This is really a frustrating time for me, in terms of blogging. I have no laptop. I’m forced to share my computer with a greasy 17 year-old. There are no great charts to write about. Most of my systems are still in between signals. Yet, it is still a very exciting time to be trading, and I want to stay engaged through writing about what I’m seeing and thinking.

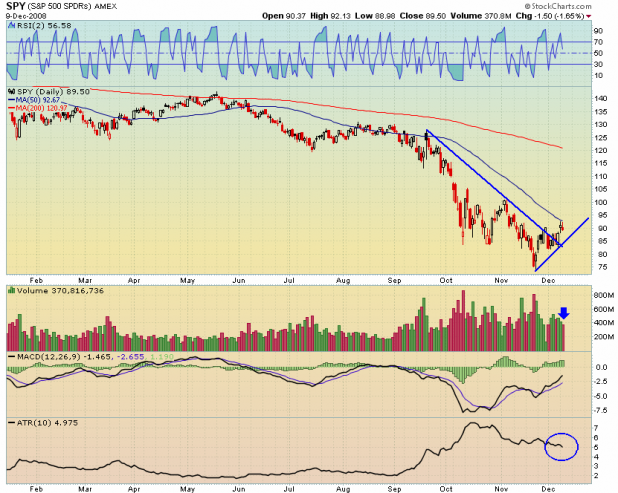

What I’m thinking and seeing is that it is time to be bullish. I can find little in the technicals to be extremely bearish about, unless you consider the prior 12 months of chart. Right now, the indexes are making higher highs, and higher lows. Volatility is decreasing. Today’s pullback was nothing to be alarmed about. Forget the previous 12 months. Traders should be taking on small, starter positions here, with loose stops. Caution is still in order, although I believe we are getting some significant support built here.

The greatest concern to all traders is the 50 day average. The 50 day average can provide serious resistance. However, once the indexes climb above the average, it marks (in my opinion) the beginning of a new trend, and can then develop as support.

Note carefully on all of these charts that these index ETFs have climbed right to the 50 day, and have paused. I am not alarmed by this, yet. We should expect resistance here, and we have seen it. Now we need to see an orderly pullback, and then another run at the 50 day average.

Note we have a fairly steep uptrend defined, starting from the November low. Volatility, as measured by ATR(10) is slowly tailing off. Volatility must decrease if we want the more skittish investors to return to the markets. Also, volume decreased on today’s pullback.

Same on the SPY. Paused directly at 50 day average. Volume decreased. Volatility decreasing. Uptrend still intact.

The Qs have a slightly different technical look. As volume has been decreasing for the last few weeks, I think the ETF may be consolidating, rather than trying to come off a bottom. If it is consolidating, the triangle formation makes sense to me. I would love to see a move on volume out of the triangle and above the 50 day average (shown by blue arrow).

To be clear, no one should be betting the farm with long positions. Caution is still in order. Watch the newly formed uptrend lines (drawn from November lows) for clues. If the indexes break beneath the uptrend lines, and then close beneath them for a day or two, the markets may seek to test the November lows.

The markets will remain volatile. The only way not to get shaken out, when positioning early in a new uptrend, is to start with small positions and use loose stops.

I’m seeing rising wedges take shape on all the indices.

Shed-

You would think management around here would spring a laptop your way, considering it’s the holidays.

…then I don’t wanna be right!

B-rad, could be. Why did you mention starting a line from Nov.14th. What is the significance?

Cheesefries, I’m Sayin’!!! Where’s my stinkin’ new laptop, FLY!!!

DMG, when are we gonna meet for beers, in Carytown?

B-rad, now I’m seeing them too…Ruh roh…lol

When you explain why you’re sharing a computer with a greasy 17 yr old.

Headed out of town this weekend but I’m always open to getting my drink on.

DMG, my son is a facebook freak. Until my laptop died, he had my desktop box all to himself. Now he’s going through facebook withdrawal.

I can agree with Wood’s assessment. We could starting a measured move up.

Wood – i would’ve never guessed you had a 17 yr old.

You started early, huh?

Glad i didn’t ask if the 17 yr old was a ‘she’ and how close she was to 18 yrs.

; )

http://www.foxnews.com/images/349018/0_21_030208_robots.jpg

Fear of “this time it’s different” can make even the most steel fisted womanizers head for the hills, and then fundamentals are overridden and you might lose.

What in the hell is all this money doing in treasuries if we all good? Maybe we’re seeing waves of 1-month treasuries maturing, and sure, some of it has been hitting the market along with people rolling into more short term treasuries. People are also starting to get out of Munis, so where else are they going to go?

People are accepting 0% for 1 month, over a LOT of other things.

I wonder if we will see people jumping into more baskets of currencies and Gold? If so, we will see foreign currency bubbles that will throw a lot of trades off, and it would justify monetary intervention of some sort.

And what’s with this supposed run on physical Gold? WTF?

Either you truly believe that things will change significantly in our lives for the next few years or more (kind of like terminator this week, which was a pretty good episode), or you think that things will recover quickly and that the economy and conditions won’t get that bad.

Well, I guess we really just need to keep an eye on how things really are, from your own city to our cities, to the nation, countries, etc and then make a judgment as to how bad it will be and how long you think it will last. Then you think of who will make it out OK, what their intrinsic value will be in that new business environment, and then put a price on it. Oh, and if you believe that our currency is going to devalue, good fuckin luck.

Or, all of what I wrote is wrong or de minimis & a flood of money is about to come piling out of Treasuries and back into stocks. I could see that too.

TCA, didn’t mean to step on your, uh, toes (charts) with my charts.

Glad we are near agreement!

DMG, I was his age, when he was born. He was born January of my senior year in HS.

DSB, I think things will be different for many years to come. I am still very worried about our country.

However, bear markets will still have rallys.

You don’t need to tell me about treasuries. TBT is going to roast me, for a second time, I have a feeling.

TBT has my nuts on fire, however I have some great Treasuries that have appreciated on the other side.

Can we just get a medium volume ‘he kicked me down the stairs’ ‘recapitulation’ month where we can REALLY set up our long trades?

sheeeeeit

Have you had your ‘talk’ with him yet?

..just kidding – good on ya – i’m out.

I think we might see slightly better rates tomorrow. I’ll let you know.

DMG, do it. Later.

DSB, what’s your squeal point for TBT?

I don’t have one. People will get the hell out of Treasuries at some point, and that is like a law of nature to me. Therefore, I will continue to ‘leg in’ – at market extremes.

I think there might be a bubble in “things that you will need to survive a really bad scene” next as people diversify out of numbers on a screen due to lack of confidence b/c of fear. From firearms to remote properties to toilet paper, that’s where a lot of money could go.

I see TBT as a win-win as long as the system stays intact, so I am just going to keep an eye on it and let it sit on the back burner, staring at me with mean red eyes, for now.

Well put my friend. I’m definitely seeing the bubble in “things you will need to survive a bad scene.”

Another day like today, and I’ll be out of TBT.

Why?

WTF is a rising wedge? Aren’t those bearish? From the lines you’ve drawn on your charts, Wood, wouldn’t those be triangles which can break either way? TIA

Rising wedges are bearish

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:chart_patterns:rising_wedge

Thanks, Danny. So would you say these are triangles or rising wedges?

Thanks again.

DMG is coming to Jakeville this weekend with his teeny and ball and chain.

And a dog, I believe.

__________

ERX, DIG, OIH, XLE etc, seem to be offering the most bang for one’s buck, ovah heah.

I also have nice positions in NRP, CHK, NOV, OXY and (just today) P-ABST B-LUE R-IBBON!

(yelled in “Dennis Hopper voice”)

_______

Test

I cannot believe I am reading this shit. Trader without dead laptop, no computer, and no backup, relying on grease.

LMAO.

With all the money you make, you should have at least 2 computers and a laptop. What were you thiking or were you thinking?

Nice rally in yellow and black gold today.