In between now and the next crisis, before the street begins to see how the slowdown in consumer spending and the crash in commodities will affect earnings, there is going to be a rally. I believe that today was the first day of it, and that tomorrow will follow-through in stupid celebration of the 85 billion dollar insurance policy the gov’t just bought on American International Group, Inc. [[AIG]] .

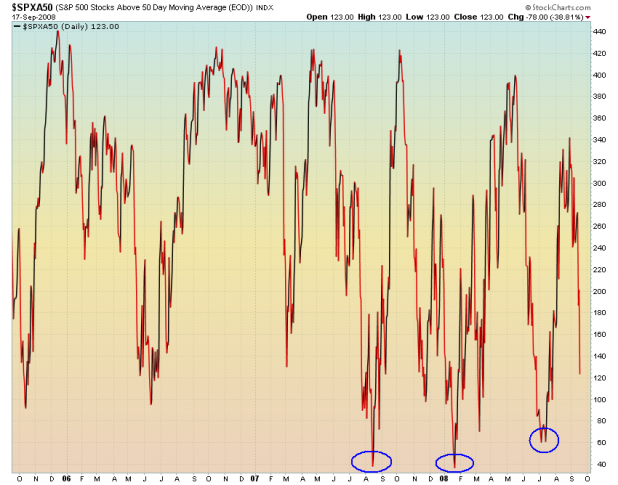

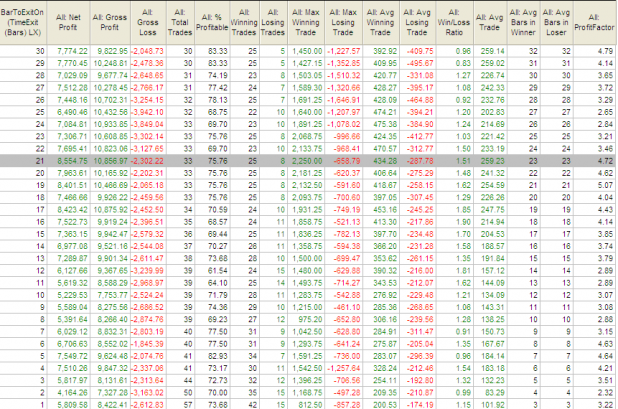

I published a strategy last night, Stretched VIX Strategy Signals Buy the Spy, that showed that yesterday’s level of fear tends to result in a tradeable bounce. The edge from this strategy tends to diminish after 12 days.

I figure we have a week or two of rallying as investors celebrate cheating death. In other words, and with respect to Jake Gint, “Party like its Weimar!”

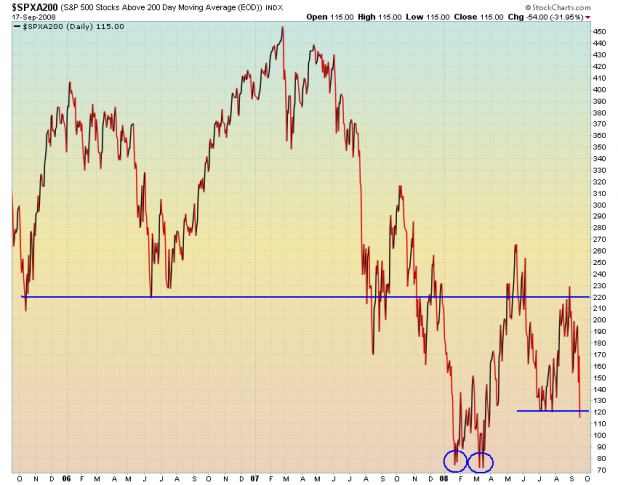

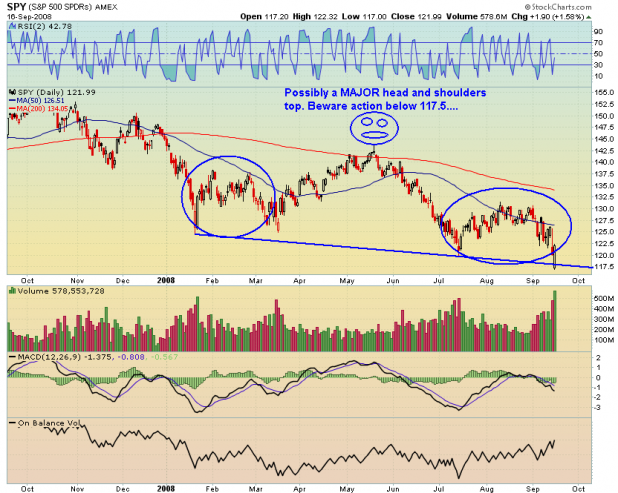

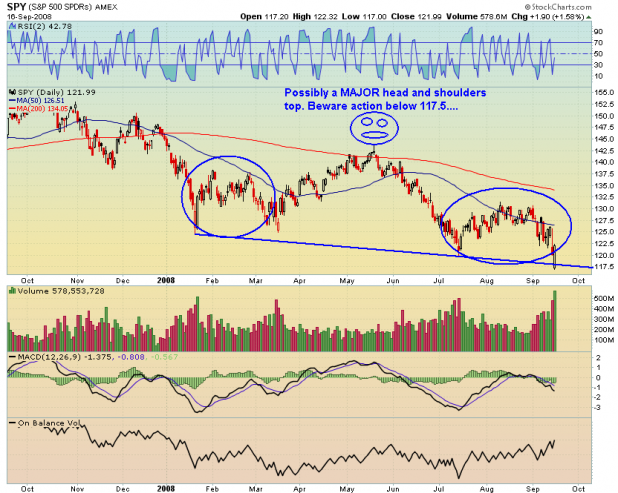

Looking at the chart of the Dow Jones, the volume surge cannot be ignored. A surge of volume on a key reversal day is a signal of capitulation. I cannot emphasize enough how important this surge of volume is for judging capitulation. Also, IBankCoin had one of the best days ever in terms of traffic, yesterday. Anecdotally, this also signals a bottom.

Also note the positive divergences in the MACD and the OBV.

Here is a quick note from investopedia on OBV: A method used in technical analysis to detect momentum, the calculation of which relates to volume to price change. OBV provides a running total of volume and shows whether this volume is flowing in or out of a given security. OBV attempts to detect when a financial instrument is being accumulated by a large number of buyers or sold by many sellers.

This suggests that since the July low, there has been continued accumulation of Dow components. Whether or not you find that believable, the divergence is very clear.

I want to be long until the Dow meets the 50 day average. By the time it meets the top of its recent range at 11,750, I want to be in cash, or building shorts.

On [[UWM]] , a Golden Cross is forming and the OBV is getting ready to make new highs.

Note the volume on [[SPY]] as well as the new high in OBV. Also note the huge and scary head and shoulders. I would not be long past 127.50, nor would I be if we break 117.50.

Establish a range for profits, and stick with it. One should not be leaning too heavily in one direction as the indexes approach the boundaries of their recent ranges.

It should be very interesting from a technical perspective too see how this plays out.

Â

Comments »