Listen to me you late Lucy’s: the biotech index comprises of 75% of the winners up more than 30% for the year, thus far. In other words, all of the spec money is being made in one fucking sector. Let me remind you, this is a sector without profits and in many cases revenues.

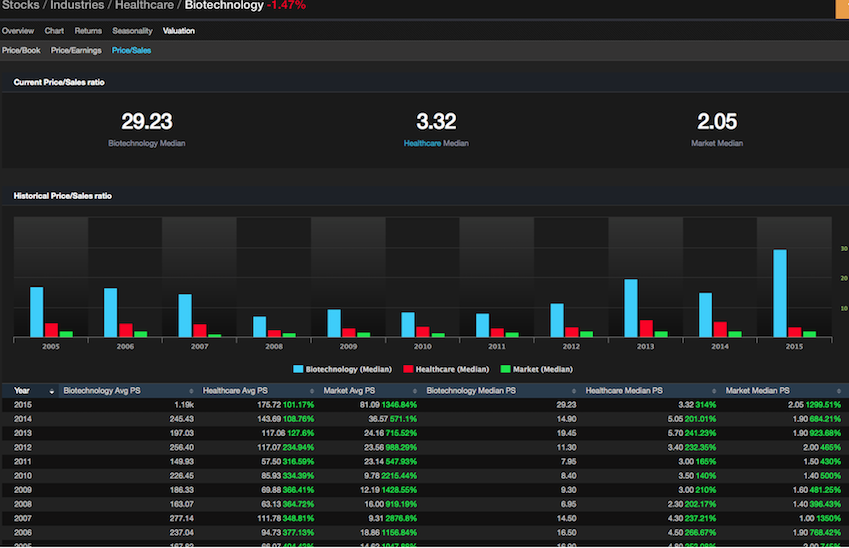

As per Exodus, have a look at the valuation of the biotech sector, compared to previous years.

The median price to sales ratio is now upwards of 29x. That’s fucking lunacy. Within the drug sector, the majors, the median PE is 40 and the median p/s is 7.69–taking into account all drug companies with caps greater than $5 billion.

Naturally, you’re inclined to disagree with me, as is the case during most euphoric runs. While it’s true, innovation and evolutionary change is transpiring in the biotech sector right now; it’s also true that many of these companies are merely in phase 1. In the past, a phase 1 company would be valued in the low $100-$200 million range. Now they’re worth in excess of a billion. Too much dumb money is abundant in this one space. Get out now, else lose your nuts in the great biotech collapse of 2015.

I am not calling for a market pullback. Instead, I think we will see a rotation out of biotech into stocks that are growing fast, but haven’t run yet.

Names that pop up in my screens include: SBNY, BIDU, BABA, GLW, PCLN, AAP, PACW, FB, CMG, MIDD, SWI–just to name a few.

A rotation out of biotech into tech, banks and retail would be healthy for a prospective bull market in 2015. Should we continue running up biotech like this, the eventual collapse is going to be worse and investor sentiment and subsequent washout will be exponentially more painful.

If you enjoy the content at iBankCoin, please follow us on Twitter

Jesus, the only healthcare stock in the entire S&P 500 with a PEG under 1 is GILD, and they just announced that their hep C drug gives you heart attacks and that means they’re gonna trade down 20 tomorrow like they always do on Sovaldi troubles.

Absent some absolutely insane earnings or a 75%+ correction I’m writing off the entire sector at this point.

Drivel. I can’t wait to buy tomorrow’s gap up in the IBB.

You gave up on GOGO to soon. also, nice pop in EMES, SLCA and HCLP after Morgan Stanley initiated coverage last week at buy. I still like UNIS too. in this bull market, patience staying long has paid off. I gave up on NVAX to buy more Apple. Turns out they both had nice runs.

Sold emes higher and slcA. Still long slca. Gogo can cradle my nuts

Amen brother. One of the biggest trades I know of happening right this very moment by a group of some of the most experienced & successful traders out there is the IBB put spread. And hell, if one wanted an even larger potential return albeit w/ more risk the real money could / would be made w/ puts in any number of those real high flyers w 0 (yes that’s ZERO!) revenue at the moment. We’ve seen this movie far too many times. Biotech is the new dotcom and now that all the stupid money has poured into it…what’s the smart going to do? Hhhmmmm…

Any good Biotech EFTs that can be shorted in this Exodus pull back?

I agree, although yeah this sh** can go higher but who wants to buy here?

@WallStJesus : Exactly what this market needs -> Direxion plans to introduce two triple-leveraged Biotech ETFs

@bespokeinvest : 56 of the 89 (63%) stocks in the Nasdaq Biotech index with market caps of more than $1 billion have no earnings.

Will buy more $ZIOP tomorrow on a $1-2 downturn.

Fly – would you include XON in this?

Lots of Kirk/Baker Bros stuff on the top of the hit list, myself. It’s legalized gambling, after

all.

yes

Stocks that seem too high go higher.