The tankers are a hard sector to play in, mostly because there are so many nuances to what they do. Many people got caught up in the dry bulks, thinking DRYS would be a winner coming out of the oil collapse. Not true. I’ll get to the 2015 tanker winners in a moment.

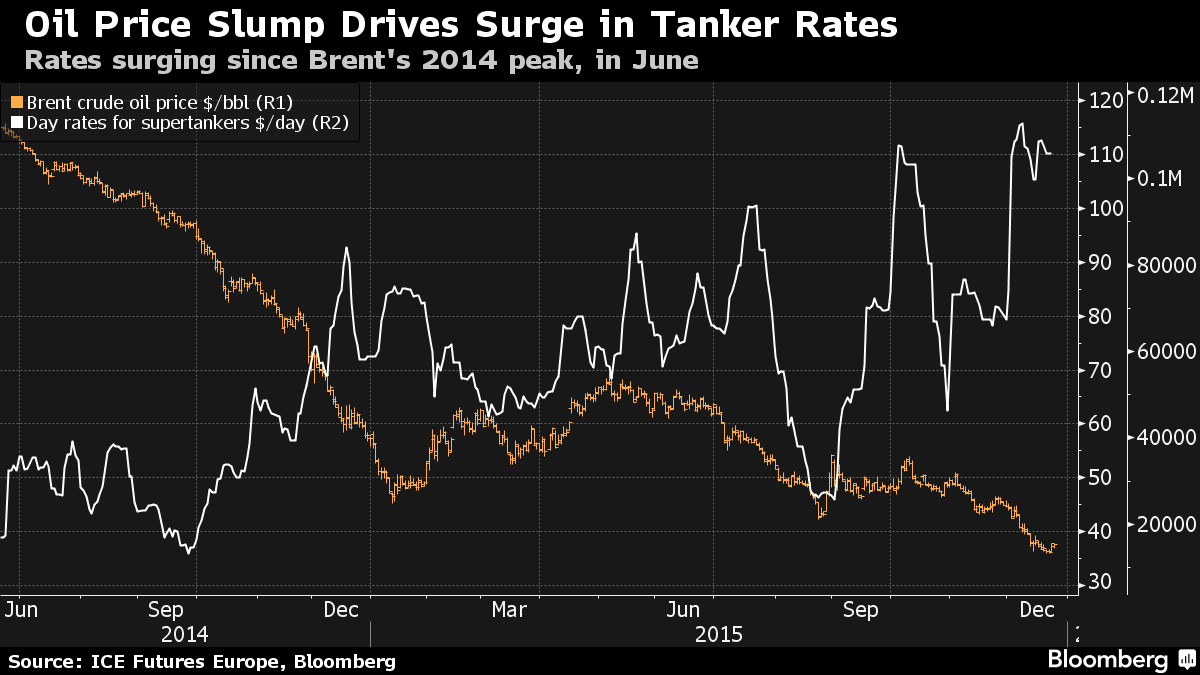

Rates have soared.

While oil prices fell about 35 percent in 2015, average earnings for these carriers jumped to $67,366 a day, the most since at least 2009, according to Clarkson Plc, the world’s largest shipbroker.

“The stars are aligned for us right now,” Nikolas Tsakos, the chief executive officer of Tsakos Energy Navigation Ltd., said in an interview at Bloomberg’s New York offices, adding that falling oil prices will likely stimulate demand and cargoes next year.

“We are benefiting from what is currently a challenging environment for the energy sector,” said Svein Moxnes Harfjeld, joint chief executive officer for DHT, in an e-mail. “We expect 2016 to be a rewarding year.”

“Investors look at tankers as an oil service, which we are,” Tsakos said. “But I think very few have identified that this side over here is the only oil service that’s positively affected by the dropping oil prices. I hope in the new year that this will be recognized, and our share prices are moving in the right direction.”

“A scenario in which crude oil prices are suppressed across 2016 could lead to a boom in tanker earnings of comparable magnitude to 2007-08,” said Tim Smith, senior analyst at Maritime Strategies International, said in a report.

There are numerous reasons for this boom to continue, from a surge of foreign oil imports into the U.S., as domestic drilling shuts down, to companies running out of room to store the damn stuff–opting to store it comfortably and conveniently in tankers at sea.

The greater the glut, the better chance tanker storage becomes a growing trend in the oil industry.

The top performing tanker stocks, traded in the U.S., during 2015 were: NAT (+65%), TNK (+38%), FRO (+18%), DHT (+17%), EURN (+15.6%), SFL (+28%).

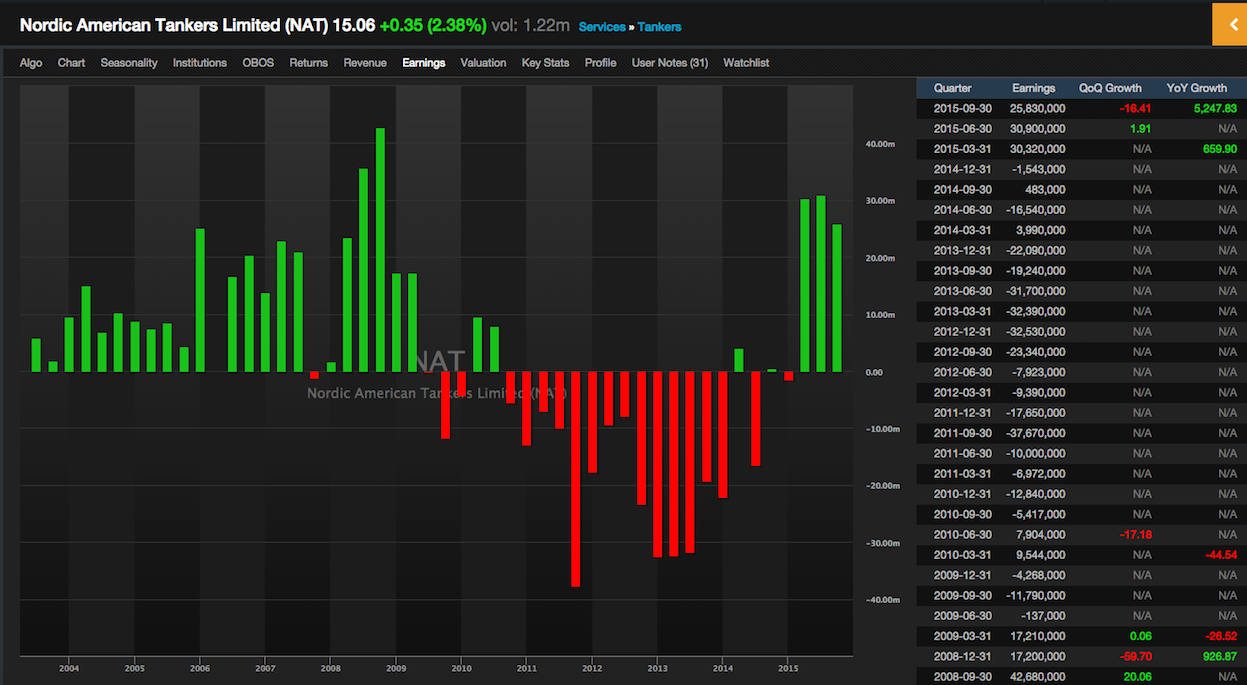

Look at the earnings growth of NAT this year. Similar trends persist in all of the above names.

It’s worth noting that in 2008, in a year when cataclysm struck mostly all equities, NAT rose from $16.55 to $19.53, paying almost $5 in dividends along the way.

If you enjoy the content at iBankCoin, please follow us on Twitter

Love posts like this. +1

I’ve been a holder of Nordic American tankers for years now. Management is the best and most conservative in the business. Clear strategy and transparent. I will hold it for years to come. Reinvesting divis along the way.

Thanks

I used to own NAT, and kept getting killed when dilution was used to buy more ships, and with dividend cuts. My current tanker play is GMLP. Yield is 17%, DCF coverage is 1.34, they just started a buyback, and they just reaffirmed guidance (including dividend payout). Because this space can be “volatile” (extra Ghengis Khan) my position is small.

BREAKING: Iranian scientists stumble on cold fusion discovery while creating nukes and oil will now trade to $0.00