For the first time in weeks, I applied myself in trading. I didn’t trade from my phone or laptop and I didn’t study or read anything other than the screen. I completely ignored Mrs. Fly and her missives and looked into the screen and came out the other end +187bps. It’s very convenient that this happened. I might’ve tuned in and got bogged out — trading frenetically in a dour tape.

It felt like the olden days when my intuition was peaking and could not lose in a trade even if I tried. But it also made me think that I’ve lost something, and I only realized it after attaining it again. There is a certain and distinct fire that used to burn very hot and bright inside of me, younger Fly on Wall Street attempting to make it big on his own.

Having achieved success very young and gone through the crucibles of numerous hardships, as time worn on I moderated myself and even preached austerity. Gone are the days when risk was fucking on and in abundance. In recent years, I’ve accepted supreme gains of the mediocre varietal. What I mean by that is, +55% last year is a superb showing and I am very grateful for having achieved it. But it’s moderate in the big scheme of things, barely noteworthy and not the sort of performance you’d ever boast to anyone about. Sure, I once made 10x in an options scheme back in 2012 and I made 17x in my $ETH gambit a few years back — but it’s all isolated events with my money.

I used to do this professionally, bob and weave for the masses — your brokers broker — the guy whose desk was crowded for today’s picks. In a sense, via iBankCoin and to a limited degree on X — I am still him. But it’s not the same.

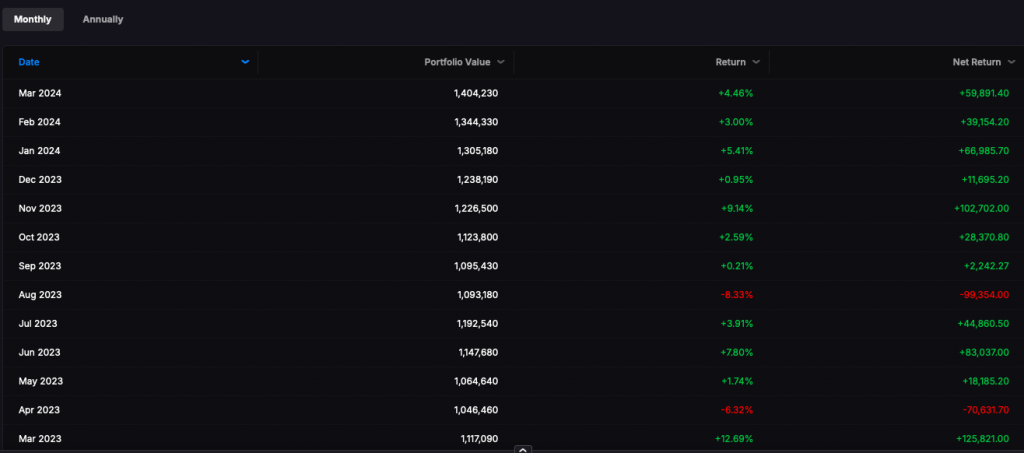

I closed 95% long with a strong bias for commodities, and a portfolio beta of 1.76, +15.5% year to date — never been higher.

Comments »