Asia Falls on Falling Earnings; Societe Generale Predicts a Halt of Earnings Profits

“Asian stocks fell after Chinese companies posted slumping profit and Societe Generale SA said the country’s earnings growth with come to a halt this year.

Gome Electrical Appliances Holding Ltd. plunged 21 percent in Hong Kong after China’s No. 2 electronics retailer missed profit estimates. Hong Kong’s Hang Seng China Enterprises Index of Chinese companies listed in the city dropped for the 10th day in 11 days. Li & Fung Ltd. (494), the world’s biggest supplier of clothes and toys to retailers, slid 5.2 percent in Hong Kong on a plan to sell shares.

The MSCI Asia Pacific Index dropped 0.4 percent to 127.46 as of 5:18 p.m. in Tokyo, having lost 1.2 percent this month. The measure advanced 12 percent this year through yesterday, headed for the biggest quarterly gain since the three months ended September 2009.

“We’re seeing a modest correction following recent gains,” said Yoji Takeda, who oversees about $1.1 billion at RBC Investment Management (Asia) Ltd. in Hong Kong. “We’ve seen some negative earnings, but overall the economy is still growing at a healthy speed, so I’m not too worried.”

Comments »Global Markets Trade Mixed While U.S. Futures Trade Modestly Higher

Ritholtz: Is Margin Debt Signalling a Top?

Market Update

Comments »The broad market made a modest move to an incrementally improved multi-year high, but listless action has left stocks to remain near the neutral line as they chop along with little direction.

Tech stocks are up a solid 0.4% today, but the largest sector by market cap has been unable to inspire meaningful interest in the rest of the market. Although Tech has helped the Nasdaq move narrowly higher, both the Dow and S&P 500 have been bouncing along the neutral line for the better part of the day.

Data has been relatively underwhelming in that the latest Consumer Confidence Index fell on the order of what had been widely expected. Germany’s latest reading on consumer confidence also turned lower from the prior month.

Energy stocks have been a drag on trade. The sector has drifted down to a 0.7% loss, although oil prices have generally oscillated along the flat line for the second straight session. Oil was last quoted with a fractional loss at $106.95 per barrel.

Despite the generally quiet tone of trade, the Volatility Index is up more than 5% today. It dropped sharply during the stock market’s rally in the prior session.

The lack of action among stocks has been mirrored by currencies, such that the dollar has spent its day mired near the neutral line. Neither the euro, sterling pound, nor the Japanese yen have attempted any sort of dramatic move. DJ30 +2.73 NASDAQ +7.47 SP500 +0.63 NASDAQ Adv/Vol/Dec 1130/825 mln/1325 NYSE Adv/Vol/Dec 1440/290 mln/1450

Case Shiller Index Comes In Better Than Expected @ Down 0.4%

Gapping Up and Down This Morning

Gapping up

OPXT +61.9%, BZH +5.5%, KBH +2.7%, PHM +1.9%, ISTA +7.9%, RBS +2.8%, ING +1.2%, BCS +0.7%, UBS +0.6%,

ISTA +8.6%, RBS +2.8%, LEN +2.7%, RIO +0.9%, BCS +0.7%, WAG +3.3%, ARNA +2.0%, VALE +1.5%, ATVI +1%,

DANG +2.9%,

Gapping down

MAPP -28.2%, NBIX -8.6%, MMR -5.3%, APOL -4%, HTS -2.9%, TOT -2.7%, DG -1.4%, BP -1.3%,

Comments »U.S. Equity Preview: OPXT, NBIX, MAPP, LEN, LNDC, HTS, BWLD, & APOL

Apollo Group Inc. (APOL) fell 6.3 percent to $40.50. The biggest U.S. for-profit college company was cut to neutral from outperform at Credit Suisse Group AG.

Buffalo Wild Wings Inc. (BWLD) decreased 2.4 percent to $92.11. The operator of about 800 namesake restaurants was cut to hold from buy at Deutsche Bank AG, which said the stock is less likely to beat expectations after its valuation rose.

Hatteras Financial Corp. (HTS) declined 2.6 percent to $27.32. The real estate investment trust that invests in mortgage securities issued or guaranteed by U.S. government sponsored entities will sell 15 million shares in a public offering.

Landec Corp. (LNDC) : The maker of packaged food products reported third-quarter earnings were 18 cents a share, surpassing the average analyst estimate by 5 cents.

Lennar Corp. (LEN) increased 3.9 percent to $27.44. The third-largest U.S. homebuilder by revenue reported first-quarter earnings excluding some items of 8 cents a share, beating the average analyst estimate of 5 cents.

Map Pharmaceuticals Inc. (MAPP) plunged 22 percent to $13.45. The biopharmaceutical company failed to win U.S. regulatory approval to sell its inhalable version of a 60-year- old migraine drug after regulators questioned the manufacturing process.

Neurocrine Biosciences Inc. (NBIX) : The San Diego-based drugmaker said results from a phase II trial of NBI-98854 in tardive dyskinesia patients didn’t meet the primary endpoint when data was included from a site where efficacy assessment protocol wasn’t followed. With that site removed, the results shows a “significant” reduction in symptoms, the company said.

Opnext Inc. (OPXT) surged 54 percent to $1.74. The maker of optical components for communications networks will be purchased by Oclaro Inc. (OCLR) in an all-stock deal. Holders of Fremont, California-based Opnext will get 0.42 shares of Oclaro stock, or about $1.96, for every Opnext share they own.

Comments »Regional Banks Have Yet to Rally Like the Big Banks; Is There Value ?

“In 2012, large bank stocks have outperformed regional banks.

“In 2012, large bank stocks have outperformed regional banks.

NEW YORK (CNNMoney) — Investors may be able to find some big bargains while betting on smaller regional banks.

Financial stocks are in the midst of a 2012 comeback, but shares of regional banks haven’t enjoyed the same surge as their larger peers. While Keefe Bruyette & Woods’ large bank index (BKX) is up more than 26% in 2012, its regional bank index (KRX) is up about 15.5%.

Still, analysts say it could be time for the stocks of regional banks to shine.

Several hundred banks closed or were taken over by the FDIC since 2008. The remaining community and regional banks are a healthier bunch and are well positioned to benefit from the nascent uptick in demand for consumer and business loans.

“So many banks went belly up during the crisis that the regional and community banks that are left are in much stronger condition to pick up market share now that lending is picking up,” said Scott Siefers, head of equity research at Sandler O’Neill.

The Wall Street multibillion scandal no one is talking about

Merger activity among community and regional banks may finally be set to increase too….”

Asia Rallies Full Retard, Europe and U.S. Futures are Flat

JAPANESE CDS SPREADS DROP BY 10%+

Morgan Stanley Says Institutional Investors Are All In (chart porn)

According to Morgan Stanley, there’s no question about the state of big investors sentiment. As they put it, investors are “all in” on this market.

Morgan Stanley |

Please follow Money Game on Twitter and Facebook.

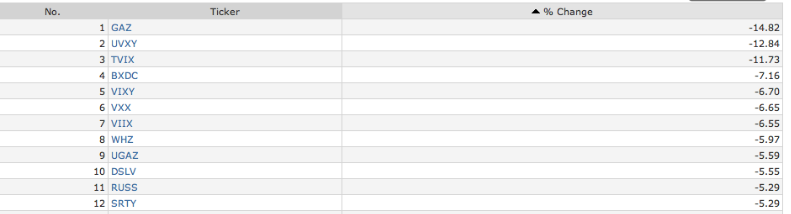

Comments »Today’s ETF Scams and Losers

Market Update

Comments »Coming off of only its second weekly loss in 12 weeks the stock market is up solidly on the back of renewed broad-based buying.

Stocks opened the day on a decidedly positive note. The move was helped along by strength in Europe, where Germany’s DAX helped lead efforts to advance following a multi-month high in its latest business climate reading. That helped temper concerns related to Spain’s ability to implement fiscal reform. Additionally, a speech this morning by Fed Chairman Bernanke seemed to suggest that the Fed recognizes the need to remain accommodative in its policies, given that job market conditions remain far from normal.

Health Care stocks have had an impressive session so far. The sector is currently sitting on a 1.3% gain with help from health care facilities plays and managed care providers. Industrials and Financials are close behind with gains of 1.2%.

Telecom and Utilities — both defensive in nature — are each up 0.2%. Their lackluster performance today is consistent with how they have fared in 2012.

Without higher oil prices to provide Energy stocks with a boon, the Energy sector has lagged the rest of the market for most of the session. Collectively, Energy stocks are currently up 0.4%, which is less than half of what the broad market has put together. Oil prices have chopped along the neutral line for most of the session and currently sit at $106.80 per barrel, which makes for a 0.1% loss.

An increased tolerance for risk has allowed the dollar to drift lower. Its descent has left it lagging a collection of competing currencies by about 0.4% after it had been relatively flat this morning.

The only consequential piece of domestic data released today was the pending home sales report for February. In a surprise slip, they fell 0.5% from the prior month. DJ30 +117.65 NASDAQ +36.71 SP500 +12.64 NASDAQ Adv/Vol/Dec 1865/765 mln/590 NYSE Adv/Vol/Dec 2190/290 mln/755

Bernanke Ignites a Rally Into Frothy Territory

Markets are registering overbought again…not that this meant anything lately.

Can we expect the market to keep climbing higher ? Looking at momo names like Apple up only $0.68 it is hard to believe.

DOW UP 136

S&P UP 13.8

NASDAQ UP 35

[youtube://http://www.youtube.com/watch?v=5QaVzv5aR6U 450 300]

[youtube://http://www.youtube.com/watch?v=5QaVzv5aR6U 450 300]

Today’s Money Flows

ISSUE GAINERS SYMBOL EXCH LAST PRICE MONEY FLOW RATIO

(in millions)

Apple AAPL NASD 598.59 +234.6 1.51

iShrs Russell 2000 IWM ARCA 83.77 +53.0 3.06

Google GOOG NASD 643.59 +15.9 1.21

IBM IBM NYSE 206.73 +15.8 2.05

Qualcomm QCOM NASD 67.61 +15.4 1.64

Abbott Labs ABT NYSE 60.82 +12.3 3.47

iShr FTSE China 25 FXI ARCA 37.21 +12.3 2.41

EMC Corp EMC NYSE 29.36 +12.1 2.99

McDonald's MCD NYSE 96.33 +12.0 1.80

Procter & Gamble PG NYSE 67.70 +11.8 3.12

BHP Billiton BHP NYSE 72.04 +11.6 2.82

IntercontlExchange ICE NYSE 139.86 +10.5 5.53

Wynn Resorts WYNN NASD 130.65 +10.5 1.40

Johnson & Johnson JNJ NYSE 65.04 +10.4 2.00

Caterpillar CAT NYSE 109.00 +9.9 1.64

Citigroup C NYSE 37.35 +9.7 1.27

Verizon Communications VZ NYSE 39.19 +8.7 1.88

pricelinecom PCLN NASD 727.60 +8.6 1.17

Microsoft MSFT NASD 32.37 +8.3 1.38

FedEx FDX NYSE 92.65 +8.0 1.71

ISSUE DECLINERS SYMBOL EXCH LAST PRICE MONEY FLOW RATIO

(in millions)

PwrShs DB USD Bullish UUP ARCA 21.95 -64.0 0.06

First Tr Inds/Prdcer Dur FXR ARCA 19.46 -32.9 0.00

iShrs MSCI Japan EWJ ARCA 10.03 -29.6 0.03

SPDR S&P 500 SPY ARCA 140.78 -20.7 0.89

ExxonMobil XOM NYSE 86.59 -20.7 0.47

JPMorgan Chase JPM NYSE 45.54 -17.8 0.58

iShrs MSCI Emerg Mkts EEM ARCA 43.23 -17.8 0.68

Intel INTC NASD 28.04 -17.1 0.44

Baidu BIDU NASD 147.67 -14.7 0.80

General Electric GE NYSE 19.99 -14.2 0.45

Tiffany & Co TIF NYSE 71.70 -12.2 0.38

Philip Morris Intl PM NYSE 87.78 -12.0 0.47

Deere & Co DE NYSE 82.43 -10.9 0.55

Cisco Systems CSCO NASD 20.67 -10.6 0.45

Chevron CVX NYSE 107.53 -10.6 0.59

Yandex YNDX NASD 24.31 -9.9 0.20

Amazoncom AMZN NASD 198.26 -8.8 0.86

Freeport McMoran FCX NYSE 38.70 -8.3 0.69

iShrs Tr MSCI EAFE EFA ARCA 55.21 -7.7 0.57

Merck MRK NYSE 38.42 -7.4 0.36

Comments »

52 Week Highs and Lows

NYSE

New Highs 113 COMPANY SYMBOL HIGH VOLUME ------- ------ ---- ------ Abbott Labs ABT 60.88 775,079 Accenture PLC A ACN 65.50 555,728 Advance Auto Parts AAP 90.13 52,006 AegonNVNon Cum Sub Nts AEK 26.13 21,468 Airgas Inc ARG 87.47 52,164 Allergan AGN 94.87 186,912 Alliance Data Sys ADS 127.08 29,891 Bebidas de Americas ADS ABV 43.22 245,731 Bebidas de Americas ADS C ABV/C 35.63 3,045 Amer Eagle Outfitters AEO 17.50 1,037,667 American Express AXP 57.98 505,669 Amer Vanguard AVD 20.92 16,682 Anheuser Busch BUD 73.06 83,622 Armstrong Wrld Ind AWI 59.78 108,056 BP Prudhoe Bay Royalty Tr BPT 126.89 18,759 Bally Technologies BYI 47.47 68,458 Beam Inc BEAM 58.85 74,393 Big Lots Inc BIG 46.66 74,846 BlackRockStrategicBond BHD 14.32 6,935 CBS Corp B CBS 32.56 918,916 CBS Corp A CBS/A 32.82 404 CDI Corp CDI 17.85 12,445 Cabelas CAB 39.21 176,136 Capital One Fincl COF 56.38 547,635 Carriage Services CSV 6.95 4,670 Chipotle Mexican Grill CMG 420.84 65,540 Church & Dwight CHD 49.53 33,379 Cincinnati Bell CBB 4.15 87,558 CinemarkHldgs CNK 22.67 88,328 Coca-Cola KO 71.79 581,297 Colgate-Palmolive CL 96.71 214,813 Constellation Brands A STZ 23.77 114,041 Constellation Brands B STZ/B 23.65 300 Core Labs CLB 131.44 22,562 CubeSmart CUBE 12.10 89,256 Diageo PLC DEO 98.08 64,696 Diebold Inc DBD 39.98 81,916 Disney DIS 44.25 1,990,684 El Paso Corp EP 30.30 988,832 Extra Space Storage EXR 28.38 61,845 Fair Isaac FICO 44.03 21,469 FleetCor Technologies FLT 39.89 21,834 Fomento Economico FMX 78.05 13,877 Foot Locker FL 32.05 321,695 GP Strategies GPX 17.15 11,040 Gabelli Hlthcr & Well GRX 8.19 3,827 Gap Inc GPS 26.84 819,434 Global Cash Access GCA 7.02 319,107 WW Grainger GWW 218.27 66,172 Guidewire Software GWRE 35.00 29,172 Hlth Care REIT 6.50 Pfd J HCNpJ 25.25 6,900 Herbalife HLF 72.11 214,672 INVESCO IVZ 26.67 352,239 Imperva IMPV 40.04 529 Independence Hldg IHC 10.15 2,443 InterXion Holding INXN 18.32 57,655 InvenSense INVN 22.35 490,638 Jarden Corp JAH 40.56 330,647 KapStone Paper & Pkg KS 21.31 42,889 Kenexa KNXA 32.09 26,309 Kilroy Realty KRC 46.66 38,421 Kinder Morgan KMI 39.24 201,384 LeapFrog Cl A LF 8.20 107,024 LifeTime Fit LTM 52.68 19,987 Limited Brands LTD 49.53 315,190 Lowe's Cos LOW 31.14 1,364,086 Luxottica Grp LUX 36.46 54,075 Manning & Napier MN 15.27 9,339 MarriottVacations VAC 28.29 16,941 Mastercard MA 430.21 128,000 McCormick & Co Vtg MKC/V 52.56 900 McCormick & Co MKC 52.77 47,159 Mead Johnson Nutrition MJN 82.97 278,106 Metro Health Ntwks MDF 9.38 34,061 Mindray Med Intl ADS MR 33.94 23,760 Mine Safety MSA 41.66 8,477 MS Cap Tr V 5.625% Cp Scs MWO 24.48 3,900 Nacco Indus NC 116.88 3,433 Nordstrom Inc JWN 55.48 105,493 Nu Skin Enterprises NUS 62.02 90,024 Omnicom Grp OMC 50.68 116,207 PVH Corp. PVH 92.13 222,076 Philip Morris Intl PM 88.25 763,521 Pier 1 Imports PIR 18.53 137,599 Plantronics PLT 39.93 97,450 Polaris Indus PII 73.48 374,445 Praxair PX 113.59 141,467 Prestige Brands Hldgs PBH 17.75 30,175 Progressive Corp PGR 23.04 185,189 Raytheon RTN 52.99 253,746 Realty Income O 38.52 33,318 Rentech Nitrogen Ptrs LP. RNF 26.86 33,971 Roper Indus ROP 101.06 45,639 STAG Industrial STAG 14.15 4,235 Salient MLP & Engy Infr SMF 26.00 3,357 Sherwin-Williams SHW 108.66 72,383 Simon Property Group SPG 145.10 103,746 SolarWinds SWI 41.19 452,114 Sovran Self Storage SSS 49.63 6,464 Sturm Ruger RGR 49.95 85,337 SYNNEX SNX 43.42 30,424 TJX Cos TJX 39.39 523,981 Teledyne Tech TDY 63.11 7,293 Tempur-Pedic TPX 84.83 113,840 Teradata Cp TDC 69.50 99,505 Tim Hortons THI 54.52 29,083 Total Sys Svcs TSS 22.99 50,251 Vaalco Engy EGY 9.63 143,127 Valmont Indus VMI 117.92 61,869 VISA (Cl A) V 120.17 556,095 Western Digital WDC 42.81 727,307 Wright Express WXS 66.23 41,726 YUM! Brands YUM 71.19 370,747 New Lows 7 COMPANY SYMBOL LOW VOLUME ------- ------ ---- ------ BlackRock Utility & Infr BUI 18.16 13,691 Colony Finl 8.5% Pfd A CLNYpA 24.74 18,500 East Am Natl Gas Tr NGT 22.00 1,450 General Steel Hldgs GSI 0.79 75,416 Kimco Realty Dep 6 Pfd I KIMpI 24.50 19,300 Nortel Inversora ADS NTL 19.24 8,412 Promotora de Info ADS PRIS 3.39 3,383

NASDAQ

New Highs 144 COMPANY SYMBOL HIGH VOLUME ------- ------ ---- ------ ACI Worldwide ACIW 41.10 25,215 ASB Bancorp ASBB 13.11 100 Accelrys ACCL 8.45 32,578 Advisory Board ABCO 87.83 14,970 Affymax AFFY 14.15 720,245 Alexion Pharm ALXN 95.01 319,599 Allot Comm ALLT 21.75 24,039 Ameris Bancorp ABCB 13.45 2,500 Analogic ALOG 66.55 3,710 Angeion ANGN 6.10 400 Arctic Cat ACAT 42.64 28,141 Arena Pharmaceuticals ARNA 2.88 12,958,664 Ariad Pharm ARIA 16.38 828,951 Bank of Kentucky Fincl BKYF 26.95 2,277 Beacon Roofing Supply BECN 26.08 34,809 Bed Bath & Beyond BBBY 67.17 200,806 Blackbaud BLKB 33.73 7,440 Bridge Capital Hldgs BBNK 13.03 12,096 Bryn Mawr Bank BMTC 22.60 2,200 Buffalo Wild Wings BWLD 93.33 320,302 Cal-Maine Foods CALM 42.40 58,178 Callidus Software CALD 8.10 21,567 Calumet Specialty Prdts CLMT 26.39 41,699 Carmike Cinemas CKEC 13.51 25,105 Carrols Restaurant Group TAST 12.87 60,952 Casey's General Stores CASY 55.19 29,804 Celgene CELG 77.44 341,322 Centerstate Banks CSFL 7.94 8,753 Cerner CERN 78.28 230,434 Check Point Sftwre Techs CHKP 63.94 184,644 Cirrus Logic CRUS 24.85 203,923 Cisco Systems CSCO 20.75 4,263,352 Comcast CMCSA 30.25 1,192,045 Comcast A Sp CMCSK 29.85 364,506 Conn's CONN 16.02 25,203 Copart CPRT 53.49 20,774 Credit Acceptance CACC 105.49 12,989 Cubist Pharmaceuticals CBST 44.59 62,073 DXP Enterprises DXPE 45.00 10,535 Daily Journal DJCO 80.00 489 Discovery Comm C DISCK 46.93 26,182 Discovery Comm A DISCA 48.93 83,201 Dollar Tree DLTR 95.87 143,725 Dorman Products DORM 48.42 11,653 Electro Rent ELRC 18.94 5,210 Elmira Savings Bank ESBK 21.37 1,295 Emclaire Financial Corp EMCF 18.59 145 Equinix EQIX 149.29 82,610 eResearch Tech ERT 7.78 63,605 Exar EXAR 7.99 18,899 Expedia EXPE 34.77 198,387 Extreme Networks EXTR 3.95 82,804 FEI Co FEIC 48.75 66,728 Fastenal Co FAST 54.59 175,179 Finish Line (Cl A) FINL 26.16 211,334 First Intst BancSys Inc FIBK 15.00 9,226 First Tr ISE Cloud Comp SKYY 21.25 9,792 First Tr NASDAQ100EqWt QQEW 27.08 2,403 Firsthand Tech Value Fd SVVC 39.74 43,934 Fiserv FISV 69.90 66,597 Francesca's Holdings FRAN 33.74 75,662 Global X NASDAQ 500 QQQV 29.57 812 GRAVITY Co ADS GRVY 3.20 325,169 Great Wolf Resorts WOLF 5.73 40,576 Guaranty Bancorp GBNK 1.93 8,666 Guaranty Federal Bancshrs GFED 9.33 110 HSN Inc HSNI 38.77 37,258 Hackett Group HCKT 5.46 51,929 Hain Celestial Group HAIN 44.13 20,794 Heritage Oaks Bancorp HEOP 4.96 8,319 Herzfeld Caribbean CUBA 7.65 34,202 Hibbett Sports HIBB 54.93 35,157 IAC/InterActive IACI 50.50 56,307 IF Bancorp IROQ 12.27 100 IRIS Intl IRIS 13.43 11,120 inContact SAAS 5.97 12,639 Infinity Pharmaceuticals INFI 12.20 15,537 Integrated Elec Services IESC 3.99 11,466 Integrated Silicon Sol ISSI 11.20 12,253 Intel INTC 28.09 6,097,521 Intl Bancshares IBOC 21.39 14,276 Intuitive Surgical ISRG 538.90 28,657 iShrNasdaqBiotch IBB 123.32 20,677 Jive Software JIVE 27.65 55,065 Joe's Jeans JOEZ 1.33 52,621 KLA-Tencor KLAC 53.39 266,890 LNB Bancorp LNBB 6.30 5,239 Ligand Pharmaceuticals LGND 18.74 15,347 Liquidity Services LQDT 48.34 55,507 LivePerson Inc LPSN 17.44 54,018 MAKO Surgical Cp MAKO 45.00 176,229 MTS Systems MTSC 53.72 12,052 Madison Square Garden MSG 34.65 55,249 MarketAxess Hldgs MKTX 37.79 34,631 Mattel Inc MAT 34.27 235,633 Maxim Intgrtd Prod MXIM 28.96 209,003 Monster Beverage MNST 61.35 105,593 NASDAQ Prem Inc & Growth QQQX 15.56 12,167 Neteasecom NTES 60.15 86,980 O'Reilly Automotive ORLY 91.40 76,307 OSI Systems OSIS 63.93 22,125 Old Line Bancshrs OLBK 10.20 1,558 Old Sec Cap Tr I 7.8% pfd OSBCP 4.70 100 Oritani Fincl ORIT 14.71 41,265 Patrick Industries PATK 10.95 19,766 Peet's Coffee & Tea PEET 77.00 24,089 Pharmacyclics PCYC 28.49 67,614 PwrShs SP SmCp Cons Discr PSCD 32.46 1,735 PwrShs S&P SmCp Cons PSCC 34.18 2,153 PwrShs S&P SmCp Hlth Cre PSCH 35.27 2,434 pricelinecom PCLN 727.70 290,608 Procera Networks PKT 22.18 44,311 Qualcomm QCOM 67.96 1,944,234 Rand Logistics RLOG 9.10 8,043 Regeneron Pharmaceuticals REGN 120.90 165,220 Ross Stores ROST 58.64 487,911 Ruths Hsptlty Gr RUTH 7.49 14,237 Ryanair Hldgs PLC (ADS) RYAAY 35.86 50,332 SS&C Techs Hldgs SSNC 23.41 8,613 Saba Software SABA 12.71 32,217 Santarus SNTS 5.71 73,816 Snyders-Lance LNCE 25.49 29,409 Sourcefire FIRE 50.47 92,758 Spectranetics SPNC 10.76 31,351 Starbucks SBUX 55.88 730,602 SurModics SRDX 15.93 4,999 Synacor SYNC 7.90 49,300 Taylor Capital Group TAYC 14.25 5,616 TIBCO Software TIBX 31.94 268,452 Town Sports Intl Hldgs CLUB 12.55 19,111 Tractor Supply Co TSCO 90.66 448,145 US Ecology ECOL 21.62 53,188 Ubiquiti Networks UBNT 32.69 106,602 Ulta Salon Cosmetics ULTA 94.73 75,333 Ultralife ULBI 5.50 24,059 Umpqua Hldgs UMPQ 13.58 49,491 United Bancorp UBCP 9.52 5,175 Utd Community Fincl UCFC 2.19 24,345 Verenium VRNM 4.15 652,804 Verisk Analytics Inc VRSK 47.28 310,656 Volterra Semiconductor VLTR 33.26 95,764 WPP Group PLC (ADS) WPPGY 70.06 22,924 Wright Medical Group WMGI 19.47 18,730

Zumiez ZUMZ 36.76 22,986 New Lows 7 COMPANY SYMBOL LOW VOLUME ------- ------ ---- ------ A123 Sys Inc AONE 1.48 3,132,453 Cleantech Solutions Intl CLNT 1.88 28,216 D Medical Industries DMED 0.35 21,299 Deer Consumr Prdcts DEER 3.10 33,087 ProShs UlShrt Nsdq Biot BIS 22.98 1,500 Pure Bioscience PURE 0.29 5,498 Sunshine Heart SSH 8.50 300Comments »

Today’s Heat Map and A/D Lines

Most Active Options Trades

-CALLS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE BAC 3/30/12 10.0000 510 0.1800 up 0.0400 BAC 4/21/12 9.0000 229 1.1200 up 0.1100 INTC 5/19/12 26.0000 103 2.2700 up 0.3200 DIA 4/21/12 136.0000 100 0.1400 up 0.0400 DIA 4/21/12 135.0000 100 0.2500 up 0.0600 FCX 3/30/12 40.0000 89 0.3100 up 0.0900 LVS 3/30/12 60.0000 84 0.4200 up 0.1700 AAPL 3/30/12 600.0000 79 7.0500 up 0.5700 SUN 5/19/12 42.0000 78 0.3100 dn 0.3900 FCX 3/30/12 39.0000 66 0.7400 up 0.2500 -PUTS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE LVS 5/19/12 50.0000 268 0.6800 dn 0.2000 X 3/30/12 29.0000 144 0.4400 up 0.0000 LVS 5/19/12 55.0000 134 1.8100 dn 0.3900 LVS 5/19/12 45.0000 134 0.2500 dn 0.0700 FCX 3/30/12 37.0000 110 0.1400 dn 0.0900 FCX 3/30/12 38.0000 100 0.3200 dn 0.1600 AAPL 3/30/12 600.0000 81 9.0000 dn 1.8100 MSFT 3/30/12 32.0000 77 0.1600 dn 0.1700 COF 4/21/12 55.0000 74 1.2800 dn 0.1200 SU 4/21/12 33.0000 68 0.7600 dn 0.3300 -VOLUME- CALLS PUTS TOTAL 9201 11287 20488

-CALLS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE HD 4/21/12 50.0000 2938 0.8200 up 0.1200 BAC 3/30/12 11.0000 2024 0.0300 up 0.0000 BAC 3/30/12 10.0000 1831 0.1700 up 0.0300 AAPL 3/30/12 600.0000 1723 7.1000 up 0.5900 VVUS 6/16/12 13.0000 1358 10.8000 up 1.3000 INTC 5/19/12 26.0000 1328 2.2700 up 0.1300 BAC 4/21/12 10.0000 1202 0.4600 up 0.0600 BAC 5/19/12 10.0000 1166 0.6500 up 0.0700 EMC 4/21/12 30.0000 1094 0.5400 up 0.1200 PEP 7/21/12 70.0000 1032 0.3600 up 0.0700 -PUTS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE INTC 4/21/12 28.0000 1159 0.6300 dn 0.0900 PBR 10/20/12 25.0000 1140 1.6500 dn 0.2100 INTC 4/21/12 27.0000 1078 0.2800 dn 0.0400 WMT 9/22/12 60.0000 1060 2.3500 dn 0.0500 TLT 6/16/12 120.0000 900 9.2600 up 0.4100 TLT 6/16/12 108.0000 900 1.9100 up 0.0400 AAPL 3/30/12 575.0000 866 1.2100 dn 0.7800 VVUS 4/21/12 18.0000 780 2.2300 dn 0.1700 DAL 5/19/12 11.0000 734 1.6400 dn 0.0200 AAPL 3/30/12 580.0000 733 1.8000 dn 0.9600 -VOLUME- CALLS PUTS TOTAL 291117 237516 528633Comments »