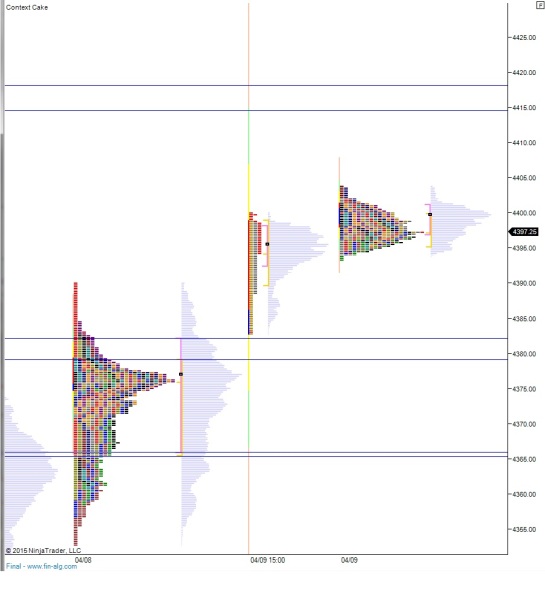

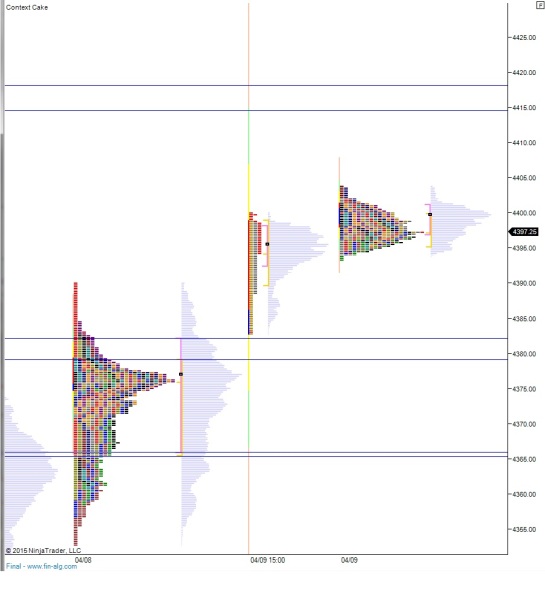

Nasdaq futures are set to open flat after spending the globex session consolidating along the upper-end of Thursday’s range. The economic calendar was quiet this morning and has little scheduled for this breezy Friday. Around 12:20 Fed’s Kocherlakota is scheduled to speak, but these talks have not carried much weight recently. At 1pm energy traders will have a look at the Baker Hughes Rig Count and at 2pm the US Monthly Budget Statement is out.

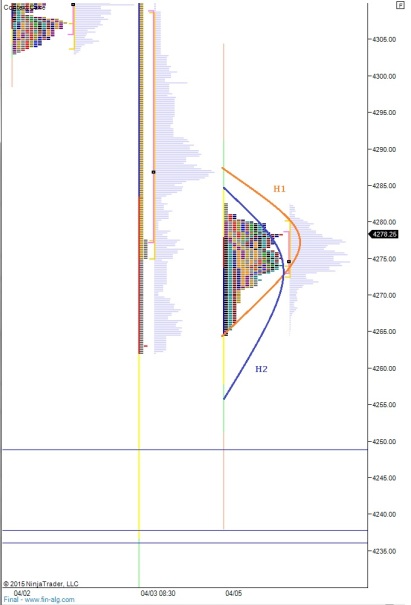

Yesterday the Nasdaq printed a neutral extreme day. Bulls used a tactic recently employed by sellers (Tuesday, 4/7) and made a late-day second range extension. Of day-types generally observed by market profile theorists, the neutral extreme carries one of the highest directional convictions. Thus when Tuesday printed one, it likely enticed bears into thinking they could build off it. When Wednesday opened strongly against them it may have created tinder. Today it will be the bull’s job to hash out whether they truly meant business with their intra-day and late-date initiative buying.

Location wise, we are trading in the fast Fed reaction range (about 4410 – 4375) where price can move fast. If we instead build out lots of time and volume at these prices, that would suggest a significant sentiment shift is underway.

Heading into today, my primary expectation is for buyers to continue exploring higher prices. Look for a move to take out overnight high 4403 and continue higher to target 4414.50. From here to about 4418 I will look for responsive sellers to come in and 2-way trade to ensue.

Hypo 2 is sellers push down though overnight low 4393.25 and accelerate us down to 4382.25. From here to about 4379.25 I will look for signs of responsive buyers and 2-way trade to ensue.

Hypo 3 is buyers take out 4418.25 early and sustain trade above it, setting up for a drive higher to 4440.

Hypo 4 is we fall down through yesterday’s range and test out 4365.

Level are highlighted below:

Comments »