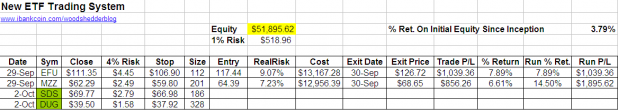

The entries for Thursday are highlighted in green.

There were more than 2 total signals generated. Here they are, in order of greatest to least volume, [[TWM]] , [[FXP]] , [[MZZ]] , [[EFU]] , [[SDD]] , [[SSG]] .

As explained, the system will only enter 2 trades a day, and will select the ETFs with the greatest volume. I will eventually test taking the diETFs that have the lowest RSI(2), instead of the greatest volume, as theoretically those will have more room to run. I’m confident that selection by volume will be the best selection method, but will post results of differing selection methods, in the future. After all, one of my goals is to help flesh out the issues that arise when developing a system, and entry selection, when there are more entries than allowed, can have a significant effect on performance.

I want to discuss setting stops when system trading. As evident in the spreadsheet, the stops have already been calculated so they can be placed when the order is entered. What happens though if these diETFs gap down a few percent on the open? If we have set a 4% stop, then it is likely to get hit. The best way to counteract a gap down scenario is to have the platform/brokerage set the stop after the entry is made. On Tradestation, this is called the “Stop Offset from Primary,” with “Primary” being the actual entry, and the “Offset” being the stop level in percentage terms. For this system, the stop offset is -.04

I will discuss how to handle gap-ups in a future post.

I received an email this evening from the co-developer. He states this about this system: “The good news is this thing is kicking ass now. The bad news is it sucked before the first of the year.”

One issue we will have to figure out is what is different about 2008 that has allowed this system to generate huge returns? During the end of 2006 and all of 2007, the system did not do much of anything (I will post the equity curve in the future). Figuring these sorts of things out can lead to the development of adaptive strategies (strategies that adjust with market conditions), although the answer may be simply that there was not enough participation (volume) in these diETFs early in their lives to permit this strategy to work.

Â

I was wondering when you first posted it if the sheer volatility of 2008 is really helping the system out. If a lot of the trades are very short term, maybe it’s acting like a scalping system and has hit its stride with the huge movement in these double ETFs. If volatility is indeed one of the things that’s helping it, maybe one thing to try for the ETF selection criteria would be ETF with the highest ATR.

Great post though Woodshedder, I love the system trading stuff!

Woody,

maybe 2 things

1- vix or volatility was one directionl in second half of 2006 and for most of 2007. in 2008, just by looking at a vix chart, it was pronounced and siseways. also, average at a lot higher levels.

2- percentage price swings and numerical price swings in 2008 were out of this world.

Good point ichabod.

FXP and EFU have the highest ATR(10). FXP also has the lowest RSI(2).

I like the way you are thinking. If I adjust the selection criteria, in one test taking the highest ATR, and in another taking the lowest ATR, that might give some indication whether or not it is the increase in volatility that has made the system excel in 08.

Chivas, If it turns out to be volatility that has caused it to excel, then this could be a great strategy to keep on the shelf for when things go haywire. It would be nice to have a system that excels in low volatility, and use VIX readings to guide capital allocation between the two strategies.

There’s a scarier answer to that as well.

I’ve read about some scientists that applied the same kind of analysis to the stock market that is used to detect earthquakes.

The point is that, apparently, when the market begins to mirror itself more in the last quarter than in the last year, things are bracing for a huge shift.

I suppose it would keep going fractal like in that pattern until a crash (i.e. getting more like last week than last month, getting more like yesterday than last week/month/quarter) but I haven’t ponied up the $25 to read the article.

Agreed on the increase in vol, but it could also be satisfied by the idea of entering a bear market – in other words, just using some definition of, say moving averages.

One more comment – just looked at the VIX since the beginning of the year. Now, we’ve had a big increase in vol, but the trend of the VIX really started to change in July of 07 – how did the strategy perform then?

Damian, I’ll take a look, starting specifically in July, this evening.

Cuervo, that’s some interesting stuff. Pony up the 25 bucks, you cheap bastard.

Both the picks have gapped up…what now, prof. Woodshed?

Set stops based on the gap. Keep them 4% beneath entry. If not, risk will overwhelm reward.

Wood,

If you really want to develop a trading system, you need to learn window event methodology, and learn how to test its statistical significance, the way you do it is just silly, sorry man, but Chivas asked me why I critisized your posts.

Thank you, mexican.

Now please return to demonstrating your system for mowing my grass.

Woodrow, realistically, if you bought SDS and DUG at the open today Oct.2, after both had gapped up and you got your fill, at what price, about, did you actually buy? no doubt both etf’s still did well today anyways but the fill price is important, rather than the open. And, do your returns somehow factor in fill prices after gap up or gap down on the open? Also looking forward to your next report-recommendation.thanks

Buylo, Scottrade almost always gives me the open price, to the penny. Tradestation however does sometimes fill my orders at worse than the opening price, although I have also had fills at better than the open price.

Today, SDS opened at 71.75 3 bars later (1 minute bars) closed at 71.86. There was plenty of time and volume to get filled at and below the opening price. I have not looked at DUG because I’m in a hurry, but I encourage you to check it out.

The returns are based on the opening price, as recorded at the exchanges. They will typically be the same opening prices you see on yahoo, google, etc., but sometimes they differ. The gap up does not really matter except for when setting stops and calculating risk.

Let me know if this didn’t answer your question.