Bulls are now presiding primary in the swamps, attempting to survive by breathing through straws. It won’t be long until the crocs seek you out and snap your legs off.

Early this morning I was like you swimming freely in the clear blue water, skin very white and clean. I was happy to see stocks trend up and I partook in the spoils, thinking “hey, this is nice.” My gains crested above 70bps and I looked at my trading, then at my long term strategic, and hated what I saw. I had rotated my strategic into commodities which were no longer working and I had some other stocks that simply were not as good as the one’s on sale now.

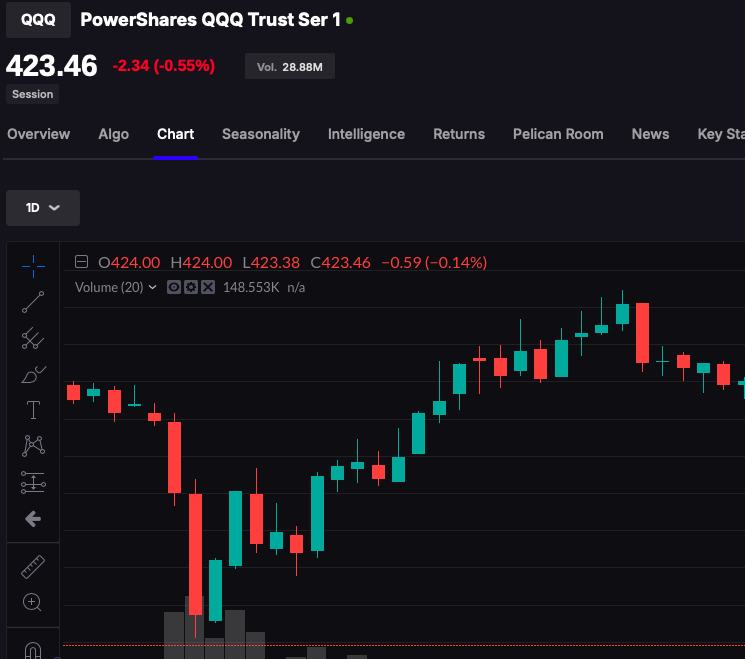

And then I saw this.

See the one large red candle on the 5min? It scared me because I thought it might’ve led to a series of red candles. All wars start with a single shot, and all bear markets begin with a red candle. So I sold everything in my trading, took +49bps, and fucked off. I also raised 35% cash in my strategic, with the idea of reallocating later.

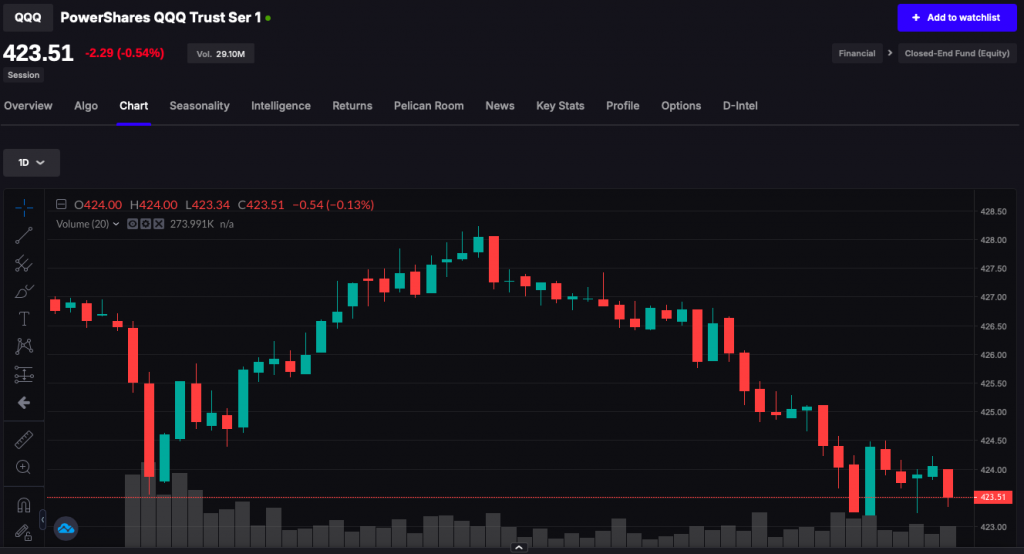

The net result?

It’s fucking over pal. Ten thousand sell orders preside over it, blotting out the sun. You might think it’s not over — but it really is. It’s also true that I get melodramatic for the sake of fucking with you and making myself laugh as I type this shit. In truth, market squalls are part and parcel of living in a big city. You like that fucking penthouse and that theater — well now you have to take this rape and bullet wound to the knee cap. Forget about tennis this summer.

My dream is as follows: COLLAPSE.

Perhaps one day, but the global economy is still strong and this sell off will end soon just like all previous sell offs. The only unique aspect to this is rates, once again climbing higher, placing a rope around the neck of the economy.

More later.

Comments »