I know it’s “uncool” to be scared of the stock market falling. Most of you fucking faggots are trading while drinking apple martinis, so complacent it makes me sick.

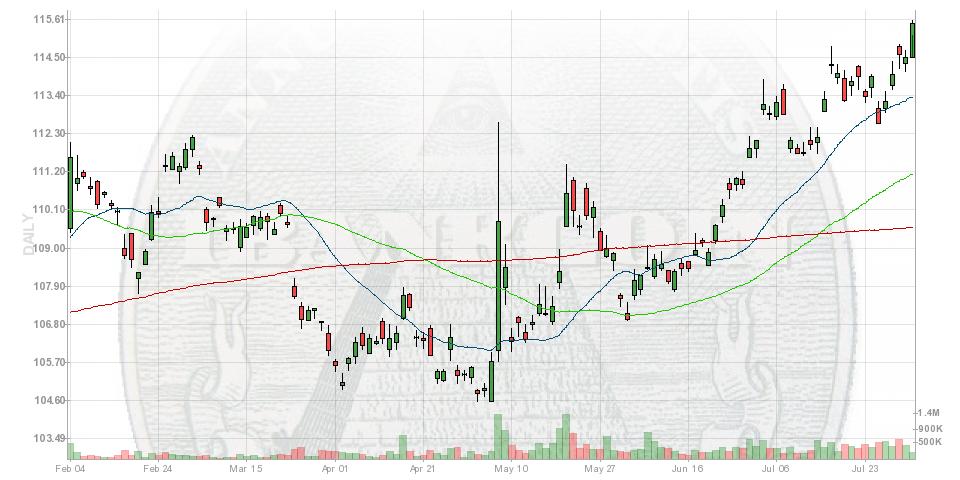

That is a 6 month chart of the Yen. Now, you are aware of the relationship between stocks and the Yen, no? Well then, explain why the unraveling of the carry trade no longer matters. Furthermore, I want you to elaborate on where funding is coming from, if not Yen.

One way or another, this is all coming to a head in September. By then, we will receive news of 3rd quarter sales and republicans will do their best to put the fear of God into you bible toting jackasses, so that you may kick out the verminous demoncrats. Moreover, by late September, news agencies will start discussing the dire condition of U.S. states and how they are relying on a Federal bailout. More than 20 states are spending Federal dollars they have yet to receive, with regards to 2011 budgets. Keep in mind, the GOP is running on a “zero bailout” policy.

At any rate, the market is digesting yesterday’s gains with a certain coolness that can only be attained by smoking a pack of menthol cigarettes inside of a closed automobile. As for me, I’m in the do nothing camp. Actually, I am quite busy studying the fundamentals of every single stock publicly traded, literally, via The PPT.

Why be scared with the PPT?

FIG (Fly Is Gay)

Banned.

What he said (banned)

Not that there’s anything wrong with that…

Yes, I’ll be the first to admit it. I am scared. I am scared that my VXX doesn’t appear to be scared. I’m scared that their is something going on behind the scenes that i don’t know about, making my investment thesis retarded.

Like maybe an ugly middle east war.

Or impending flooding of the market by Ben. Or maybe Ben just out and out buying equities.

Who the fuck knows.

The world is not right.

If they close the hormuz straight, oil jumps 30% overnight .

Goldman and JPM will then run into the oil pits, and bid it up to 200$.

Then , like clockwork, your local news will blame your local “circle k” gas pump for “price gouging”.

The hilarious part is, JPM and GS will bid oil up to a price that no one can afford. You could see a gap to 200, then a dump back to 100 or below in a one week period, after the hormuz straight is re-opened.

Love that “free press”. Doing a great job in today’s day and age!

Nice that JPM and GS get FDIC insurance for those activities.

This is certainly quite a bizarre situation. The only piece that hasn’t yet fallen into place are some real earnings warnings to match the clear macro slowdown, although you’d think that various “channel checkers” would be taking stocks down ahead of the “formal” warnings. The only thing holding this market up has to be the amount of skepticism out there (perhaps along with the sliding dollar), but eventually all that really counts are the earnings/revenue/cash flow numbers, and they have to be about to erode at a very good clip… This market, I think, is now running on fumes.

(Short SPY, long SDS, long DUSA)

Q3 earnings will not be good in consumer sectors, i promise you that.

Channel checkers will know after they finish processing July numbers.

I am not so sure of that.

That the earnings won’t be good, or that the channel checkers will figure it out?

If consumer sentiment or employment doesnt rise, earnings in consumer companies will disappoint. Q2 was the last quarter with easy comps.

If either employment gains or consumer sentiment swings up, i’ll withdraw my claim.

Also, this excludes leaders like Apple who are selling awesome shit and will just eat everyone elses cake.

I predict Q3-q4 earnings will be bad.

well thats what i said. I said “they’ll be bad” and you said “im not so sure of that”

Anyway, im glad we agree. I prefer harmonious alignment with the Fly.

Running on fumes…and the robots are very, very high.

PFE Good

PG Bad

So which is it?

Yes.

Long live the euro carry trade, financed by Spain

not scared at all….

roast beef and sharp cheddar for everyone!

So, if you call the fly gay you get banned?

BEN STEIN VOICE ON ……….. ( WAAAOOOWWWW )

BEN STEIN VOICE OFF

Why dont you every be specific fly , and say

by SEPTEMBER 30TH, I THINK THE DOW WILL BE AT 8000

Or whatever your pea brain thinks

I wonder if your thin barack skin will ban for that also

i will be specific by saying to you, Good Sir, you are banned.

FIG

LOOK TO THE 10YR NOTES, THEY SHALL GRANT YOU REDEMPTION. PUMP AND DUMP ON STOCKS AND COMMODITIES, SHORTS ARE GETTING THEY’RE FUCKING NECKS SQUEEZED RIGHT NOW. I’M NOT SWEATING ANY OF THIS. IN FACT, I QUITE ENJOY SEEING THE AMOUNT OF IRRATIONALITY WE’RE CURRENTLY SEEING.

I’M NOT SWEATING ANY OF THIS

Your manic “all-caps” posting aside.

_________

barack dildo ass- swipe hussien osama jabodigan-nuts.just had my italian sub.man,what a burp

Make mine Newports… Doing nothing today as well. Got kind of “fucked up” leaning short yestersay, and while npt scared, definitely need a day to clear the dome

I’ll have you know that apple martinis are like the gatorade of champions.

wine coolers dude…. late 80’s style

Calvin Coolers.

Orange Mad Dog baby!

boone’s farm. be there or be square

What’s the word? THUNDERBIRD!!!

You know.

apple martinis are for girls.

“pending home sales” numbers are total fucking bullshit, any jackass that actually believes these #’s, and actually buys the home builders, good luck.

^Indeed.

‘ was “down the shore”. This is peak season. Rentals that are “normally” (last few yrs) fully booked have vacancies. Owners/landlords are staying there or asking relatives, who could not normally afford it, to use the places. Perfect weather, but still no waiting in line for rides at the boardwalk.

Just waiting for a black swan-dive from the 13th to trigger a confidence capitulation.

Snooki?

You got bail, girl?

________

ya the yen is ripping titts

I’ve been through “harder” conditions then this.

This is a breeze.

Hey, can I bum a Kool from you?

No apple martini here.

Drinking an Arnold Palmer and listening to WFAN on the Internet.

I like to hear them complain how embarrassing the Mets are and why the Yankees may not be able to keep up with the Rays.

Too much high fructose corn syrup

in Arnold Palmer, although I can understand the golf connection.

Try Gregory’s Boxes of lemonade or assorted teas.

Pure cane sugar not as bad,

although sugar is bad period.

Le Fly>

I have a theory about the Yen. First of all it should be approaching 200 by now because Japan will go bankrupt or they will steal the people’s life savings to prevent it.

I don’t think the yen to the Dollar strength means much for equities. It’s just showing weak a dollar. The real litmus test I still believe is the Euro/Yen cross and the Yen is weak there.

The Aussie is also at 91 cents which shows there isn’t any liquidity inversion as the Aussie is a pretty good indicator there.

Lastly your risk jaws on the PPT is showing the jaws have opened up.

The weak Dollar Yen actually helps the US. As far as funding goes the real funding source for the US is China.

+1

Listen to the currency trader!

______

I always listen to J. Unfortunately more than half the time I have no fucking idea what he’s talking about. But every now and then I write down passages from his post and use them at dinner parties. Chicks dig it.

Just kidding, I don’t do dinner parties.

The only answer I can give other than “theryou are right, I’m scared” (which is probably the best answer) is that correlations are only temporary. For example, people used to think that if you watched the price of bonds, you would know where the market was headed. Or people thought that M1 made a huge difference in where stock prices would be. Or trade figures, GDP, unemployment.

People used to say if oil gold and commodities are down, stocks are up. Every correlation there was, people used logic and reason to justify it…

Sometimes it’s in reverse. if oil is up, stocks are up. If gold is up stocks are up. If commodities are up stocks are up. argument can be “If money is not going into commodities, it must be going into stocks” or “if investors are moving into cash both should go down, if investors are moving out of cash both should go up.

“if the money supply goes down, there is less money to go into stocks”.

logical statemetns don’t always work.

Earnings do matter, but in market tops forward earnings estimates are too aggressive, in market bottoms the esimates are too conservative.

So correlations work…

until they don’t.

As for who’s funding us? who knows. Maybe the market in a retarded way will say “hey, if the americans lose funding, they’ll be forced to make budget cuts, if the government gets out of the way, businesses will have a chance to compete without government interference and corrupt officials passing laws to only selectively help certain businesses that are privately held. This means public businesses can grow, too ineffecient businesses to succeed will finally be allowed to fail, and after that the economy booms. And then since the US cuts funding the rest of the world must start printing money and stuff.

It doesn’t have to make sense, it just has to appear to do so so that there are transactions being taken at high prices. Sure, eventually maybe the trading bots will stop trading amongst themselves at artificially high prices, and we will see “flash crashes” as a regular type of thing… but if history is any guide, eventually everything people think they know about the market will be wrong, and the more convinced they become, and the more people that believe it, the more likely they’ll be wrong.

/rant that really doesn’t matter

Dow to 11,500 within the next two months, then I’ll start looking for an October massacre, Red Sox-style.

The Yen will come back down to earth, and should break 95/$USD or everyone in Japan, who has any money, will threaten to perform seppuku / hara-kiri / or whatever weird crap they do to kill themselves.

The Central Bank extortionists are at work here, as we speak.

Yeah I’m thinking the same thing like $SPX 1180 then down down down..

Aren’t you glad you are in gold?

_________

The suicide of chic choice in Japan will be retro — single engine planes are all the rage, as are “flag headbands.”

You know what comes next.

_____

Yes I am, and silver too.

As a matter of fact I think many of you are wrong.

The Yen is trading according to The Central Bank of Japan and their USD liquidity swap program. Check it out. When the commercial paper market dried up there the CBOJ started buying up all sorts of crap from hurting financial firms including bonds, stocks, etc. In addition, they lowered rates to 0.1% from 0.5% and they created USD swap lines whereby the US would supply near-infinite dollars backed by whatever collateral Japan could provide. When they initiated it in Sept. 2008 the USD/JPY tanked and again when they re-initiated it on May 10, 2010 the yen dislocated and then continued to rise. As they “strengthened their credit” with USD by shoring up risk in the commercial paper and debt markets the yen has risen. It should be noted that they have been running a current account surplus that has surged 88% yoy.

Evidence of these similar actions can be seen in the EUR/USD swap lines too. On May 9, 2010 the Fed announced USD liquidity lines for Europe and EUR/USD rallied the next trading day. The cross traded a little lower but shortly thereafter it regained much strength.

Swap lines expire in January 2011.

At any rate, the market is digesting yesterday’s gains with a certain coolness that can only be attained by smoking a pack of menthol cigarettes inside of a closed automobile.

Odd, no?

________

A lot depends upon Congress doing the right thing.

LOFL! I know, I know….

_______

Yep,. When our interest rates went to almost zero, the Japanese yen carry trade began to not make any sense at all. So all the heck of a lot of money that moved out of the Japanese economy and into the U.S. through this trade, keeping the yen super low and good for their exports, started to go bye bye….so the money comes from us Printing more………….why do you think I am not worried about one day rallies so much…….For Sept/Oct….Fly you also forgot to mention that China has a major party the first week in Oct which slows the place down like their New Years Party and the End of the Shanghai World Expo which a lot of 2009 spending was on and a lot of chinese will be out looking for a job as the result of it closing up Oct 31.

This is a bland market. Pure VANILLA. I’m bored, someone make a move please.

DBV is an etf that tracks the carry trade, and it’s holding up well. So yen strength may not have anything to do with carry trade.

The yen carry trade is dead. The dollar is the new carry currency thanks to indefinite zero rate policy.

That is the reason for the dollar weakness and the reason why global markets are on the verge of the greatest inflationary rally of all time.

only Chivas on the rocks of course.

the unraveling of the carry trade is a huge positive for a few very important reasons.

where funding is coming from should be obvious.

Clacka! Clacka! Clacka! Clacka!

_______

Just change your name to JakeGutenberg already.

The Gutenbergs didn’t make that kind of noise… they were all hand operated.

No, I’m talking noise… like with a Wharfedale Press steamin’ on!

______

The yen is getting stronger for a very simple reason: there aren’t enough of them in existence and, quite likely, a lot more are going to be vaporized by bankruptcies and worthless “repair bond” derivatives coming due in the next few years. Japan mortgaged their future because they were sure that they would be able to grow their way out of the debts, debts that they had expected to pay off years ago. That’s my theory.

if you are scared.. get the fuck out of this market, period.

Mr.Fly , lately I’m starting to get your sentiment 100% conrarian .. it works!