Before you read my post, watch this video.

I realize this small potato is being derided in the public square, a spectacle for the unwashed mob to throw their soured cabbage. He is the most hated man in the world and to some deserving of The Catherine Wheel. The truth is, this sort of insidious practice has been taking place for a long time, in our beloved pharmaceutical space. How else do you think BIIB and AMGN make all of that money?

However, two wrongs do not make a right. Moreover, this moron is especially obtuse, well deserving of the 2015 Asshat of the Year award.

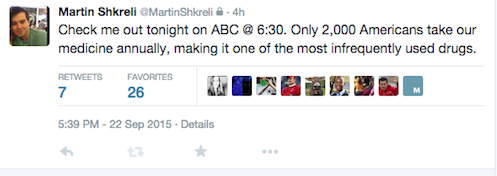

Check out his latest tweet.

If I follow his logic, because this drug only affects 2,000 or so indigents, it’s okay to rip them off and purposely cause their deaths. This is Scrooge McDuck thinking, a bitter child with a new toy taking advantage of those who want to use it. I hate this side of human behavior. Whenever greed is mixed with avarice, an asshole is born.

Fuck your capitalistic rebuttals. I get “for profit” and how it is the engine for innovation. But in this particular case, after studying his background, he’s just a dipshit trying to fleece sick people who need this drug to live. This pill was $1 just a few years ago and has been bought and sold from one company to the next, eventually reaching $13.5. Good old Marty comes along and jacks the price, overnight, to $750. Bear in mind, this is a drug that has been around for over 60 years and is without patent protection. Theoretically, any generic drug company can file an NDA and put Marty out of business.

I hope it happens.

Oh, during tonight’s news Marty said he’d buckle to public opinion and lower the price from $750 to an undisclosed amount. Perhaps he’ll be gracious enough to reduce the annual cost from $600,000 to maybe an affordable $500,000?

ASSHAT!

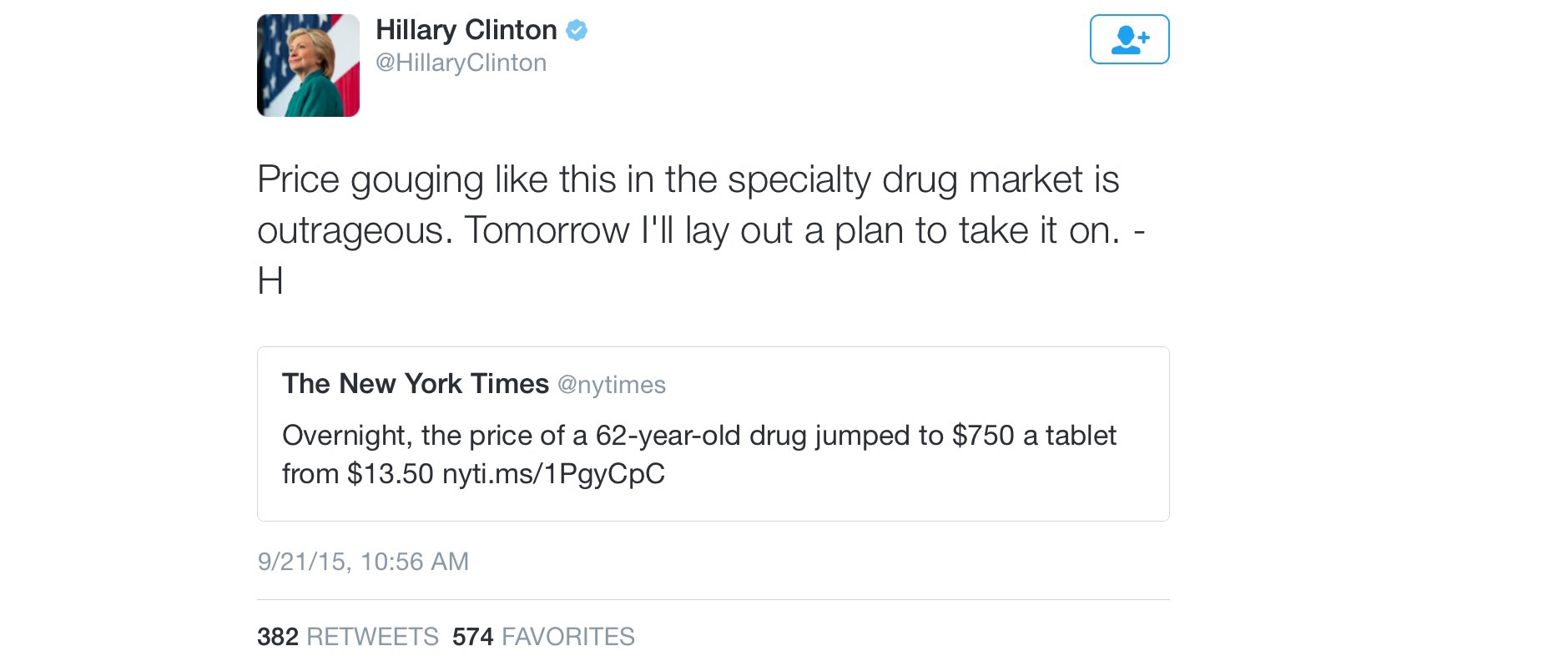

Oh by the way update: It was because of Marty that Hillary Clinton made that comment regarding excessive drug profits. The result, over the past two days, has been a -9% drop in the biotech index, or many, many billions of dollars in market capitalization.

Update: Zerohedge has some interesting color on Marty.

Comments »