For a long time, I’ve been wanting to track and paper trade a system here on iBC.

I have not done so yet, as I do not want to disclose the specifics of systems that I am trading. There is, however, a system I’ve been watching that I think will be perfect for iBC for several reasons, with the 2 most important reasons being that I’m not trading the system (yet), and the ETFs it trades should be liquid enough to allow participation by others without creating large slippage.

I will not divulge the entry criteria, but I will be posting the signals nightly, in order to give plenty of time to be acted upon at the next open (I’m not recommending that you trade this system).

To whet any appetites, this system is up a whopping 71.6% this year.

Introduction to the New ETFÂ System.

One of the pitfalls of trading a system is that one can easily start trading the system and find that he has begun trading it at the absolute worst time. This might mean starting a system and suffering through a drawdown before the system starts to generate profits. If one is lucky, he might find that the first trades are huge winners. The system trader will then have nice profit cushions, to absorb future drawdowns.

With that in mind (profit cushions) I want to start tracking this system, as of today, September 29th, 2008. The system trades only the double long and double inverse ETFs.

The three signals generated on Friday’s close were [[MZZ]] , [[EFU]] , and [[SCC]] . However, this system will only take 2 trades per day, maximum. And it will hold only a maximum of 4 ETFs. When provided more opportunities than the system will allow, the system chooses the ETFs with the most volume. Therefore, this morning, this system bought [[MZZ]] and [[EFU]] . It is very important to note that the system also generated a sell-signal, as of tonight’s close, so these ETFs will be sold at the open Tuesday.

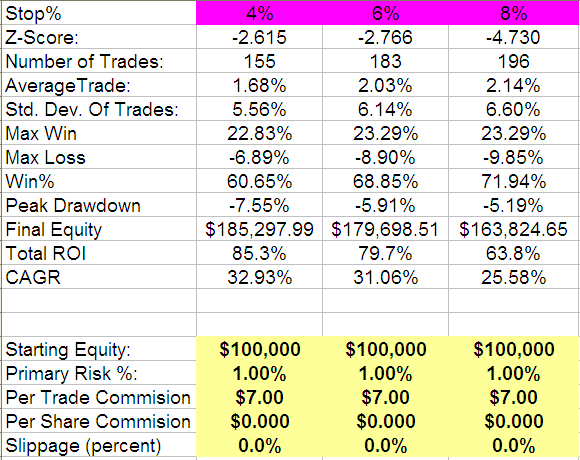

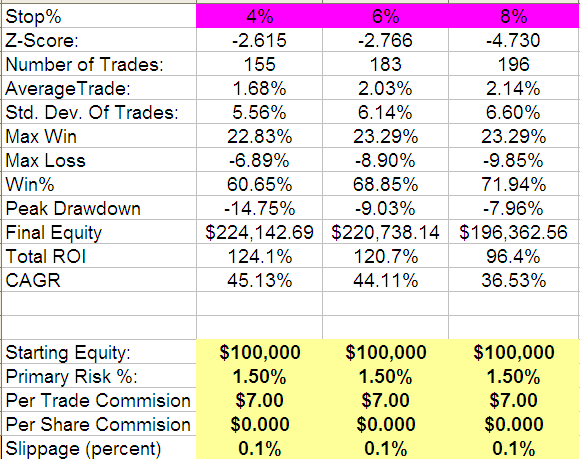

Position Sizing

The importance of calculating position sizes is crucial to the success of any system. Here is how this system will calculate position sizes:

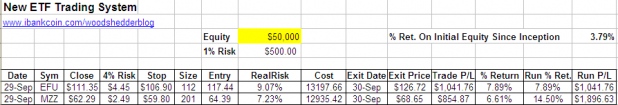

- Initial Equity is $50,000.

- Risk on each trade will be 1% of equity.

- A 4% protective stop will be used on every trade.

Caveat:Â Position sizes set before the open can be troublesome because if a 4% stop is set based on the close, and the ETF gaps 2% on the open, the trade will actually move 6% before the stop is hit.

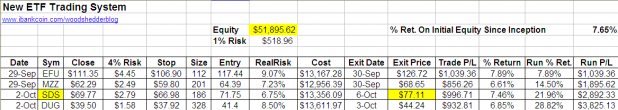

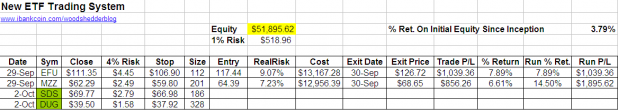

MZZ was purchased at the opening price of $64.39 The stop was set at $59.80, or 4% of the Friday’s close. As mentioned in the caveat, MZZ gapped up over 2 points.

The system will risk 1% of equity, which means this trade will risk $500.00 Therefore, 201 shares of MZZ were purchased. For the purpose of clarity, lets do the numbers so everyone understands the position sizing.

Since we are calculating our order the night before, we must use that evening’s closing price. MZZ closed at $62.29 Using the close, we figure the stop of 4%, which equals $59.80, or a risk of $2.49 To calculate the number of shares, we divide the 1% of equity by the amount risked. The formula is below:

$500.00Â / $62.29*.04 = 201

So now, we are long 201 shares of MZZ, but we purchased them at $64.39 (due to this morning’s gap). This means our actual risk is now $922.59, or almost 2% of equity. Uh Oh!!! This could be a real problem, in real-time, if the trade turns against us. If one were able to monitor the open, position sizing could be adjusted as it became evident that the ETF would gap. However, I devise systems to be traded by those who work, and can’t trade while working. Lucky for us, these trades went deep into the money, and quick.

On to EFU. Based on the position sizing above, 112 shares of EFU were purchased. I won’t bore you with the stop details as you can calculate those, and besides, the stop will never be hit.

After the first day of trading the system, this is how the numbers look:

Symbol    Cost            Value at Close    Unrealized Gains

MZZÂ Â Â Â Â Â Â Â Â $12,947.39Â Â Â Â $14,319.24Â Â Â Â Â Â Â $1371.85

EFUÂ Â Â Â Â Â Â Â Â $13,160.38Â Â Â Â Â $15,232.00Â Â Â Â Â Â Â $2071.62

Cash       $23,892.23

Not to shabby for the first day!

Each evening I will continue to post on this system, and flesh out all of the intracies, including more fancy accounting and statistics. I hope that this process will be very helpful for everyone as we begin to understand the process of mechanical system trading.

For Tuesday, we will sell MZZ and EFU on the open (the exit criteria will be covered in the future). There are no new entry signals for Tuesday.

Stay tuned…

All posts will be housed under the category of *New ETF Trading System, at least until it gets a formal name.

Comments »