You bearish types make me physically sick. The very sight of your comments makes me want to projectile vomit onto someone. Can you refrain from making predictions, please? Thanks.

Biotech still looks good. I know this trade is long in the tooth; but NDRM still looks great. I have a few more that I want to own, but will only do so once I sell either NDRM or XLRN.

Homebuilders are strong too. I am long TPH and have no desire to sell into this market decline.

We are down due to a cacophony of reasons, none of which makes any sense. I refuse to become subjected to group think and bare all of my senses, just because the market trades down for a day.

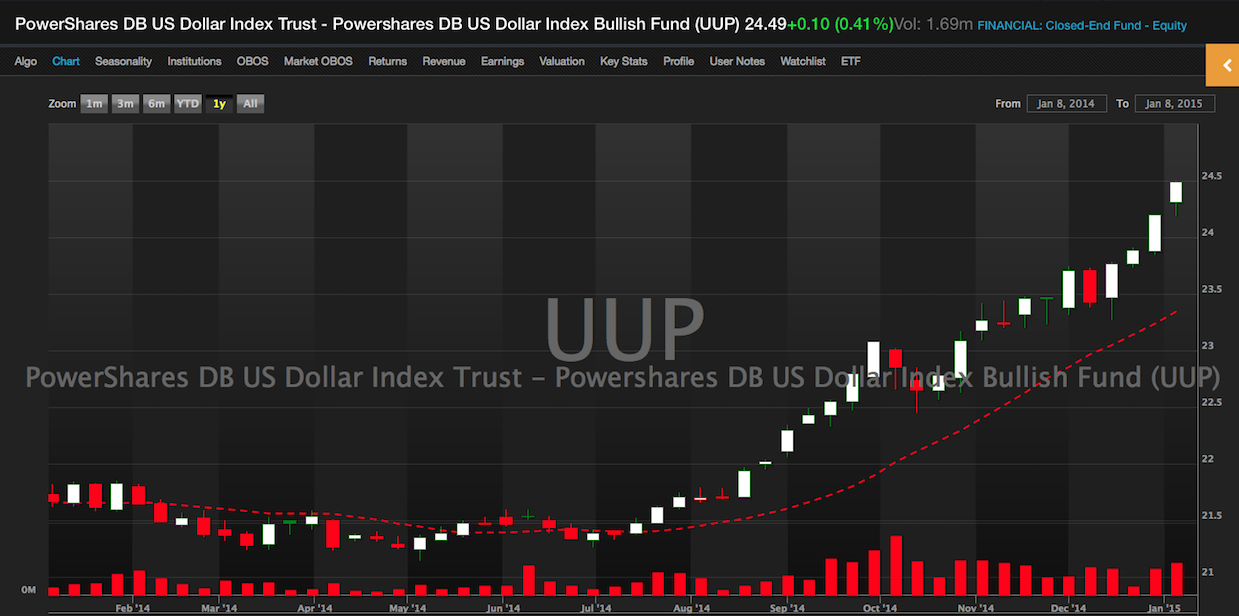

Let’s put things into perspective, shall we?

We rose by 325 points yesterday and have lost less than half that today. Net, net, we are doing fine.

Go eat a sandwich and shut the fuck up.

Comments »