The fact that we are to monitor every Fed speech, even assholes from Kansas, has me sick to my stomach. These people are incorrigible and beyond reproach. The audacity and self aggrandizement of the Federa Reserve is at a level that has never been seen before. It’d as if they had total control of the U.S. economy and our legislators were on permanent vacation.

When was the last time we heard anything from the fiscal side? It’s financial engineering all day, every day.

At any rate, the most important Fed head, next to Yellen, gave a speech at the University of Bridgeport (really?) today, citing disinflationary pressures and the need to chill the fuck out on the rate hike, or ‘normalization’, rhetoric.

Futures extended their gains on this news.

“I judge that a cautious and gradual approach to policy normalization is appropriate,” said Dudley, a close ally of Fed Chair Janet Yellen and a permanent voter on policy.

Caution, he added in a dovish tone, is needed “because of our limited ability to reduce the policy rate to respond to adverse developments, recognizing that we could also use forward guidance and balance sheet policies to provide additional accommodation if that proved warranted.”

“Although the downside risks have diminished since earlier in the year, I still judge the balance of risks to my inflation and growth outlooks to be tilted slightly to the downside,” he said at University of Bridgeport.

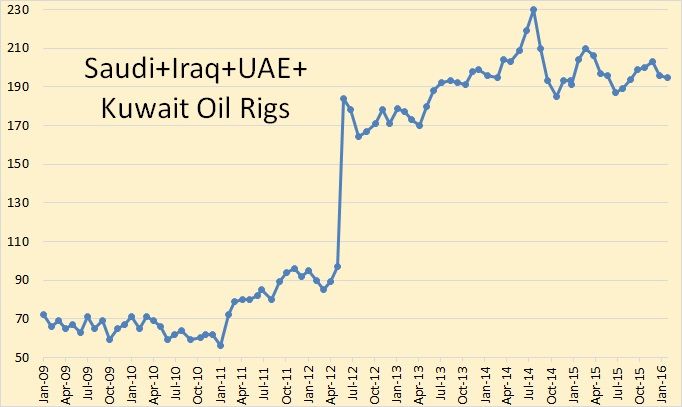

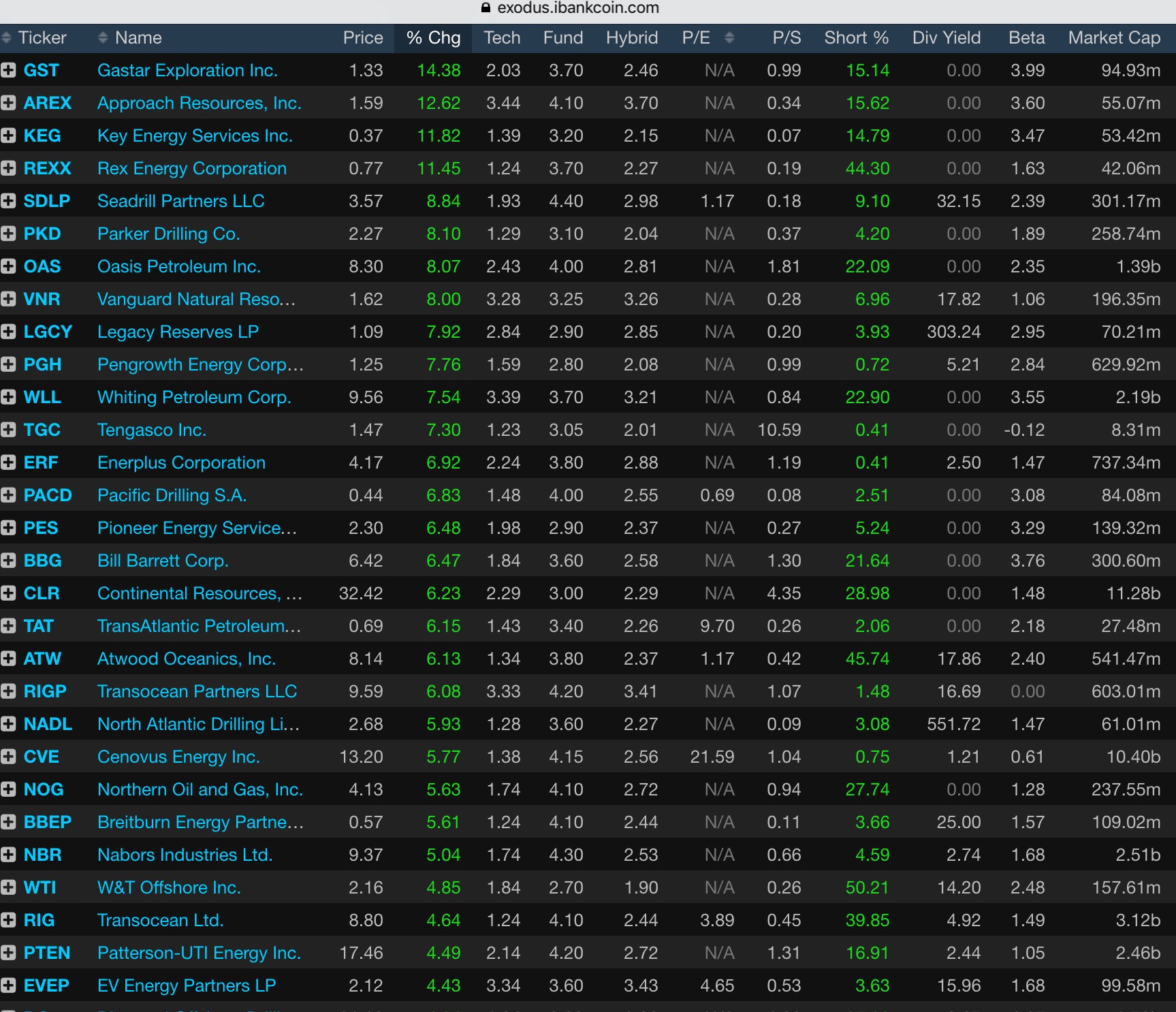

Low oil and commodity prices “may signal more persistent disinflationary pressures than I currently anticipate, while renewed tightening of financial market conditions could have a greater negative impact,” Dudley said, while “there is significant uncertainty about economic growth prospects abroad.”

Happy Friday.

Comments »