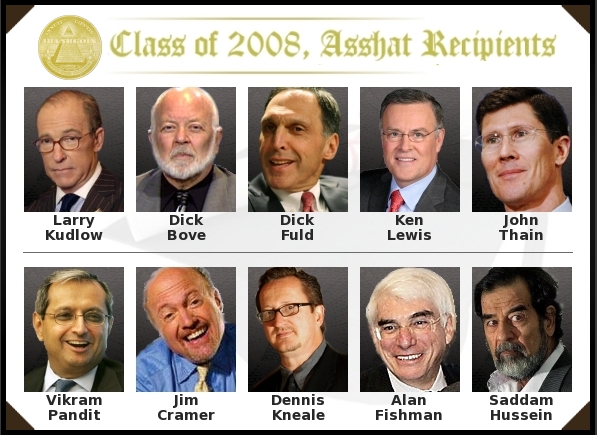

And I am not talking about the garden variety type. How can so many people get the market wrong, so consistently?

Answer: You’re all idiots.

You people should be shining my shoes for what I bring to table. Lo and behold, the market is coming around to my way of thinking—oil up, banks down. Fucking shocker.

Hey, I got an idea. How about some of you charting analysts go chart the credit default swaps on Morgan Stanley [[MS]] and Goldman Sachs Group, Inc. [[GS]] ? Tell me what they say and then give me your market diagnosis. While you’re at it, go check the cds’s for General Electric Company [[GE]] . I wonder how the market would do on a GE bankruptcy? Shall we try to find out?

Both Goldman and Morgan are in trouble here. I know the assholes from SEC are reinstating that ridiculous short sale restriction rule tomorrow; however, that will not solve the underlying problem, which is confidence. There isn’t any.

From what I understand, following the Lehman Brothers Holdings Inc. [[LEH]] bankruptcy, auditors were shocked at what they saw on the Lehman books, with regards to transparency. Actually, there wasn’t any. CDO’s were marked far too high and their commercial backed paper was priced for dot com boom times. Can you say “jail”?

So, where should a lowly investor, such as yourself, put his money now?

For starters, get long some commodity stocks, as the Federal Reserve and Treasury actively deplete and loot the country for all of its IOU’s. There is a long term price to pay for all of this spending and it doesn’t equate to a stronger dollar or fun and gleeful times.

With my money, I am shorting more GS. It’s going to book value ($99). And, I am buying more [[DIG]] and Freeport-McMoRan Copper & Gold Inc. [[FCX]] . Just in case you were wondering, I am holding my WNR for higher prices (I had to say that).

Oh, I almost forgot: Bill Miller from Legg Mason, Inc. [[LM]] still sucks.

UPDATE: I changed my mind. I am selling all of my DIG and IEO, but leaving FCX. I will now lever myself for a downside move, without hedges.

Comments »