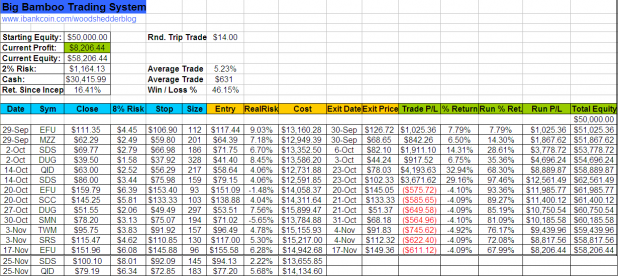

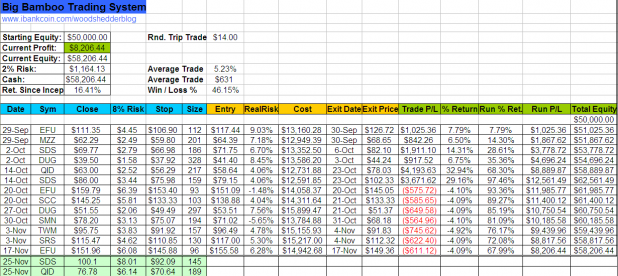

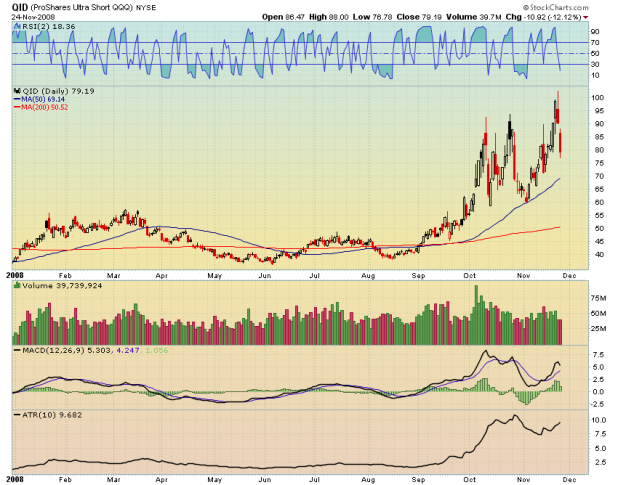

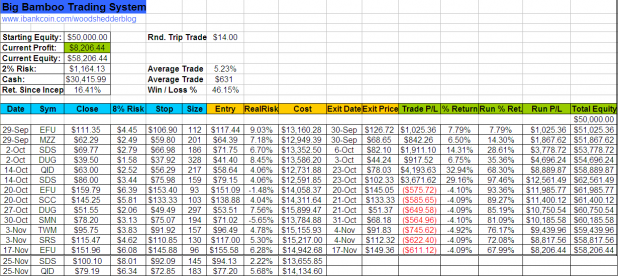

The Big Bamboo was blessed with a gap-up on the indexes, which resulted in the system picking up SDS and QID at a significant discount to Monday’s closing price. Thus, both trades were quickly profitable and never went against the entry for more than 50 cents. I picked up SDS in my personal account, and received a price improvement of one dime over the listed open.

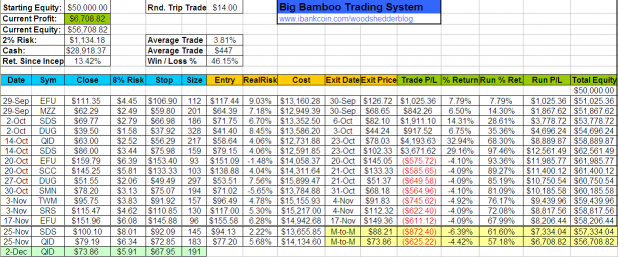

I want to note that I made a mistake in last night’s spreadsheet, when I put in Monday’s low-of-day instead of the closing price of QID. That mistake changed the position size a bit, but not signficantly. The mistake has been corrected in tonight’s sheet.

The above trades will either be stopped out, or sold when RSI(2) closes above 80.

More (Possible) Short Signals

The Big Bamboo is designed to give signals, and then reset. For example, last night, there were more signals than the ones the system purchased. However, the system doesn’t see those pre-existing signals tonight, because it reset, even though the same conditions exist tonight that existed last night.

Through pure accident, BHH set his screens up so that the Big Bamboo signals will arrive without the system resetting nightly. What that means is that the system could be tweaked to take 2 more signals tomorrow, to give it the max 4 positions. To be clear, there are still signals leftover from last night, that were not acted upon, and without the reset, the system would be buying 2 more tomorrow.

Of course we didn’t back test the Big Bamboo to take signals that were leftover from the previous day, assuming the correct conditions still exist the next day. We did run some quick tests this evening, and it really doesn’t change much to get rid of the reset. It actually improves the CAGR, slightly decreases the average trade %, and increases the drawdown by about 1.5%.

As the system is often in cash and should theoretically perform better with more opportunities, it might make sense to take away the reset feature in future versions. For now, I will leave the Big Bamboo the way it is.

For the record, the next 2 signals are to buy SKF and SRS on the open. I am going to purchase one or both of them tomorrow in my personal account, but will not track them in the spreadsheet.

What is the Benefit of The Reset Function?

Simply put, the reset function keeps the system from going all in at exactly the wrong time. Once 2 positions are entered, the conditions that created the edge must disappear, and then setup again in order for more signals to be generated. This helps to ensure that the system does not end up going all in at the onset of a period of sustained strength, or weakness (remember, the Big Bamboo goes both ways).

My intuition is telling me that the markets could be making an attempt to sustain a rally. As the Big Bamboo is only half in, it would be no big deal if the rally does continue, stopping both trades out. However, if the existing positions do not stop out, and the edge re-appears, then and only then will the system go all in with the final 2 positions. In effect, the system will use up to half its cash, then look around and survey the market landscape before deploying the rest of the cash.

Comments »