Just when you thought it was safe to declare the mall dead, it rises from its swampy grave, as you’re sitting there sipping a cup of earl grey tea (milk and orange honey) short retailers, and it eats your face off. You didn’t see it coming. You just got your fucking face chewed off, period.

Head zombie leading the assault is SHLD — soaring higher after a better than expected, horribly bad, quarter.

Reports Q1 (Apr) loss of $2.15 per share, excluding non-recurring items, $1.43 worse than the two analyst estimate of ($0.72); revenues fell 20.3% year/year to $4.3 bln vs the $4.05 bln two analyst estimate.

At Kmart, comparable store sales decreased 11.2% during the first quarter of 2017, primarily driven by declines in the grocery & household, pharmacy, apparel and home categories.

Sears Domestic comparable store sales decreased 12.4% during the quarter, primarily driven by decreases in the home appliances, apparel and lawn & garden categories.

Adjusted EBITDA was $(222) million in the first quarter of 2017, as compared to $(181) million in the prior year first quarter.“In April 2017, we provided an update to our restructuring program, including increasing our annualized cost savings target to $1.25 billion. On May 15, 2017, the Company entered into an agreement to annuitize $515 million of pension liability with MLIC, under which MLIC will pay future pension benefit payments to approximately 51,000 retirees. In addition, the Company recently reached an agreement to extend the maturity of $400 million of our $500 million 2016 Secured Loan Facility from July 2017 to January 2018, with the option to further extend the loan until July 2018.”

Number 2: GES

Does anyone still wear these faggot jeans? I remember in my early 30s buying a pair for like $100 and feeling like I’ve been raped. The store is heavily gay and the clothes, more or less, really suck. That has been built into the share price, which has gone straight down, until now.

Reports Q1 (Apr) loss of $0.24 per share, $0.08 better than the Capital IQ Consensus of ($0.32); revenues rose 2.2% year/year to $458.6 mln vs the $449.22 mln Capital IQ Consensus.

Americas Retail revenues decreased 14.9% in U.S. dollars and 14.7% in constant currency. Retail comp sales including e-commerce decreased 15% in U.S. dollars and constant currency.Europe revenues increased 23.3% in U.S. dollars and 29.1% in constant currency. Retail comp sales including e-commerce increased 5% in U.S. dollars and 11% in constant currency.

Asia revenues increased 16.9% in U.S. dollars and 15.5% in constant currency. Retail comp sales including e-commerce increased 4% in U.S. dollars and 2% in constant currency.

Americas Wholesale revenues increased 5.7% in U.S. dollars and 7.7% in constant currency.

Licensing revenues decreased 9.3% in U.S. dollars and constant currency.

Co issues downside guidance for Q2, sees EPS of $0.08-0.11 vs. $0.12 Capital IQ Consensus Estimate. Sees net revenue growth of 2-4%.

American Retail comps to be down Low double digit to high single digit; Net revenue down LDD to HSD

Europe revenue up mid-teens

Asia Revenue up mid to high teens

American Wholsesale down mid single digit.

Licensing revenue down mid single digit.

Co issues in-line guidance for FY18, sees EPS of $0.34-0.44 vs. $0.33 Capital IQ Consensus Estimate. Sees net revenue growth of 3.5-5.0%.

American Retail comps to be down Low double digit to high single digit; Net revenue down LDD to HSD

Europe revenue up high teens

Asia Revenue up mid to high teens

American Wholsesale up low single digit.

Licensing revenue down mid single digit.

Number 3: BBY

Interesting in buying a brand new flat screen teevee? I know I’m not. Or how about one of those stupid fans for $600 or an iRobot? We all need that shit, not to mention the wide variety of DVDs on display. The stock is crushing higher today, after reporting better than expected results.

Reports Q1 (Apr) earnings of $0.60 per share, excluding non-recurring items, $0.20 better than the Capital IQ Consensus of $0.40; revenues rose 1.0% year/year to $8.53 bln vs the $8.28 bln Capital IQ Consensus. Enterprise Comparable Sales Increased 1.6%. Domestic comparable sales % change — 1.4%.

Co issues in-line guidance for Q2, sees EPS of $0.57-0.62, excluding non-recurring items, vs. $0.59 Capital IQ Consensus Estimate. Q2 Guidance: Enterprise revenue in the range of $8.6 billion to $8.7 billion. Enterprise comparable sales change in the range of 1.5% to 2.5%. Domestic comparable sales change in the range of 1.5% to 2.5%.

FY18 Guidance: Enterprise revenue growth of approximately 2.5%. Enterprise non-GAAP operating income growth rate in the range of 3.5% to 8.5%, based on the recast FY17 non-GAAP operating income of $1.733 billion. On a 52-week basis, Enterprise non-GAAP operating income growth rate in the range of 1.5% to 5.5%, based on the recast FY17 non-GAAP operating income of $1.733 billion

Number 4: PVH

How’s that new Tommy Hilfiger sweater or Van-Heusen dress shirt? Oh, you stopped buying those brands in the 90’s? Surely, you still buy Calvin Klein jeans and underwear, no? Maybe no one buys their nonsense, but the stock is flying in the pre-market.

Reports Q1 (Apr) earnings of $1.65 per share, excluding non-recurring items, $0.05 better than the Capital IQ Consensus of $1.60; revenues rose 3.7% year/year to $1.99 bln vs the $1.96 bln Capital IQ Consensus.

Co issues raised guidance for FY18, sees EPS of $7.40-7.50 from $7.30-7.40, excluding non-recurring items, vs. $7.43 Capital IQ Consensus Estimate; sees FY18 revs of +3% from +2% to ~$8.367 bln vs. $8.42 bln Capital IQ Consensus Estimate.

Revenue in 2017 is projected to increase approximately 3% (increase approximately 5% on a constant currency basis) as compared to 2016. Negatively impacting revenue in 2017 as compared to 2016 is a reduction in revenue due to the effects of the Mexico deconsolidation and the G-III license. Revenue for the Calvin Klein business is projected to increase approximately 6% (increase approximately 7% on a constant currency basis), which includes the negative impact of the Mexico deconsolidation.

Number 5: WSM

Jeff Macke sums up the Williams and Sonoma quarter. We all need a $5,000 espresso machine. Let’s be honest.

$WSM This is a good Q. shares would be higher if not for haters and cynics. You folks could use a $5,600 cup of Espresso. #MillennialNest pic.twitter.com/WKyzij7xpv

— Jeff Macke (@JeffMacke) May 24, 2017

Reports Q1 (Apr) earnings of $0.51 per share, $0.02 better than the Capital IQ Consensus of $0.49; revenues rose 1.3% year/year to $1.11 bln vs the $1.11 bln Capital IQ Consensus.

Comparable brand revenue growth of 0.1%.By brand:

Pottery Barn -1.4%

Williams Sonoma +3.2%

West Elm +6.0%

Pottery Barn Kids +5.7%

PBteen -14.3%Co issues guidance for Q2, sees EPS of $0.55-0.61 vs. $0.60 Capital IQ Consensus Estimate; sees Q2 revs of $1.195-1.230 vs. $1.19 bln Capital IQ Consensus Estimate.

Co issues in-line guidance for FY18, sees EPS of $3.45-3.65 vs. $3.54 Capital IQ Consensus Estimate; sees FY18 revs of $5.165-5.265 vs. $5.2 bln Capital IQ Consensus Estimate.

“In the first quarter, we saw strong sequential improvement in the Pottery Barn brand, demonstrating the effectiveness of the brand initiatives that we are implementing. West Elm, our newer businesses (Rejuvenation and Mark and Graham), and our company-owned global operations delivered another quarter of double-digit growth, and Williams Sonoma started the year off strongly. We also continued to realize positive results from our supply chain initiatives, as we drive continuous improvements across the organization to deliver increased efficiencies and a superior customer experience.”

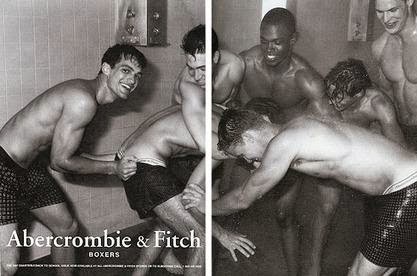

Number 6: ANF

Everyone likes their faggot-gear, yes? I’m always mesmerized by their live feed of Huntington Beach inside of their Hollister stores. Fascinating stuff. I do appreciate how discriminating they are against fat people, however. They don’t even make clothes for you — only for pretty thing people.

Reports Q1 (Apr) loss of $0.91 per share, excluding non-recurring items, $0.21 worse than the Capital IQ Consensus of ($0.70); revenues fell 3.6% year/year to $661.1 mln vs the $651.25 mln Capital IQ Consensus. Q1 comps -3%.

FY18 Guidance: Comparable sales to remain challenging in the second quarter, with trend improvement in the second half of the year. A gross margin rate down slightly to last year’s adjusted non-GAAP rate of 61.0%, with continued pressure in the second quarter. Net income attributable to noncontrolling interests of approximately $4 million.

“While we anticipate the second quarter environment to remain promotional, we expect results to improve further in the second half of the year, as we see returns from our strategic investments in marketing and omnichannel. The international roll-out of full omnichannel capabilities, coupled with insights from multiple customer touchpoints online and in-store, including our rapidly growing loyalty programs, means we are better equipped to anticipate our customers’ needs whenever, wherever and however they choose to engage with our brands. We continue to tightly manage costs and inventory, and focus on execution to position our business for sustainable growth.

“

If you enjoy the content at iBankCoin, please follow us on Twitter

Not seen a more homosexual picture in some time than that ANF picture.

just some guys pal-ing around in their boxer shorts in the high school showers

Homos are happy, gay beta males. I guess they need their ANF clothing to do all that sashaying and prancing around selfie thing.

It’s all ripping higher cuz “analysts” (as in anal penetration) no longer can tell the diff between GAAP and non-GAAP, which as I remember was supposed to be a “temporary” reporting fix…which now turned into “fixed”. How about we look at GAAP earnings? No? Then it’s all waste of time but the commentary was good and the gay shower dick up your ass photo is pretty greek.

lol at the ANF pic

It’s just a few kids having fun in the shower guys. Come on.

Just a couple of guys having harmless fun. Make sure you read the comments. https://youtu.be/N9Ae0h2pd78

i’m amazed that sears actually does $4 billion in a revenue, a quarter.

Maybe my M $25 Jun 16c aren’t toast

ANFaggot pic just violated me

So Fly you have figured out the perfect formula for getting lots of comments: Show something extra homo from our friends at Abercrombie and everyone rushes in to post about how much they aren’t enjoying it.

Genius, really.

This quote from the K Mart analysis cracks me up.

“At Kmart, comparable store sales decreased 11.2% during the first quarter of 2017, primarily driven by declines in the grocery & household, pharmacy, apparel and home categories”.

In other words, damn near everything they sell went in the shitter.

what movie is that picture from?