Goldman’s head of global credit, Charles Himmelberg, thinks you’re all idiots for making such a fuss about the oil collapse and the comparison to the 2008 sub prime meltdown.

His main points are the lack of size of the debt problem, when compared to the housing collapse. For example, the subprime debt was $800 billion. The bad oil debt, although $1.5 trillion globally, is merely just $300 billion in the high yield sector.

Is this man out of his fucking mind?

“For one, the magnitude of the subprime mortgage problem in 2007 was much larger with total mortgage debt outstanding rising $5 trillion from 2002 to 2007, while the growth of debt in the oil and gas sector (globally) increased by just $1.5 trillion from 2006 to 2014,” the team says. “At the risky end of the market, subprime mortgages totaled $800 billion in 2007, whereas [high-yield] debt exposed to the energy sector in the US, including both bonds and loans, is estimated to be about $300 billion today.”

“In the run-up to the subprime crisis, the market tolerated extremely high levels of leverage embedded in mortgage-backed securities because house prices and hence mortgage losses were viewed as highly predictable,” the team points out. “In the energy sector, by contrast, the historical volatility of oil prices was well known (even if bond markets failed to foresee the collapse), and thus prevented issuers from pursuing anywhere near the same level of leverage or complexity that was encouraged by the faulty, ‘AAA’ assessments of credit risk in mortgages.”

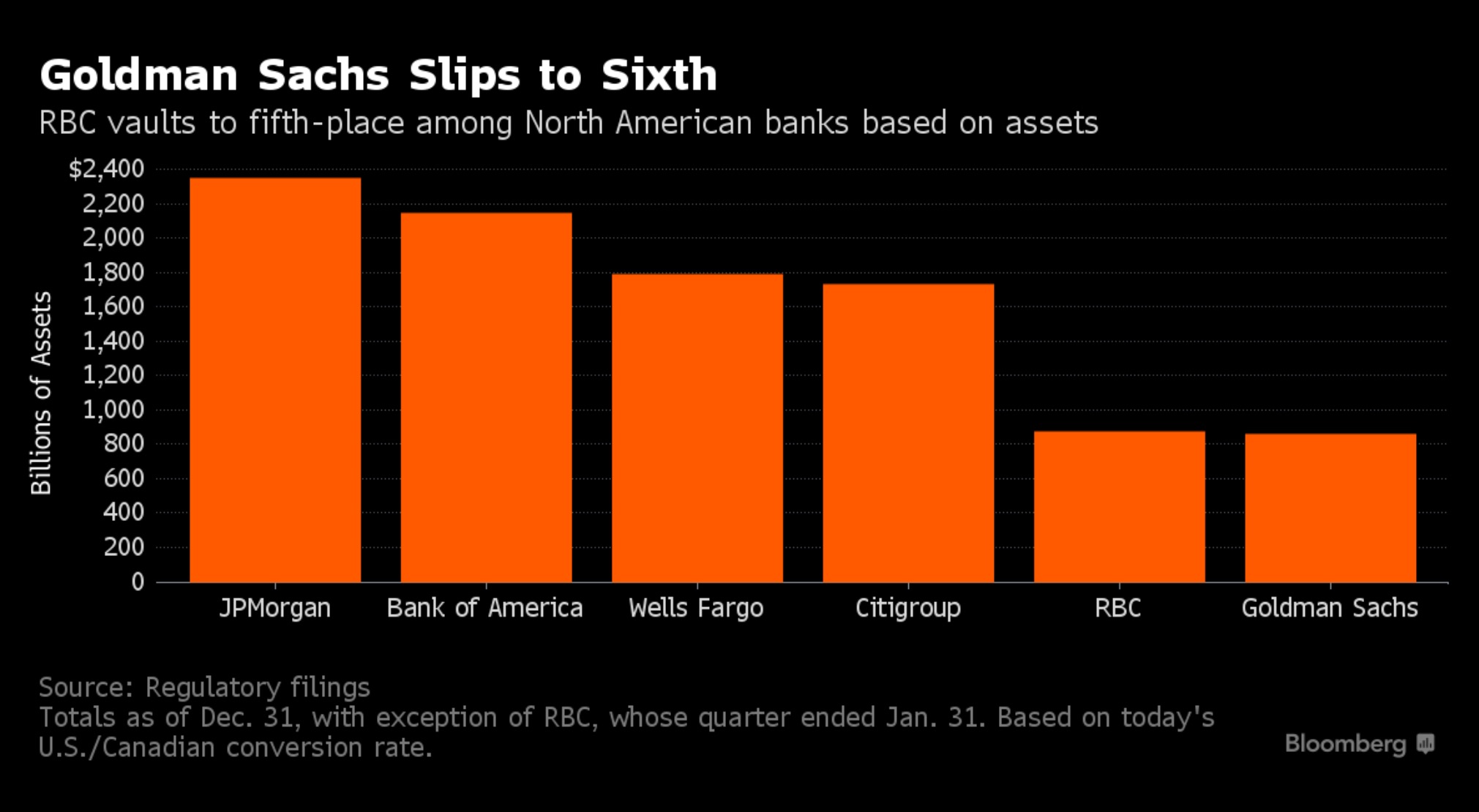

“Bank balance sheets have far less exposure to energy risk today than they had to mortgage risk in 2007,” Goldman says. “In 2007, for example, mortgages and mortgage securities comprised 33 percent of all bank loans in the U.S. Today, by contrast, commercial loans to the energy sector are relatively modest at just 2.5 percent of total bank loans.”

The level of naivety exhibited in this report runs very deep. Although the debt is less than the housing collapse, does it make the current scope and depth of this debt crisis benign?

In other words, western finance as we knew it was ending in 2009. Comparing this to that is childish and absurd. The world may not be ending; but that doesn’t mean everything is good.

Plus, there are ancillary effects to this story that he doesn’t mention, such as housing debt gone bad due to oil centric job loss and the many industries that rely upon big oil to sustain their bottom line.

Comments »