Thankfully, we have a bit of good news out of Europe.

Comments »Asia Pare Some Gains After Good Data From Japan and South Korea

Asia was off to a good start, but has pared some gains after some higher yields were seen in both Germany and Italy. Machine orders in Japan did better than expected while South Korea’s unemployment fell.

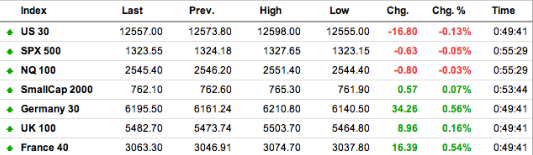

Comments »Global Markets and U.S. Futures Flip Flop Around the Unch Line

FLASH: US Futures Are Flat, Europe Higher, Ahead of Asian Trade

The Bulls Take Back Yesterday’s Losses

Hopes of QE is running in the streets. The bulls managed to recoup yesterday’s losses despite a wide range of negative news. The bears only have light volume to grab at today.

DOW up 160

S&P up 15

NASDAQ up 33

The bulls are looking for clam love…

[youtube://http://www.youtube.com/watch?v=Yow4Aus8oTo 450 300] Comments »Today’s ETF Action

Market Update

The major averages suffered a bit of morning chop, but have managed to rally firmly into the afternoon. The bulls are probably thankful for Europe not tanking into the close and are smoking some hopium for world wide stimulus. All in all the markets will have breakout above 1325 or below 1275 to to give investors some clear direction.

[youtube://http://www.youtube.com/watch?v=CSvFpBOe8eY 450 300] Comments »Heat Map and A/D Lines

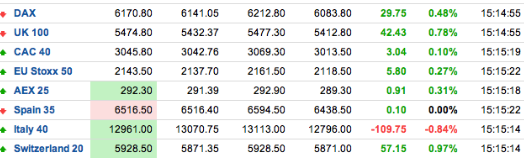

FLASH: SHORTS LEFT TITS UP, EUROPE RALLIES INTO THE CLOSE

FLASH: European Shares are in Plunge Mode, As Yields Rise, Across the Board

CAC is now negative for the day.

It’s not just Spain and Italy. German, French, Austrian and other sovereign yields are spiking sharply, pan-europe.

Comments »Hedge Fund Managers Turn Bearish as Outflows Rise

“TrimTabs and BarclayHedge report each month about hedge fund inflows and outflows, and if you have been watching the tape you shouldn’t be surprised that the trend is toward ‘outflows’ of late. What is interesting is that there is a one-month lag and that means that the current report covers the month of April. If stocks were still holding up in April and the outflows were large then, imagine how bad the outflows were in May”

Comments »The Private Sector is Not Well When Middle Class Counties Collect Food Stamps

“MORRIS COUNTY, N.J. (CNNMoney) — Since the recession, persistent unemployment has left middle-class life out of reach for millions of Americans.

But few residents of Morris County, N.J., could have ever imagined they would end up on government assistance.

Morris County is known for its wealth and million-dollar homes. Median household income there is over $91,000. Yet, the number of people receiving food stamps in the area has nearly tripled in the past five years.”

Comments »Import and Export Price Data

U.S. Futures Said to Be Higher on Speculation of Stimulus to Come

Asian Markets Fall, Europe Trades Unch, and U.S. Futures Reach for a Little Upside

FLASH: US and EUROPEAN FUTURES A MIXED BAG

FLASH: Asian Markets Yawn Off #SPAIL

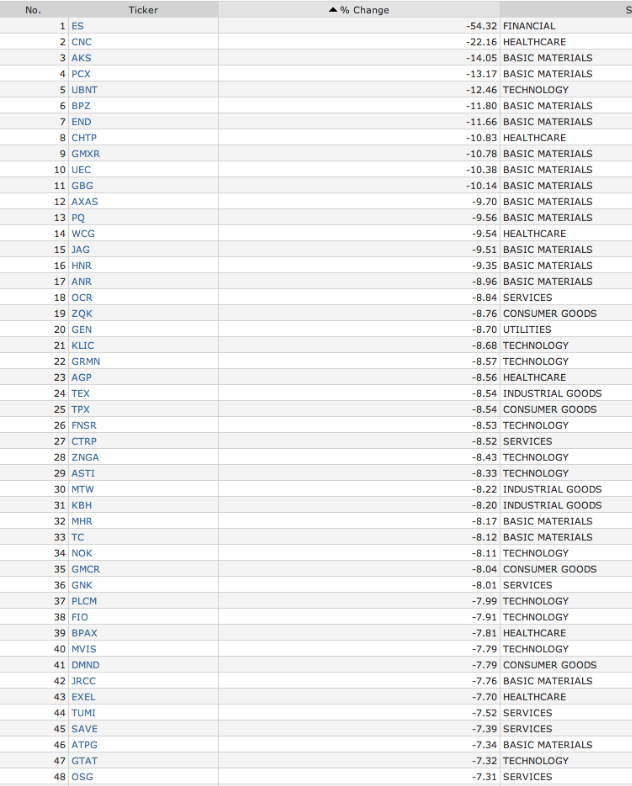

Today’s Biggest Losers

$YELP, $OPEN Further Integrated Into $APPL Ecosystem

2:16 P.M.: Restaurant integration with Yelp has gotten deeper, and integration with OpenTable to make reservations.

Full Article (live blog)

Comments »