I have read a fair amount about Tom DeMark and his indicators. The indicators are very popular, but have been somewhat hard to quantify, and therefore have had an aura of mystery surrounding them. For a very good primer on the man and his methods, this article will be very helpful: Impressive Signals from DeMark.

The recent (2008) publication of Jason Perl’s DeMark Indicators (Bloomberg Market Essentials: Technical Analysis) is exciting as Perl is fairly successful at describing the indicators in a way that allows them to be quantified. While I have not read DeMark’s books, I understand that Perl describes DeMark’s indicators better than DeMark himself.

I purchased Perl’s book a few weeks ago. While he makes every effort to clearly describe the TD setups, the content is somewhat confusing. I have not made it past the first 20 pages, and I have to keep re-reading those pages over and over. My first impression is that these indicators and setups are over-optimized and curve-fitted. Keep in mind, that is simply a first impression.

I have the rudiments of the TD Sequential Buy and Sell Setups coded, and have run some preliminary proof-of-concept type backtesting in Stockfetcher on these. So far, the results are poor. Granted, I do not yet have a thorough understanding of these indicators, and I know that finding stocks meeting the TD Setup criteria is only the first step of a multi-step process necessary to trade these strategies and indicators as they were designed.

I am curious if there is anyone out there who is trading with these indicators and strategies. I would like to hear what indicators traders are finding to be successful.

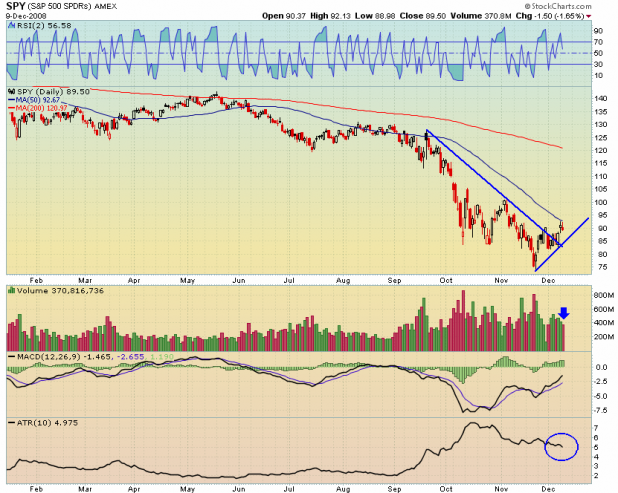

For those who are unfamiliar with DeMark, below is a screenshot showing the TD Sequential and the TD Range Expansion.

Shameless Plug: If the book appears worthy of being added to your trader’s library, please use the link to Amazon that I provided to purchase the book. I will get a very very small kickback from Amazon for the referral.

Comments »