Parts One and Two established the framework and system to use for the study. Now it is time to get to the meat of the study: How can we combine elements of trend-trading to a system that often trades counter-trend?

First, what measure constitutes the trend? Deciding the best measure for the trend can be somewhat subjective; since many, many traders use the 50 day simple moving average, that is what will be used in this study.

With the 50 day average as our trend indicator, the close must be monitored. If the close is above the 50 day average, we have a long bias. If the close is below the 50 day average, we have a short bias.

The final question then is how to capture the bias? While there are likely many ways, what will be proposed here is a combination of leverage and position-sizing. Thus, if the trade is with the trend (above the 50 day and going long, or below the 50 day and going short), as much as 2x leverage will be used. If the trade is against the trend (long and below the 50 day moving average or short and above the 50 day moving average), the position size will be decreased.

Finally, how will performance be measured to determine if the there are any improvements to the system?

Performance will be measured by 4 criteria: Net Profit, Largest Intraday Drawdown, Largest Trade Drawdown, and Average Drawdown. For each of these calculations, the drawdown figure will be divided into Net Profit to create a ratio.

For example: Net Profit = $10,000 and Largest Intraday Drawdown = $2,000. $10,000 / $2,000 = 5.0

As the ratio increases, the Net Profit is rising and the drawdowns are decreasing. Thus, the higher the ratio the better.

Using the system described in Part Two as the baseline, varying combinations of position-sizing and leverage will be used to trade with the trend while trading against it.

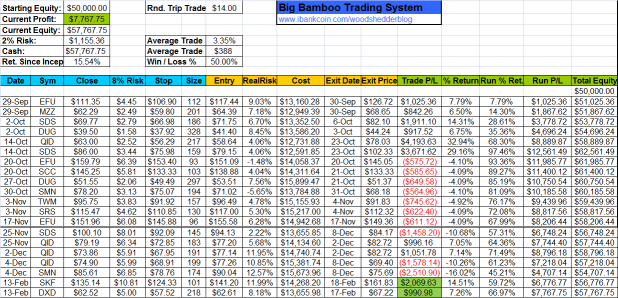

The graph above shows the results. The left most column shows the varying combinations of leverage and trend where T = trend and CT = counter-trend. We see on the first row the results of the baseline system where no leverage or position-sizing were used (T = 1.0 and CT = 1.0).

The second row shows leverage with the trend of 1.5x and a decrease in the position size when trading counter-trend of .5x. Assuming 10K per trade for the baseline system, with the trend a position of 15K is taken, while against the trend only 5K is used.

The third row shows 2x leverage with the trend (20K position) and .5x position against the trend (5K). This row shows the best drawdown ratios (in purple) for Largest Trade Drawdown and Average Drawdown. This version will have a position that is 4x larger with the trend than when trading against the trend.

Already it should be evident that Net Profit is increasing, due mainly to the leverage. However, the ratios show that drawdowns are decreasing. The 2nd row shows a ratio of 6.32 (in purple) which is the highest ratio of the study for max intraday drawdown. By simply using 1.5x leverage with the trend and cutting position-size in half against the trend, Net Profit increases while all drawdown measures decrease. In fact, for the 1.5 / 0.5 row, the largest intraday drawdown and max trade drawdown are decreased by roughly 1/3rd.

The row showing 2.0 / 2.0 is the baseline system using 2x leverage on all trades, regardless of the trend.

After the 2.0 / 2.0 row, the leverage and position-sizing are switched so that now the system is using leverage against the trend and decreasing position size with the trend. Note that Net Profit stays very close while the drawdowns increase (causing a decrease in the ratios).

I believe that the last three rows prove that leveraging with the trend makes up for the lost gains from taking smaller position sizes, while smaller position sizes when trading against the trend improves the drawdown characteristics of the system.

Summary

Beauty is in the eye of the beholder…I like the 2.0 / 1.0 version as net profit is improved by 33% over the baseline system while the drawdown ratios improve 25%, 22%, and 17% respectively.

If one is satisfied with the baseline system and just wants to improve the drawdown characteristics, then the 1.5 / 0.5 version might be appropriate.

Avenues for future research could include using the distance of the close from the trend to calculate more advanced position-sizing / leveraging algorithms. Perhaps the slope of the trend indicator could also guide position-sizing / leveraging.

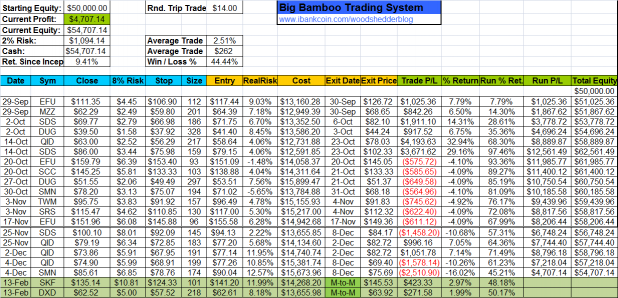

In Terms of Real Life…

The baseline system gave a long entry signal for Thursday’s (February 19th) open. Had the 1.5 /0.5 version been used, only a HALF position would have been purchased. Based on the recent market action, I would personally feel better about sitting on a half long position rather than a full long position going into Monday.

Comments »