It appears the Fed is firmly in control of maintaining short term rates, so far, something skeptics questioned could be accomplished. Bankers are like pigs in a field of slop right now.

The Federal Reserve’s most important tool for setting interest rates absorbed a record $475bn of money from financial institutions in its last monetary operation of 2015, in another sign that one of the central bank’s main methods of draining liquidity from the financial system is working.

The New York Fed said that the US central bank had awarded $474.59bn in one-day fixed-rate reverse repurchase agreements to 109 counterparties in an auction on Thursday, more than a third higher than the previous record set at the end of the second quarter in 2014.

“With two weeks having passed since the lift-off announcement, it does not appear that the Fed is having any trouble keeping the effective fed funds rate between 25 and 50 basis points.”

The $475bn awarded on Thursday matures on January 4, when markets reopen following the new year holiday, and compares to $277bn taken at an auction on Wednesday.

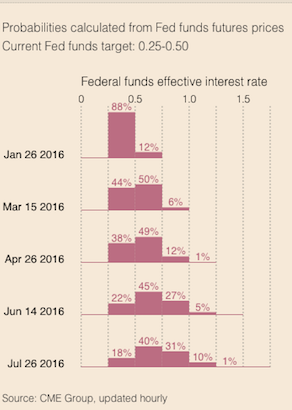

As of right now, the market is kind of leaning towards a March rate increase. However, one more good employment number and those crazy devils might give it a go in January.

If you enjoy the content at iBankCoin, please follow us on Twitter

The Fed wants us to buy banks and re? When they are getting railed on no interest to oilers…

Shkreli’s lawyer fees go up — 5000% 😛

I’m going to throw a starter pos in $POT. Good luck everyone!

And all that juicy cash gets sent back to said banks with interest to buy stocks on 1/4 & early 1/5. With some hedging on 1/6 & 1/7. Then January is determined on 1/8.

At least that’s what the gypsy told me. ….

If the Fed “drains liquidity” I can’t see where this will be positive for stocks, given market behavior during QE and ZIRP.

Am I missing something about that?

gravestonedoji , Hope this provides some perspective…

http://www.federalreserve.gov/monetarypolicy/fomc.htm

Guarantee of the S&P 500 growth is not mentioned. 🙁

“The term “monetary policy” refers to the actions undertaken by a central bank, such as the Federal Reserve, to influence the availability and cost of money and credit to help promote national economic goals.”

“The federal funds rate is the interest rate at which depository institutions lend balances at the Federal Reserve to other depository institutions overnight.”

“Changes in the federal funds rate trigger a chain of events that affect other short-term interest rates, foreign exchange rates, long-term interest rates, the amount of money and credit, and, ultimately, a range of economic variables, including employment, output, and prices of goods and services.”

0.375%, righteous.