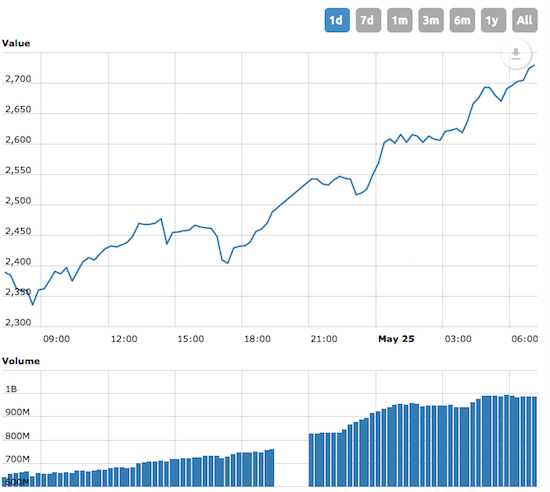

Bitcoins are higher by another 11% at the time of this post. That number can change dramatically shortly after this post. I think it’s important to note, in addition to Bitcoin, the entirety of the cryptocurrency market is entirely on fire — now worth more than $90b. Bitcoins alone is worth $44b and the all important Pepe Cash, based off RARE PEPE ART, is now worth $18.5m.

Bitcoins, the Bubble Edition

While stocks look exciting pre-market, led by retail, they pale in comparison to the infectious nature of this bitcoin melt up. I am certain this blow off top move is luring a lot of normies into the asset class — which is bound to create weaker hands, in turn will only exacerbate the move lower — whenever it comes.

If you enjoy the content at iBankCoin, please follow us on Twitter

Pure gambling. No fundamentals. Buy cryptos with fiat confetti so you can make “profit” in fiat confetti. Pure momentum speculation. How’s this diff4erent from infinite printing? It’s not. So there’s a hard limit on BTC. So what? When the actual number of cryptos is unlimited?

The fundamentals are peer to peer with no middle man/bank, privacy, security and tax avoidance. It’s no different than your bank account or brokerage account—it’s all digital “money”—only more private and secure. Money is just a store of value that is widely accepted by people. Bitcoin is starting to gain more attention now because of what is happening. It will get bigger as acceptance grows.

By fundamentals I meant supply/demand at the very least. Crypts are not “money” – you cannot even pay taxes with it, can you? And by definition, it’s really not currency. And how’s BTC a store of value? You mean like 5000 year old gold? What about volatility? How do 5% daily swings store value wehn w/i some fraction of time (day/wk/month) you can easily lose/gain 25%? It’s nothing more than the latest fad. No diff than an IPO of some “eye-ball” internets company, i.e. petshop,com…

There’s going to be a healthy correction in price at some point. But it will only attract more buyers. It’s still early in the adoption phase. AAPL could own the bitcoin market many times over. Get ready for higher astronomical prices. This is a global phenomenon. FOMO is also a driver.

How about my 2cents: there’s going to be an unhealthy correction in price at some point and it will only detract more buyers from getting into BTC because of the insane volatility. BTC is no longer in the adoption phase, it’s in the bubble and blow off stage. Get ready for astronomical prices in worthless and devalued (hyper-inflated) bullshit fiat currency. The FOMO is not in play as other cryptos, i.e. etherum, are becoming the latest fad in blockchain imaginary “coins”.

Bitcoin is a conscious decision not to own “value” in fiat currency or financial assets denominated in fiat currency. It doesn’t matter to me what the price of bitcoin is in dollars. What matters in the end is it’s puchasing power and it’s security, privacy and tax advantages.

What is being lost on the BTC enthusiasts is that BTC is valued in something that has imaginary value, like the shitty confetti conjured ex nihilo ad nauseum by pukes in central banks. If PPT, Citadel, etc. can move entire stock/bond markets, don’t try to tell me that the PPT is unable to move the BTC market either way whenever they want. There’s an infinite amount of confetti that CB can pour into BTC to shoot the price of BTC to the moon and then drive the same BTC into the ground by selling it at a loss, thus, triggering panic and avalanche of sell orders, just like they do in the paper gold market. Think about it…

Change your use of the word “imaginary ” to subjective when you’re talking about value and I can partly agree with you. But bitcoin can’t be conjured up like fiat money by the CB’s. The point of bitcoin is that no government or quasi-government entity owns or controls it. It’s really and truly free market driven and it’s a beautiful thing.

imaginary=subjective (existing in the mind; belonging to the thinking subject rather than to the object of thought)

https://tinyurl.com/j9molwm

You’ve missed my point, the dilution of BTC happens by the possibility of infinite number of competing ‘coins’, i.e. Pepe, etc.

Gov’t/banks will adopt several strategies: embrace, enhance, extinguish. It’s already happening (forking, removing limits, etc)…you’re just not identifying it, or not wanting to see it. Furthermore, gov’t can make transacting in BTC “illegal” and shut down exchanges; the Chinks are already going that way. Overall, the gov’t will make widespread adoption impossible; thus, the ecosystem of online payments will disappear. But for now, it’s good gambling racket, I admit that…

btw, I’m not the down voter; or a down voter in general.

By fundamentals I meant supply/demand at the very least. Crypts are not “money” – you cannot even pay taxes with it, can you? And by definition, it’s really not currency. And how’s BTC a store of value? You mean like 5000 year old gold? What about volatility? How do 5% daily swings store value wehn w/i some fraction of time (day/wk/month) you can easily lose/gain 25%? It’s nothing more than the latest fad. No diff than an IPO of some “eye-ball” internets company, i.e. petshop,com…

BTC VALUE: What goes up exponentially, falls vertically… or something like that…

Bitcoin has plunged 13% in the last few minutes… no catalyst evident…just a flesh wound:

https://tinyurl.com/lhq7z8u

That kinda “value” we’re talking about here?

How do swings like that store value wehn w/i some fraction of time you can easily lose/gain dozens%? It’s nothing more than the latest fad. No diff than an IPO of some “eye-ball” internets company.

GBTC $400+

There’s even an “ibank” coin. haha

https://coinmarketcap.com/currencies/ibank/

I made the statement that AAPL could own the bitcoin market, but realistically that won’t happen since everyone would have to sell them their bitcoin. With only a finite number of bitcoin to be mined, and no “printing” or hypothication, if people hold on to their bitcoin there is virtually little or no supply available except for bitcoin that is newly mined.

Baseball cards, beanie babies, bitcoins. I’ve seen this shitshow before. It’s just stupid people placing insane, irrational values on worthless crap. No different than the Dutch tulip frenzy which was slightly before my time.

Bushwacker2, am I calling you stupid for loving bitcoins? Yes, wholeheartedly. And everyone else who ‘invests’ in bitcoins.

Fly look at this bitcoin chart please (the bars are weekly):

http://imgur.com/a/0DA1l

Looks like a massive bubble about to burst, right? Well you’re kind of right. The highest point in that chart is $45. Bitcoin was on its way to its bubble peak of $266 weeks later. And it did crash after that peak. All the way down to about $60.

Now when you look at the bitcoin chart that “bubble” isn’t even a blip. I agree with you a crash will come eventually. But from where? $5000? $20,000? It’s not obvious.

What should be obvious is that bitcoin is uniquely suited to be a global reserve currency.

One last thing. I highly highly recommend you read this. You seem like you’re ready to understand what’s going on (I’ve been reading your blog for 10 years now and occasionally have laughed at your commentary on bitcoin)

https://medium.com/@mcasey0827/speculative-bitcoin-adoption-price-theory-2eed48ecf7da