Bond King, Jeff Gundlach, was out today condemning the Fed for what he called ‘unthinkable’ policy of raising rates into an economy as penurious up as this one.

I’ve been saying this for the better part of 5 years: the United States can and should never raise rates, unless of course we’re able to pay down a large portion of the $20 trillion debt load we’re saddled with.

I read guys like Gundlach, a man who does it big in real life. He doesn’t just talk the game; he lives it. He’s saying the Fed is absolutely nuts for even thinking about hiking. Janet Yellen, and her butterscotched candies, is fucking delusional and should be looking to EASE into more QE, rather than tighten. Look at the shares of CHK, FCX and X for Christ’s sake.

From the moment I laid eyes on here and heard her Woody Allen accent, I knew we were fucked. The rest of the board governors are idiots, always have been. Bernanke put them in check. But Janet is an absentee Fed Chair and she’s letting the hawks form the policy.

Back to Gundlach:

U.S. stocks are “whistling through the graveyard,” according to Jeffrey Gundlach. He’s the founder of Doubleline Capital, which manages over $70 billion in assets.

“There are plenty of markets that are falling apart and freaking out,” said Gundlach Tuesday afternoon on his monthly webcast.

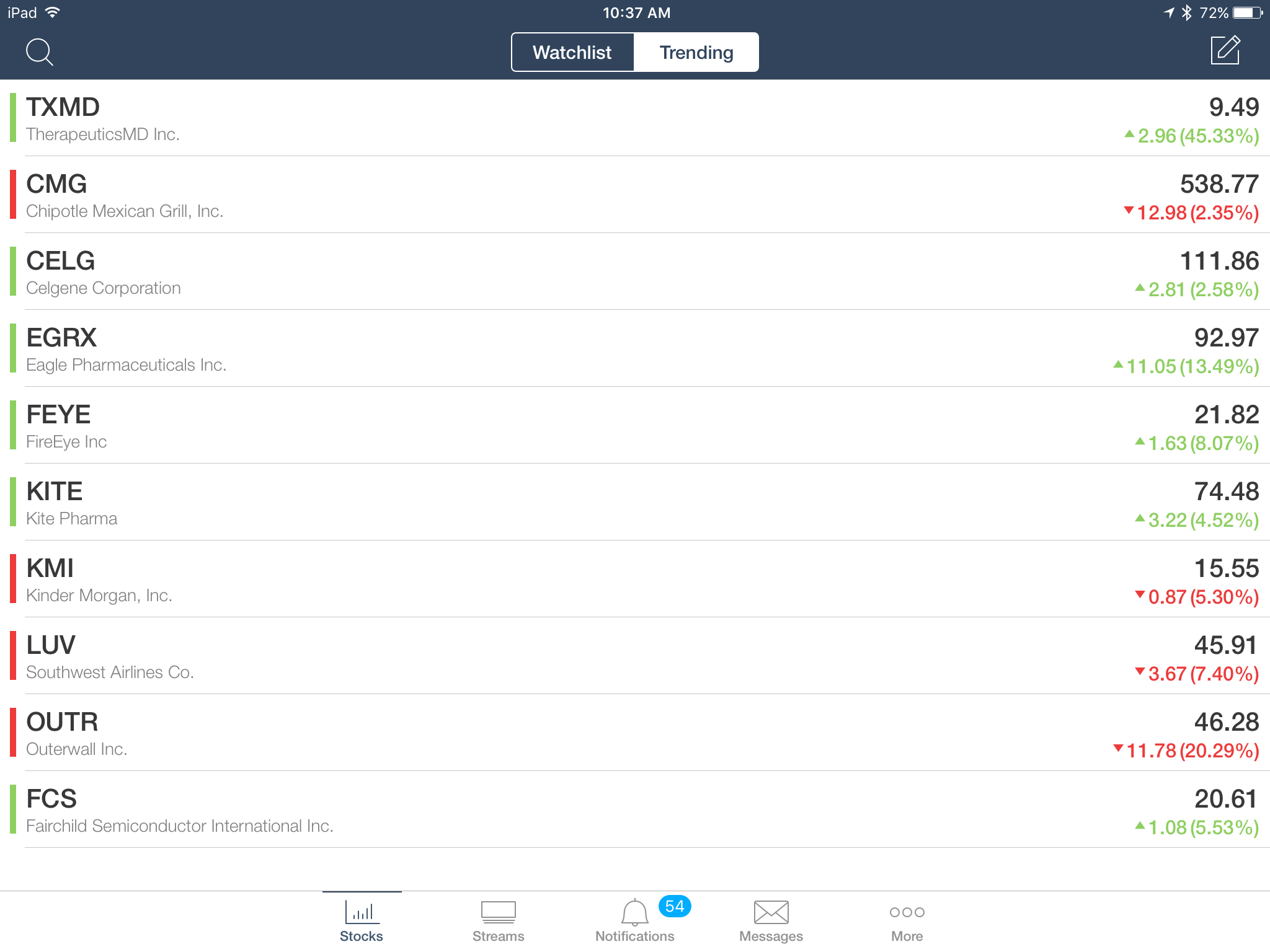

While stocks are moving sideways, the bond market is in trouble, he argues. Junk bonds are at their lowest point in six years and leveraged loans are tanking.

On top of that, emerging market equities are down close to 30% since September 2014.

Then there’s commodities. Oil hit a 7-year low this week and copper and lumber look anemic too.

The Federal Reserve is about to make a mistake

Gundlach called Fed action “unthinkable” given where many parts of the market are right now.

He predicts the Fed will raise rates now and regret it.

Fed chair Janet Yellen and other central bank officials have been stressing in recent speeches that they will move “gradually” to raise interest rates.

But Gundlach says their talk doesn’t match reality. The Fed’s own projections — the so-called “Dot plot” — shows interest rates will be about 1.38% in a year. That’s a big increase from the near zero rates the U.S. has today.

“They are not talking about ‘gradual’ in the Dots,” says Gundlach.

As many investors know, it’s a tough environment. There aren’t many bargains out there and Gundlach calls the Fed a “steamroller” that is about to come through and change the game.

“It’s getting harder and harder to make money,” he says.

Gundlach manages the DoubleLine Total Return Bond Fund.

Did you read that part about the dots? What rational central banker describes policy like that? For the life of me I cannot fathom why the Fed is willing to push $500 billion in oil and gas debt over the cliff; because that’s exactly what they’re going to do.

Mark my words: this Fed is going to leave this economy in tatters. If you thought the past two years were tough, wait until you see what 2016 brings forth–fucking centaurs and the four horsemen of the apocalypse are going to broadcast live from the NYSE, kicking the severed heads of their guests around like soda cans.

Comments »