Interest rates are still very low — but they’re heading higher. Now thanks to the Trump tax cuts, government deficits are set to increase. If the cuts result in a boost in economic activity, then it won’t be an issue. However, if in fact the economy doesn’t respond — rates will go higher — because the treasury will need to issue more bonds.

John Mulvaney, Director, United States Office of Management and Budget, said rates would ‘spike’ today in a Fox interview because of this dynamic.

That agreement, which ended an hours-long partial government shutdown, boosts government spending by almost $300 billion. Mulvaney said that in his previous job as a fiscally-conservative congressman representing South Carolina, he would “probably not” have voted for the bill.

The additional spending could increase the deficit to about $1.2 trillion in 2019, and there’s a risk that interest rates “will spike” as a result, Mulvaney said.

U.S. Treasury yields have been rising in recent weeks on worries that inflation is heating up as the spending package juices an economy already souped up by tax cuts and at or near full employment.

Jim ‘Bow Tie’ Rogers has been making rounds again, warning of yet another horrible bear market — the worst ever.

“When we have a bear market again, and we are going to have a bear market again, it will be the worst in our lifetime,” Rogers, the chairman of Rogers Holdings Inc., said in a phone interview. “Debt is everywhere, and it’s much, much higher now.”

So what’s the thesis here?

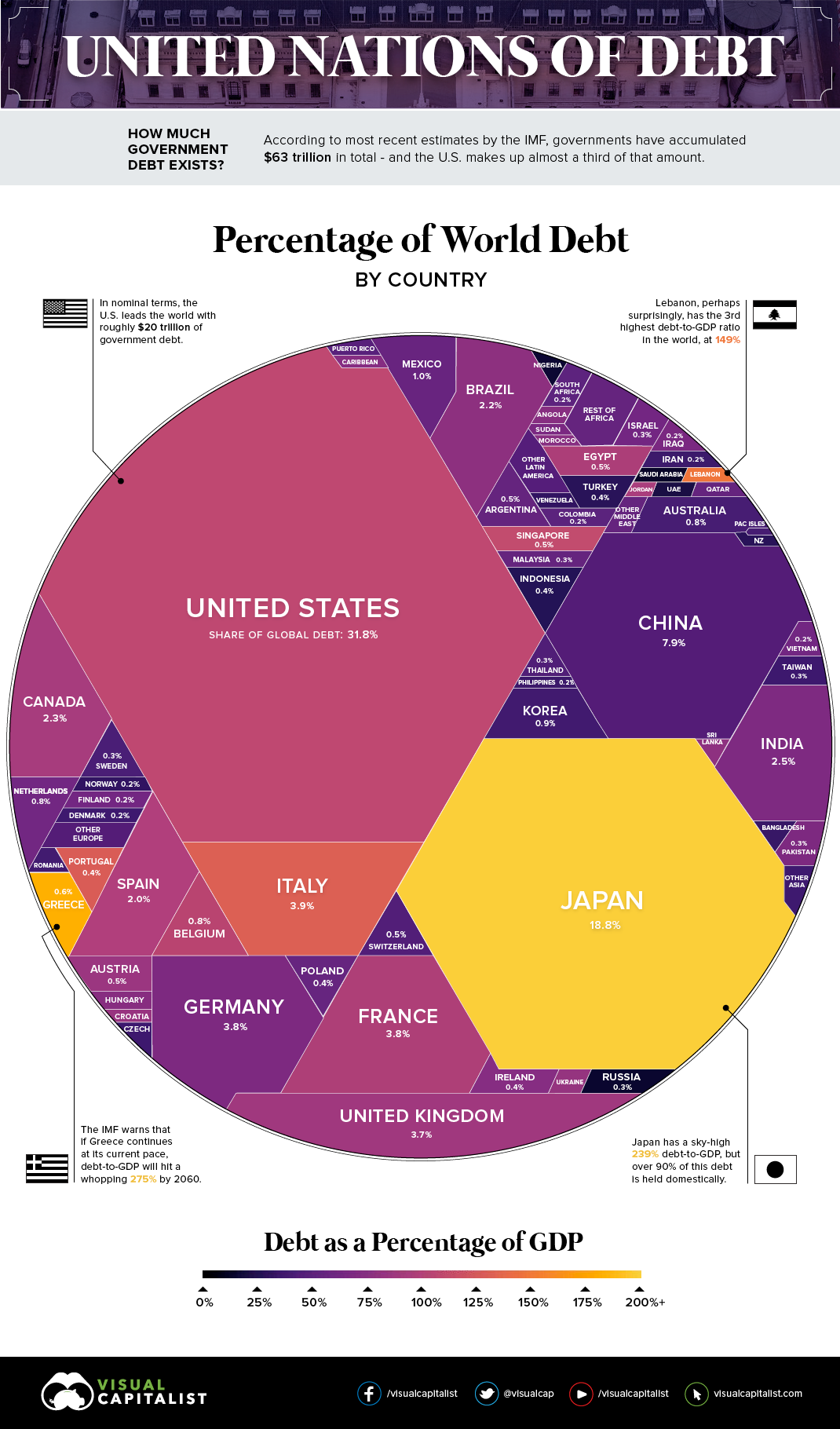

Since the financial crisis of 2008, sovereign governments, in an attempt to prevent an economic downturn, ‘papered over’ the problem by doing bailouts and issuing more debt to increase spending — in order to keep the pitched forks at bay. The subsequent result is a debt bomb equal to $63 trillion — worldwide — of which more than 30% of it belongs to America.

At some point, this debt will become too great to service. With interest rates going up, governments will have to pay more in interest, taking away from their faggot programs, in turn reducing GDP. You can clearly see how this is going to menace the world at some point during our lifetime, yes? Everything you understand about the world will change, once this blows up.

The top indebted nations are America, Japan, China, Italy, and France. The highest debt/GDP nations are Japan (239%), Greece (181%), Lebanon, Italy, and Portugal.

To make matters inexorably worse, western nations are now facing a demographic nightmare, which is on pace to cut Italy’s population by 40% inside 50 years — Japan by 50%.

How will they be able to service their debt with half the population?

Pro-tip: they won’t.

Now you know why Europe is embracing migrants.

Short term, markets are getting jittery with each tick higher in the 10yr, an irrational mode of thinking since the rate is still very low. If the 10yr was higher than 4%, I’d argue you should panic — but not yet, not sub 3%.

Nevertheless, I recall back in 1997 when Wall Street was chimping out over higher rates and would monitor Fed auctions and if they went poorly, it’d send stocks sharply lower. Look for that to happen now. Bad auctions will spook markets and cause sell offs.

Because of this, I am long TMV — which is a levered bet against treasuries — an ark destroyer.

Without question, the debt bomb is the largest bubble of all time and I could see why Jim Rogers is nervous about it. But we do have canaries in the coal mine and we haven’t seen any problems in Greece or Japan yet, so people need to calm down and eat sandwiches and enjoy the good times while they still exist.

If you enjoy the content at iBankCoin, please follow us on Twitter

Europe is embracing migrants of which 3/4 are fighting age muslim degenerate males raping white women and having no intention to assimilate.

And they will never work. Good news is the snobby euro sluts will never bang them and procreate, only through rape

what better guy to have in office, Trump, to deal with any debt time bomb. He’s the master of restructuring his own private debt over the years.

Yes, I know there’s a difference between his organizations and government debt are different. However, sovereigns have assets to be sold, both real and natural.

Restructuring his own private debt? He’s gone bankrupt 6 times.

Wouldn’t life be grand if we could borrow billions to spend and go bankrupt every decade and start all over, only to borrow billions more and go belly up again 10 years later?

Rinse… repeat (6 times).

How many businesses (besides airlines) are considered successful when they go bankrupt every 10 years?

Which is more valuable – inherently – JGBs or Treasuries? Once you answer that question to yourself, you will know which way interest rates are headed.

The bail-in, a rude idea, will be used in local fuck-ups. Sovereign defaults in Eurozone will be threatened again. People with something to lose will freak-out. Contagion. and finally death (Vincent Price)…

Morons

https://www.zerohedge.com/news/2018-02-11/economist-it-appears-market-conspiracy-theorists-were-right

The Economist: It Appears Market Conspiracy Theorists Were Right

The Bush/Obama bailouts of 2008 were the cause of all this nonsense. The round figure of 800 billion or so was bribe and slush money – nothing more. In the process everything has become systemically corrupted.

Fly, why would rates go higher due to the treasury issuing more bonds? Does it relate to an increase supply causing the price of treasuries to drop and thus rates rise as a result?

As supply increases rates must rise to attract buyers, in the absence of the central bank being the buyer of last resort. For the past decade, the Federal Reserve has been buying bonds to keep rates down. They are beginning to unwind these holdings. Those stepping into the void from the private sector will demand higher interest rates.

On top of this you have the US Budget Director talking about running budget deficits for the next 10 years. Thus more bonds will be needed, at least that is becoming the expectation.

My view is that President Trump, his budget Director, his Treasury Secretary and his new Fed Chairman have the same goal: to normalize interest rates. They keep talking the dollar down in the hopes of offsetting the effects of rates rises. Further, like any good businessman who would take over an untenable, heavily indebted organization, the only solution for survival is to grow it out from under the debt. So expect a lot of very pro-growth policies for the next 7 years while the Federal Reserve unwinds.

This can only work if Trump is successful at cutting regulation, reduces the recurring costs of the federal budget, and takes the savings, plus deficits, and invests them in infrastructure that can multiply the economic output of the nation. Think of this like the government investment in the Transcontinental Railway which started during the American Civil War. These types of investments lead to great leaps in economic prosperity.

If I am correct then Elon Musk, Jeff Bezos and Warren Buffet are going to profit mightily.

I also believe that Sen Rand Paul, who I respect, is wrong to try to cut the budget. What he should be focusing on is cutting the recurring part of the budget, while dramatically increasing the project infrastructure budget – with the goal of investing in productive assets. It is simply impossible for the Federal Reserve to unwind and the US government to cut the budget at the same time. This would drive the economy to destruction.

Not impossible. Tax the windfall wealth of the Top 1%.

Exacty. You dont think he will give bond holders a hair cut if he had to?

Rates are at threshold stocks must crash to keep rates low.

https://www.zerohedge.com/news/2018-02-11/trumps-budget-director-admits-interest-rates-may-spike-soaring-deficit

That huge run up in US debt has wildly favored the Top 1%. Studies say 1% now controls 40% of private net worth.

In 2016 total private net worth was ~$93T, so conservatively figure Top 1% have $36T, with a little appreciation since 2016, call it $40T.

Total US Public Debt is $21T. Let’s have the debt, by taxing the windfall gains of the very richest that benefited from the rapid expansion of the debt. Could easily halve the debt, and they’d still have a cool $30T+.