Treasuries have recently run higher than ever before ( feel free to fact check that, that’s what I’ve heard). I took a stab at TBT about 3 weeks ago, and was stopped out. I was very very early. I am going to set an order on Monday in my discretionary account to purchase TBT again.

I had considered shorting TLT. However, after calculating position sizing and stops, I believe TBT offers a better opportunity. Not to mention, there may not be shares of TLT available to short.

Let me explain why I think going long TBT is a better trade.

In order to determine a position size, the amount to be risked must be determined. For our purposes, let’s say we’ll risk 1K, which would be 1% of a 100K account.

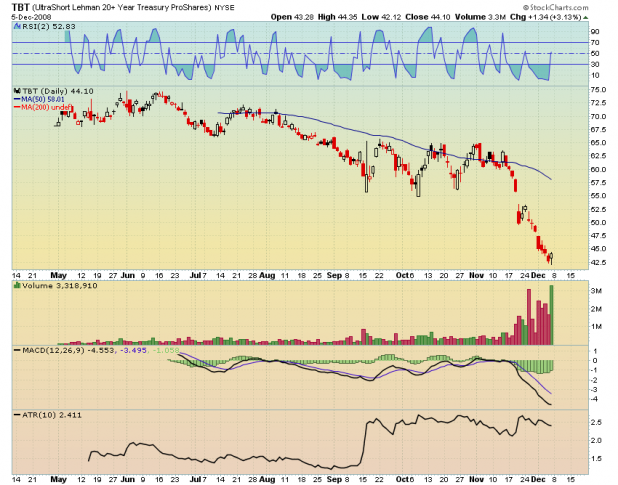

To determine the stop, I like to use ATR(10). As the above chart of TBTÂ shows, ATR is 2.41. We’ll take a multiple of that figure. I like 1.25*ATR. Here is the calculation: 1.25*2.41=3.01

Therefore, our stop will be $3.01 beneath the entry.

To get our position size, we divide our amount risked (1K) by our stop. $1,000/$3.01 = 332 shares of TBTÂ to be purchased. Note: Our stop level is conveniently beneath Friday’s low, an added bonus!

Now lets look at position sizing for shorting TLT

1.25*2.36 = $2.95Â Â Remember that was 1.25*ATR(10).

Thus, our stop will be $2.95 above the entry.

$1,000 / $2.95 = 339 shares.

Thus, shorting TLT will allow for a slightly larger position size (339 vs. 332), with the same risk as going long TBT.

Let’s take it one step further and complete some volatility analysis of each ETF.

To calculate volatility and normalize it across both instruments, we’ll divide ATR(10) by Friday’s close and then turn it into a percentage.

TBT (2.41/44.10)*100 = 5.46%

TLT (2.36/110.48)*100 = 2.14%

TBT is twice as volatile as TLT. This should be no surprise since it is a double-short ETF. If the trade gets the expected move to the upside, then TBT will be the best choice as the position sizing is similar to TLT but on any run up, it may move twice as far. Basically, the risk is the same, but the payoff may be double.

Caveat: Any significant gap up in TBT on Monday may throw off the calculations.

I got stopped out of TBT as well and fully believe that long term it will be an ATM, but due to certain FED chairman comments and actions I will wait until FED rates drop further and the FED shows some signs of slowing their relentless campaign to take longer term rates lower and keep them there.

I think I may have been a few months early.

You can also go long PST

This was good math for novice me – but aren’t bond funds the post spiked punch at the bar? Hourly only had 3 turnaround bars after smooth sailing to this point

TBT is OK for a quick trade based on technicals only, but I wouldn’t want to own any of these etf’s on steroids for the long haul. Just to many perverse risks involved.

http://www.geldpress.com/2009/05/proshares-tbt-risk/