This has to be the most dysfunctional Fed since its charter was created. Between the Fed Chief mouth vomiting to end her speeches and her band of incompetents gallivanting around the country, clamoring for rate hikes, we are certainly fucked this Fed meeting on 10/28–right near Hallows eve, coincidentally, aka “The Fly’s” favorite holiday.

As I look at the deflationary vortex and toss things into it, I am truly amazed at Janet Yellen. I’d like science to seize her brain upon death and examine it for defects, for the benefit of the world. I feel it’s important that we begin to understand how the distorted mind works. The mind that alters, alters all.

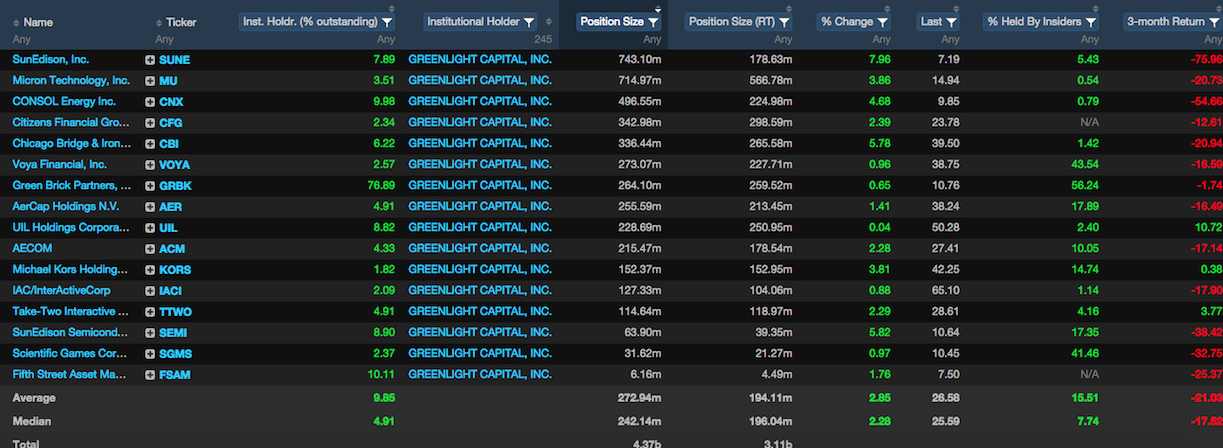

For some reason, the Federal Reserve, and all its “Fed Governors” (they’re not really governors, but lackeys who play fetch with the chief), do not look at the news, nor the stock market. They do not see entire commodity driven sectors off by 40% over the past 3 months, or the price of crude dropping like an anvil from $100 to $44 in less than a year.

Our dollar is at new highs, up 15% over 1 year. As such, our Fortune 500 companies are bearing a horrible brunt with their overseas businesses.

The bottom line is this: The Fed is using a strong labor market as an excuse to raise rates. None of their inflation targets have been hit and there is no reason to believe inflation is on the horizon either, considering that the single largest avenue for high wage employment (oil and gas) has been shut the fuck down.

What they should be talking about is another round of QE. Instead, we must wait for them to knock on our doors, this Halloween, and hope they do not stab us in the faces upon opening it.

Comments »