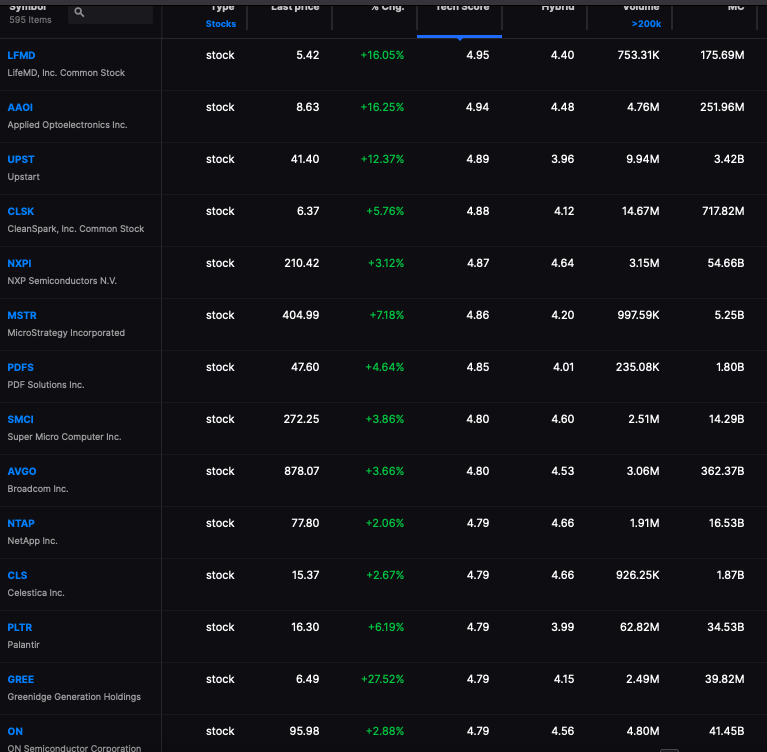

We’re doing a special trial offer for Stocklabs tomorrow. Drop your email here to get one.

Comments »