The indices pressed to new highs overnight in a rather one directional manner starting around 8pm EST. The action has pressed the /NQ into very short term overbought territory and my expectation is to see a rotation lower early on, perhaps even premarket.

The action has left behind a four handle gap on the /ES which may entice lower prices for the fill. Yesterday’s gap higher did not completely fill and was one of the tells to stay long. Often times you here tips like don’t fight the tape or go with the flow but never a clear indication of what exactly to look for. Yesterday had two tape/flow visual cues. The first was the failure to fill the gap lower. The second was when sellers could not produce a range extension lower.

Range extension refers to price travelling above or below the high/low print of the first hour of trade. You do not need market profile charts to note this occurrence. All you need are 30 minute candles. Most days only see range extension in one direction. Therefore, when price never extended lower yesterday you would be fighting the tape by attempting to initiate shorts.

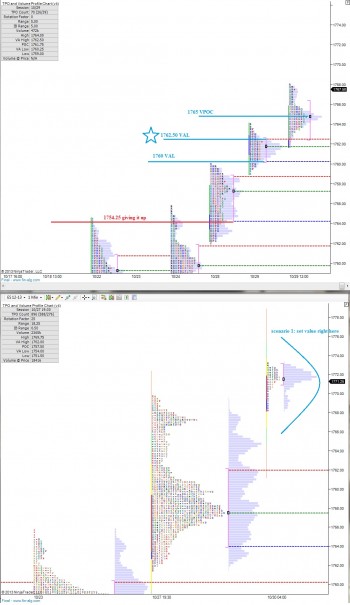

I have highlighted a scenario on the following market profile charts as well as key support levels:

If you enjoy the content at iBankCoin, please follow us on Twitter