Monthly Archives: May 2012

IT’S A TRAP! S&P Futures Spike 5

Asian trading is rather moot, allowing the zealots of bid up futures. However, we all know how this ends, don’t we?

S&P +5

Dow +38

Jon Lovitz Called “Nazi” For Deriding Obama (VIDEO)

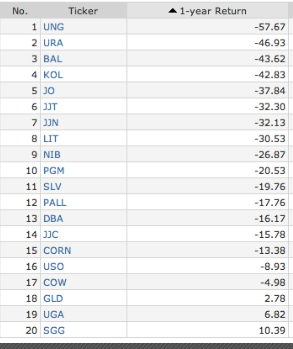

Jim Rogers is an Idiot: 1 Year Returns For Raw Commodities

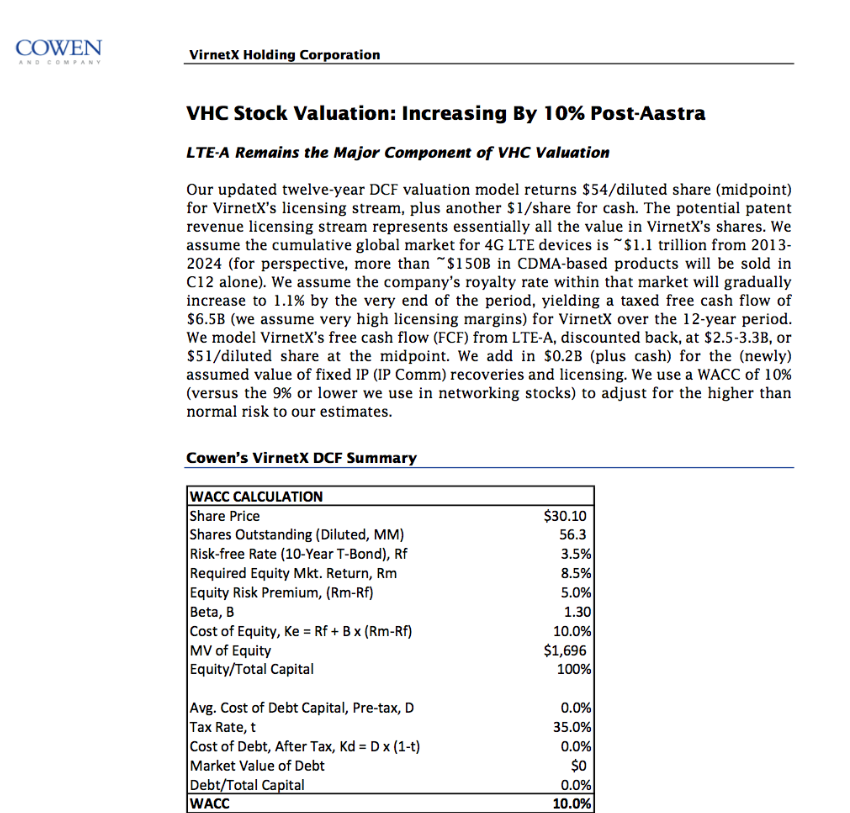

Cowen Slaps $54 Target on $VHC

Josh Brown: Notes From the Ira Sohn Conference

DAVID EINHORN is president of Greenlight Capital, Inc., which he co-founded in 1996. Greenlight Capital is a value-oriented investment advisor whose goal is to achieve high absolute rates of return while minimizing the risk of capital loss.

Martin Marietta ($MLM): A strange stock, cyclical business. At a 35 PE, market is wrong to pay up. The company is trying to buy Vulcan, it’s not going well. CEO is a megalomaniac, losing his mind.

France is a mess, huge exposure to Italy and Spain. CDS and bonds are mispricing how risky France is. “A return to the Franc is not out of the question.

Inexplicably, Einhorn just pulled out a magic wand and chanted something Norwegian like a spell.

Norway looks rock solid.

Cairn (based in Scotland)- trading at a discount to its global holdings. Drilling in Greenland, potential could be huge. 20% discount right now.

China: Culture gap and knowledge gap. Greenlight visited China. China views western investors as marks. Chinese infrastructure overbuilt based on overly bullish projections, the roads are empty, the houses are unsold.

There is not enough money coming into the Chinese banks, they are becoming illiquid and money is moving out. “I’m not missing out by not investing in China.”

Japan is now a D-List Country, adult diapers outsold baby diapers this year for the first time ever. The Yen could be in big trouble.

Japanese retail investors own 9% of US REITS, they are desperate for yield. He sees a big problem brewing for US REITs as Japanese money stops coming in, they are expensive.

Facebook gets panned on valuation.

Then an offhanded dig at Green Mountain’s unsold inventory levels.

On Amazon: Operating profits haven’t grown at all, they’ve taken $30 billion in profitless revenues away from other retailers.

Dick’s sporting goods is in big trouble with Amazon’s new push into the category.

On US Steel: Lost money in 9 of the last 13 quarters. Slowing Chinese economy and iron ore supply growth means big trouble for $X

On Apple: Hedge funds own less than 5% of Apple’s shares. THEY ARE UNDERWEIGHT. There is no reason why AAPL can’t become a trillion dollar market cap. There is no prohibition.

Apple is a software company, not a hardware company. They capture customers, making them worth a higher multiple than traditional hardware stocks. Still penetrating the market, gaining share, most cellphones are not yet smartphones. How could this stock have a below market multiple?

He wants $AAPL to launch a preferred class to pay high income. It’s a very new idea the way he’d structure it.

Comments »ABSURDITY: $HLF SURGES BECAUSE EINHORN DIDN’T MENTION THE STOCK IN PRESENTATION

+25% for the day because Einhorn didn’t pan it during his Ira Sohn presentation today.

Related: AAPL surged during late day trading because Einhorn came out bullish.

Comments »The Bulls Lose Their Grip on a Rally Again; At Least the Downside Action Was Negligible

The markets had a great start, but news out of Europe took the wind out of our sails. The Vix held above the crucial 20 mark; firmly @ 22 for the close.

Gold has been flirting with bear market territory all day. The only thing good that was down today was oil. Perhaps the Facebook IPO will perk things up.

DOW down 32

NASDAQ down 19

S&P down 6

WTI down $1.35

Gold down $18

[youtube://http://www.youtube.com/watch?v=Yoo6A-Edexo 450 300] Comments »Worker Productivity Has Gotten the Best of Us

Productivity is up and that’s good for companies, but not for you the worker bee.

Comments »History is Not on Obama’s Side for November

“Gallup is out with a look today at some key indicators that look troublesome for Barack Obama’s re-election prospects this fall.

There are three main indicators, which Gallup looks at from historical perspective to judge Obama’s prospects this year. They are his approval rating, economic factors and Americans’ view of the direction in which the country is headed.”

Comments »Gold Trades in and Out of Bear Market Territory

$1,536 marks a 20% correction from the highs. Despite all the fear; gold trades off, in this case way off, in even years since the late 90’s.

Don’t be surprised if gold makes it to $1250-$1300 per ounce; i doubt it, but you never know.

Comments »Live Coverage of the Best Hedge Fund Managers; Their Thoughts, Picks, and Vision

Auto refresh the all star line up of hedge fund managers and their comments at today’s IRA Sohn Conference…

Comments »Market Update

Snap Interactive: Facebook’s Fast Growing And Most Undervalued Social Media Company

Full disclosure. I picked up 2k shares for pure speculation off the Facebook IPO without even knowing what they do. It was part of a high risk play along with $GSVC and $SVVC, but after reading more into them I’m considering a real investment.

I do not normally dabble in bulletin board or pink sheet stocks, but this one may just be the exception.

This is not an offer to buy the stock. You must determine your risk parameters with your financial adviser. Bulletin board stocks carry a high risk with regards to liquidity and sheer asshat fuckery.

Comments »Notable ETF Inflows Over the Past Week

#ObamaInHistory: WH Links Political Messages To Bios Of Past Presidents on Website

The Obama White House is drawing ridicule for appending the official online biographies of nearly every president over the last century in order to link President Obama’s accomplishments to the former commanders in chief.

The Obama team went into the pages of U.S. presidents dating back to Calvin Coolidge to add friendly looking “Did you know?” fact boxes to the end of their bios. Those additions were used to plug a host of Obama administration initiatives, ranging from the health care overhaul to the so-called “Buffett Rule” to his green-energy policies.

For instance, the following line was added to the official bio of the late President Ronald Reagan: “In a June 28, 1985, speech, Reagan called for a fairer tax code, one where a multimillionaire did not have a lower tax rate than his secretary. Today, President Obama is calling for the same with the Buffett Rule.”

The White House is coming under heavy criticism from conservatives for the changes, and not just to Reagan’s page.

Late Tuesday, the White House defended itself, claiming the staff was merely adding links to other pages.

Read more:

Comments »FLASH: U.S. Equities Regain Half of Early Morning Gains After Going Flat on European News

A yo yo for sure. U.S. equities reacted to an ECB discussion of cutting off lending to Greek banks. The market paired 88 DOW points to just 3 DOW points and is now up 40 in the span of 5 minutes of trade…

Comments »