Monthly Archives: May 2012

PPI: Prior 0.0%, Market Expects 0.0%, Actual -0.2%…Sans Food and Energy +0.2%

The core rose from 2% to 2.7%

Comments »Global Pole Indicates Facebook Thought to be Overvalued

“Facebook Inc. (FB), seeking as much as $96 billion in its initial public offering next week, is overvalued at that price, according to a Bloomberg investor poll.

Underscoring concerns that growth may taper for the world’s biggest social network, 79 percent of respondents in the Bloomberg Global Poll of 1,253 investors, analysts and traders who are Bloomberg subscribers said Facebook doesn’t deserve a valuation so high.”

Comments »Fears of a New Bubble Prompt Regulators in Germany to Scrutinize Bank Use of ECB Loans

“German lenders’ use of cheap loans from the European Central Bank is under examination by the country’s top banking supervisor amid concerns the influx of funding may eventually create “a new bubble.”

Banks that took “implausibly high” amounts have to explain how they plan to use the money, said Raimund Roeseler, head of banking supervision at the country’s financial regulator Bafin. The exercise is part of a strategy change focusing more on what banks plan for the future than looking at what they did in the past, he said.”

Comments »Credit Agricole Posts a 75% Drop in Profits From Greek Debt

“Credit Agricole SA, France’s third- largest bank by market value, said first-quarter profit dropped 75 percent, hurt by Greek losses.

The bank slumped as much as 4 percent in Paris trading after reporting net income of 252 million euros ($326 million), less than the 482 million-euro average estimate of five analysts surveyed by Bloomberg.”

Comments »Property Curbs Take Home Sales Down 16% in China

“China’s home sales transaction value fell 16 percent in April from the previous month as the government reiterated it will keep curbs on the property market.

The value of homes sold declined to 315.4 billion yuan ($50 billion) from 373.3 billion yuan in March and 324.9 billion yuan a year earlier, based on the difference between the National Statistics Bureau’s data for the first four months of the year and the first quarter. Housing sales value from January to April fell 13.5 percent to 1.02 trillion yuan from a year earlier, according to the data.”

Comments »Cheers: Commodities Have Officially Wiped Out All Gains for the Year

A good thing for the health of the global economy; but a clear sign that deflation is hard to fight.

Comments »Industrial Production Falls Unexpectedly in India

“Indian industrial production unexpectedly contracted in March as weaker domestic demand and tumbling exports hurt the economy, undermining the central bank’s efforts to shore up a sliding rupee.

Production at factories, utilities and mines declined 3.5 percent from a year earlier, the Central Statistical Office said in a statement in New Delhi today, compared with a 4.1 percent increase in February. The median of 32 estimates in a Bloomberg News survey was for a 1.7 percent gain.”

Comments »Japan Pledges to Be a Team Player; To Inject Liquidity During Global Emergency

“Japan’s central bank pledged to deploy its foreign-exchange assets as part of any international emergency response to turmoil in financial markets.

“Time may be necessary before international organizations and other relevant institutions are able to take necessary measures,” the Bank of Japan said in a statement in Tokyo today. The bank “would be prepared to provide foreign currency until international support is provided,” it said.”

Comments »The Euro Zone is Expected to Return to Growth by 2013 Sans Italy and Spain

“The euro-region economy will return to growth in 2013, with only Spain among its 17 members remaining in recession, according to the European Commission.

Gross domestic product will rise 1 percent in 2013 after declining 0.3 percent in 2012, the Brussels-based commission said today. While Greece will have the deepest slump, with GDP declining 4.7 percent, its economy may stay unchanged in 2013. Italy and Portugal will return to growth next year, while Spain’s economy may shrink 1.8 percent this year and 0.3 percent in 2013.”

Comments »Thankfully, Global Markets Do Not Melt Down on the $JPM Debacle

Megan Greene: Spain to Need ‘Huge Bailout’ (video)

[youtube:http://www.youtube.com/watch?v=bOws4-e8uNo&feature=g-all-u 603 500]

Comments »Shares of Sony at 30 Year Lows on Record Loss

The stock is down 5% in Asian trading, following a nightmarish quarterly loss.

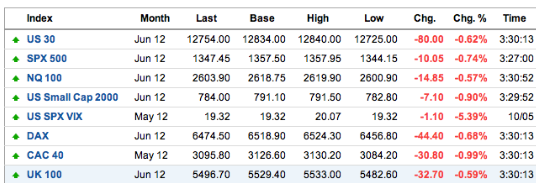

Comments »FLASH: US and European Futures Lower by 0.7%

Sterne Agee Says $JPM ‘Buttressed by Share Repurchase Program’– Reiterates $50 Target

Wake The Fuck Up and Smell the Synthetic Derivatives Rant

“The greatest shortcoming of the human race is our inability to understand the exponential function.” Albert Bartlett

Fuck all your cries of notional vs nominal. JPM’s mini debacle is the tip of the iceberg of potential losses to be had.

JPM has informed us that the losses may grow. We still do not know what the synthetics are tied too and whether this event could trigger other events for other banks.

If the Fed and Capitol Hill were so concerned of regulation and transparency to build confidence in the market place, then they would not have let the lobbyists win the issue of regulating the derivatives market….Full article

Even Jamie Dimon himself met with the Fed to delay the voting process on derivatives…. Full article

Here is the history of how we got here: Full article

What is important here are two things. This opaque market is a place to rape investors for commissions while playing three card monte with risk disclosure.

What started as a hedge has now become a swirling mass of toxic shit.

What scares me the most is the fact that currency swaps are used to lower interest payments on sovereign debt. We saw what happened in Jefferson County Alabama…and we know what is taking place in Europe.

Oh and by the way it was $JPM who fucked Jefferson County… Full article

For the love of sanity will someone please stand up and throw these greedy fucking criminals in jail before the the entire system blows up to the point where the credit freeze after LEH was just a five minute pick your nose event.

You better pray my prediction is way off the mark….Prediction

[youtube://http://www.youtube.com/watch?v=-F62B6BX0xs 450 300]

Comments »

The “World’s Largest Prop Trading Desk” Just Went Bust

Tyler Durden’s analysis on the whale of the blowup over in Jamie Dimon’s house. His thesis is most disturbing: JPM was willing to take such large risks as they knew they’d be bailed out if they went bust.

Read the article here.

Comments »About That Head and Shoulders Pattern in the Russell 2000

JC Parets of All Star Charts presents technical analysis of the Russell 2000, where he covers the massive head and shoulders pattern that has developed in 2012.

Read his analysis here.

Comments »Faber Sees ’87-Type Crash If U.S. Stocks Rise Without QE3

Marc Faber, publisher of the Gloom, Boom & Doom report, sees stocks crashing “like in 1987” if stocks climb absent further stimulus from the Federal Reserve.

Read the article here.

Comments »Derivatives Trader: ‘The Trouble is, Regulators are Idiots’

An excellent collection of thoughts by a trader about trading, City short-termism, high pay, the excitement of recent years and why he now wants a way out. This monologue is part of a series in which people across the financial sector speak about their working lives.

Read the article here.

Comments »