An old iBC favorite here…

I will be using a 10% stop.

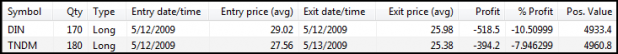

Comments »All open positions were closed this morning. The results are below.

Disregard the SLAB short position. That was an error on my part, and AmiBroker only allows one undo (a severe limitation). After testing the AmiBroker Account tool, I have decided that it is nice as it updates the positions for the user, but beyond that, it is too rudimentary in function for my purposes. The next set of trades will be logged in an excel sheet.

Below is the result of all the trades. Keep in mind it is off a tad due to the erroneous short position that I cannot delete. The commissions calculation is also too high.

There is one Power Dip pick for tomorrow. I will post it at the open.

Comments »Before breaking down the Double 7s, I should highlight a few features of the system. The rules can be expressed in 3 lines:

Initial equity = 100K.

No commissions or slippage are included as they were not included in the results reported by Connors.

Gains are compounded with each trade using all available equity.

All available data for the SPY is used. Norgate provides the data for my AmiBroker platform. I think that CSI provides data for Tradestation, but I’m not certain about that.

After reviewing the trade-by-trades as reported in AmiBroker and Tradestation, I’ve noted many discrepancies that will need to be sorted out before posting the results of the system. Most of the discrepancies seem to be due to inconsistencies in the data used by the platforms.

In the meantime, BZB Trader recently posted the metrics of his variation of the Double 7s: Qs Double 7s Update. For any statistics junkies, hopefully BZB will tide you over until I can finish.

I’ll get the results posted as soon as I can review all the data inconsistencies.

Comments »The dip-buying strategy worked as expected. On tomorrow’s open I will close all 5 positions, 4 of which will likely close with profits. For this round of dips, 4 of 7 are probable winners, making a 57% win rate.

Tomorrow evening I will post the exact exit prices, and then we can see if the system made any money on this battery of trades.

Optimization of the Power Dip position-sizing method suggests that the maximum number of positions held at one time could be greater than 5, and likely closer to 10. The positions above have been traded at 2% risk per trade. Risk will have to be reduced to 1% in order to include more than 5 positions, or there will not be enough capital. Future dip buying trades will be position-sized at 1% risk.

Comments »While the theoretical Power Dip portfolio is full, my personal account is not. Therefore I am adding CXO on the open.

I ran some further tests on the Power Dip portfolio last night, and it appears that it may be better to lower the size of each position while increasing the number of stocks being held at one time.

More on that later.

Comments »TradingMarkets describes the Double 7s as one of their “more effective ETF trading strategies…” As one would expect of a simple trading strategy published in a popular book, the Double 7s strategy has been discussed on various sites and in the blogosphere.

Other than Kirk Dolan’s report of his modifications, I have not found any other modifications or reports of any specific metrics generated by this strategy, beyond the few results reported in Short Term Trading Strategies….

Therefore, the Double 7s seems ripe for some deconstruction, to discover the system internals. Depending on what I find under the hood, I might then run some tests and add some tweaks in order to reconstruct an improved variation.

Deconstruction will consist of running the exact strategy, as published in several places, in both Tradestation and AmiBroker to compare the current results with results as they were when the system was published. Running the strategy on two separate platforms and over two separate data vendors will ensure a robust comparison.

I will examine the system metrics in detail, to determine the strengths and weaknesses.

Finally, assuming the strategy is able to be improved upon, I will rebuild the strategy and then apply it over a large portfolio of ETFs, adding commissions and money management rules.

It should be instructive, and will hopefully be an enjoyable endeavor for the readers of this blog.

Comments »I think it is healthy and good for one’s karma to begin unveiling a system right as it hits a string of losers. (Not really.) At least then I can’t be accused of providing results which would not be realistic.

I bought ASCA and ICON in my personal account. The prices listed below reflect the actual price I received.

I have been trading this system off and on for quite some time, but it has only been since I started using AmiBroker that I (and my partner) have been able to test the system properly, across all the stocks in the universe.

I have some refinements to test on the Power Dip this weekend, but once those tests are complete, the system should be very close to being “finished.”

Stay tuned for some in-depth, historical (backtest-generated) statistics and an equity curve.

Comments »