Shares of NFLX are getting face punched in after-hours trading tonight, post earnings disappointment. The growth was fine; on paper the company is fantastic. However, in light of the headlong assault provided by the money burning Bezos at Amazon, expanding into original content, coupled with the poor reviews of this past season of House of Cards, one could make a strong argument that Netflix is heading into tumultuous waters.

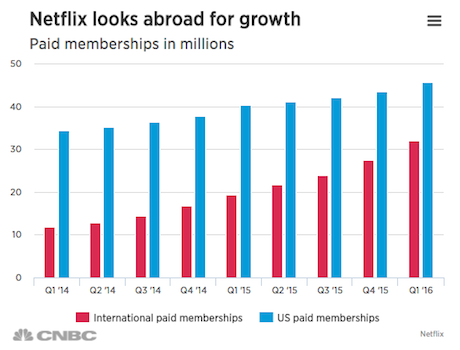

They were expected to produce 2.23 million subs in the U.S. and 4.51 million internationally. Instead, they clown-car’d in with 1.77 and 4.36, respectively. Moreover, look ahead, the company is forecasting 500k domestic subs in Q2 and 2 million overseas. These are outrageous numbers, indicative of a great business. However, expectations were for 586k and 3.5 mill, respectively. That’s a stark drop off in guidance. They attribute the slow-down to maturing markets. Once they enter a market, like Latin America, people go fucking apeshit for the service. But, as human caprices ebb and flow, people become bored with the ancient movies populating the NFLX ecosystem and cancel.

“We were incredibly excited to grow to over 81 million subscribers, it’s an enormous quarter for us that way,” Netflix co-founder and CEO Reed Hastings said during a Monday afternoon webcast. “Some of it was from our expansion around the world: It’s 130 countries so there’s quite a bit of variety.

Some people, like this imbecile from ‘TechnoBuffalo’ think NFLX has something to worry about: “Netflix has had an incredible rise, but they need to be looking over their shoulder because there is an onslaught coming led by Amazon,” Jonathan Rettinger, president of TechnoBuffalo, told CNBC after the earnings announcement. “Netflix has a lot to worry about over the next few months.”

CEO, Reed Hastings, sums up the risks and rewards nicely.

“If you think about your last 30 days, and analyze the evenings you did not watch Netflix, you can understand how broad our competition really is. Whether you played video games, surfed the web, watched a DVD, TVOD, or linear TV, wandered through YouTube, read a book, streamed Hulu or Amazon, or pirated content (hopefully not), you can see the market for relaxation time and disposable income is huge, and we are but a little boat in a vast sea. For example, while we’ve grown from zero to 47 million members in the USA, HBO has also grown, which shows how large the entertainment market is. We earn a tiny fraction of consumers’ time and money, and have lots of opportunity ahead to win more of your evenings away from all those other activities if we can keep improving.”

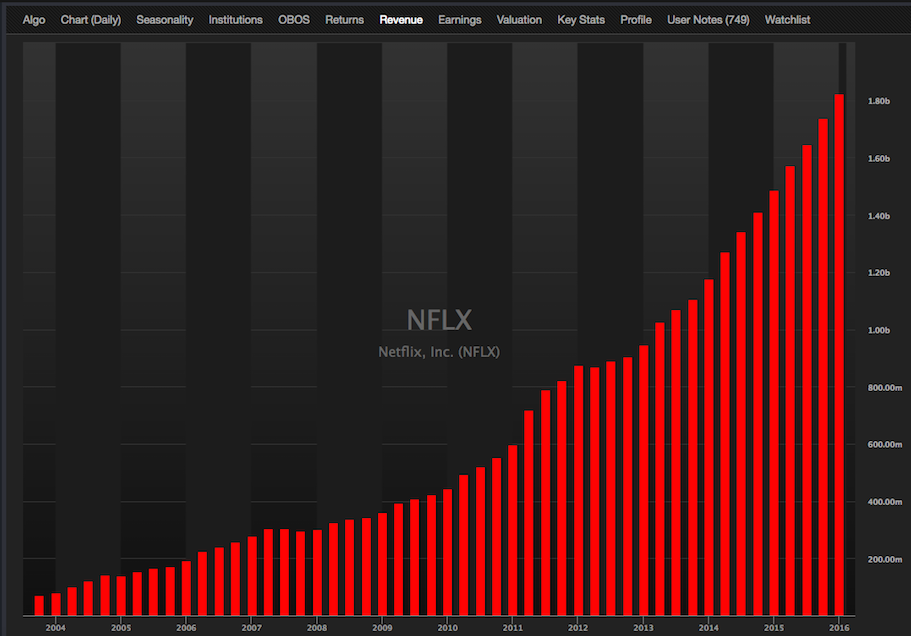

My guess, people want to be a part of the Netflix ascendancy and this small miscue will not keep growth buyers out of the stock. But, should this miss become a trend, look for valuation to become an issue. The companies PE is out of this world high. The p/s ratio is near all time high levels, above 7x, a 275% premium to the rest of the market. The stock has been trading at this high premium since the stock bottomed in 2013. Before that, the companies p/s ranged from 1.4-5. Clearly, there is downside to the name.

The reward lies in whether or not the company can continue to grow revenues 20-25% year over year. Look at that revenue growth chart.

Comments »