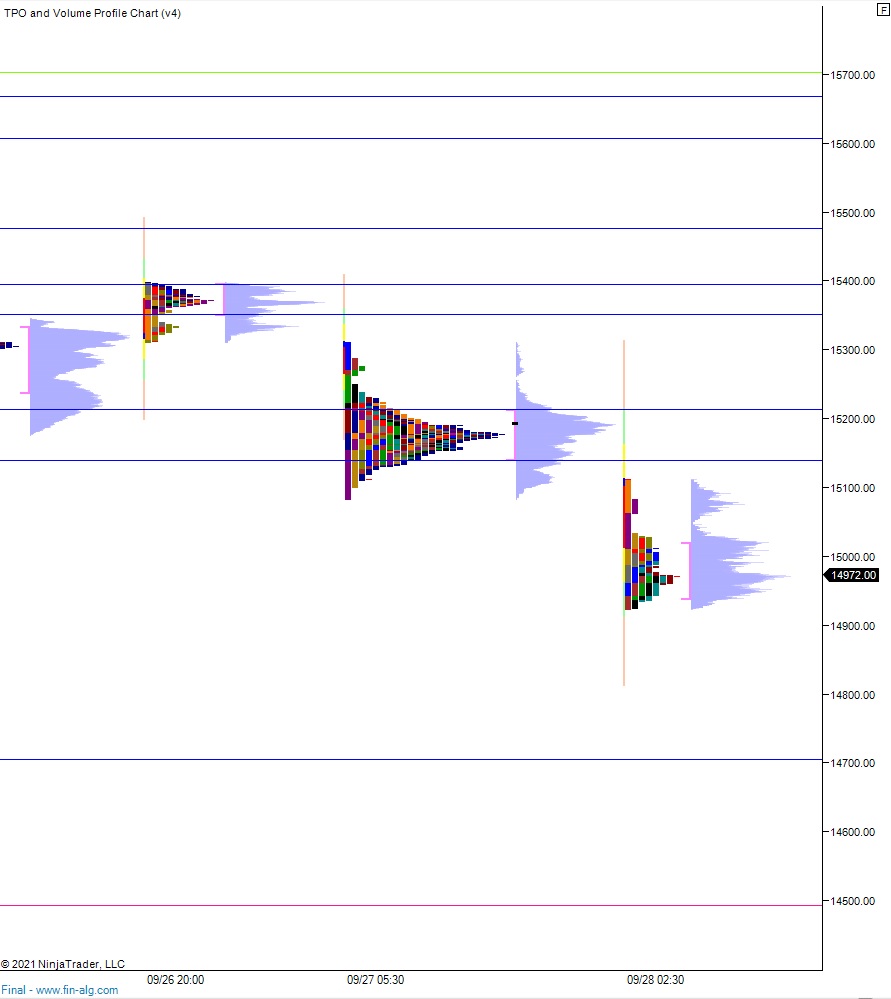

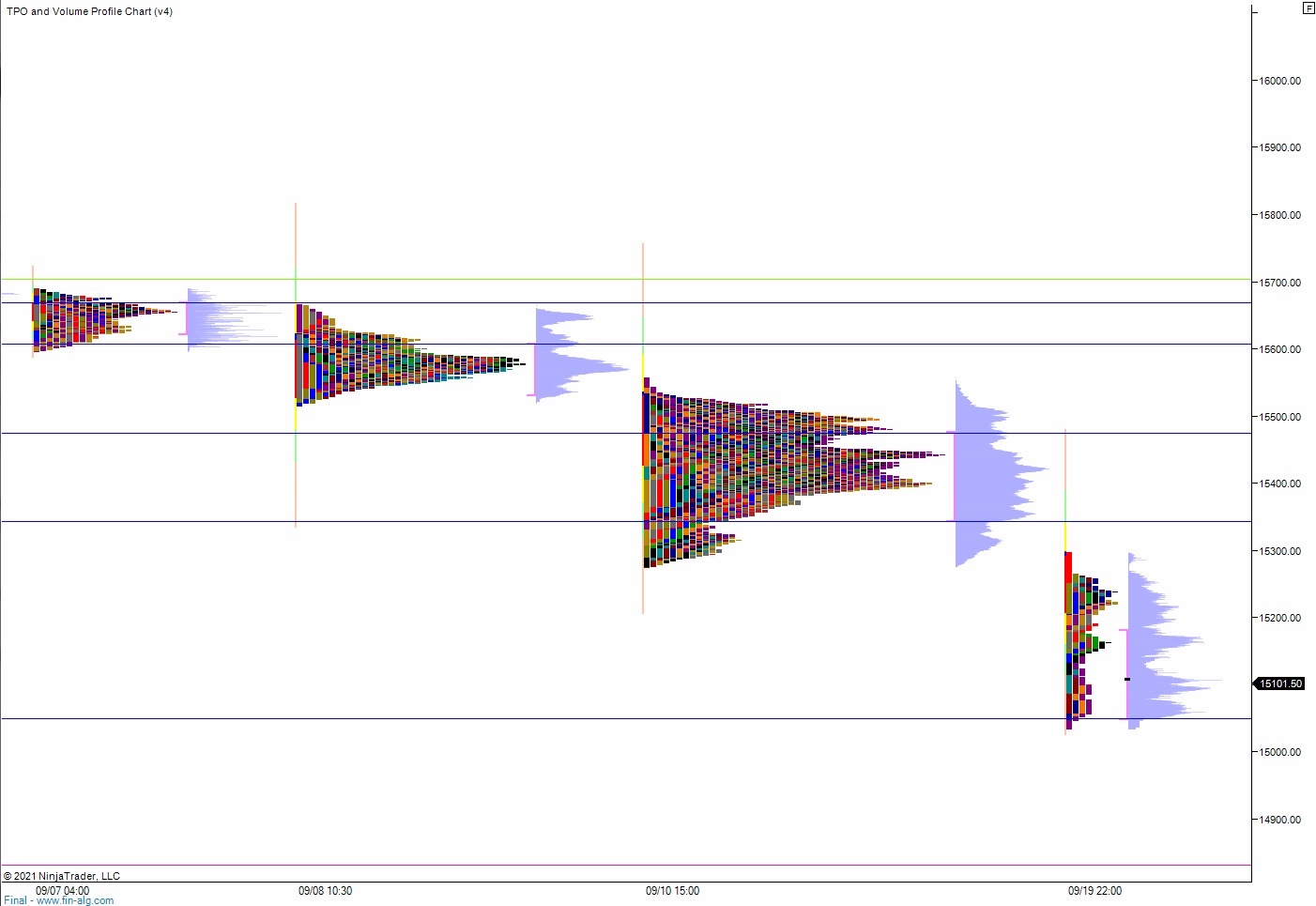

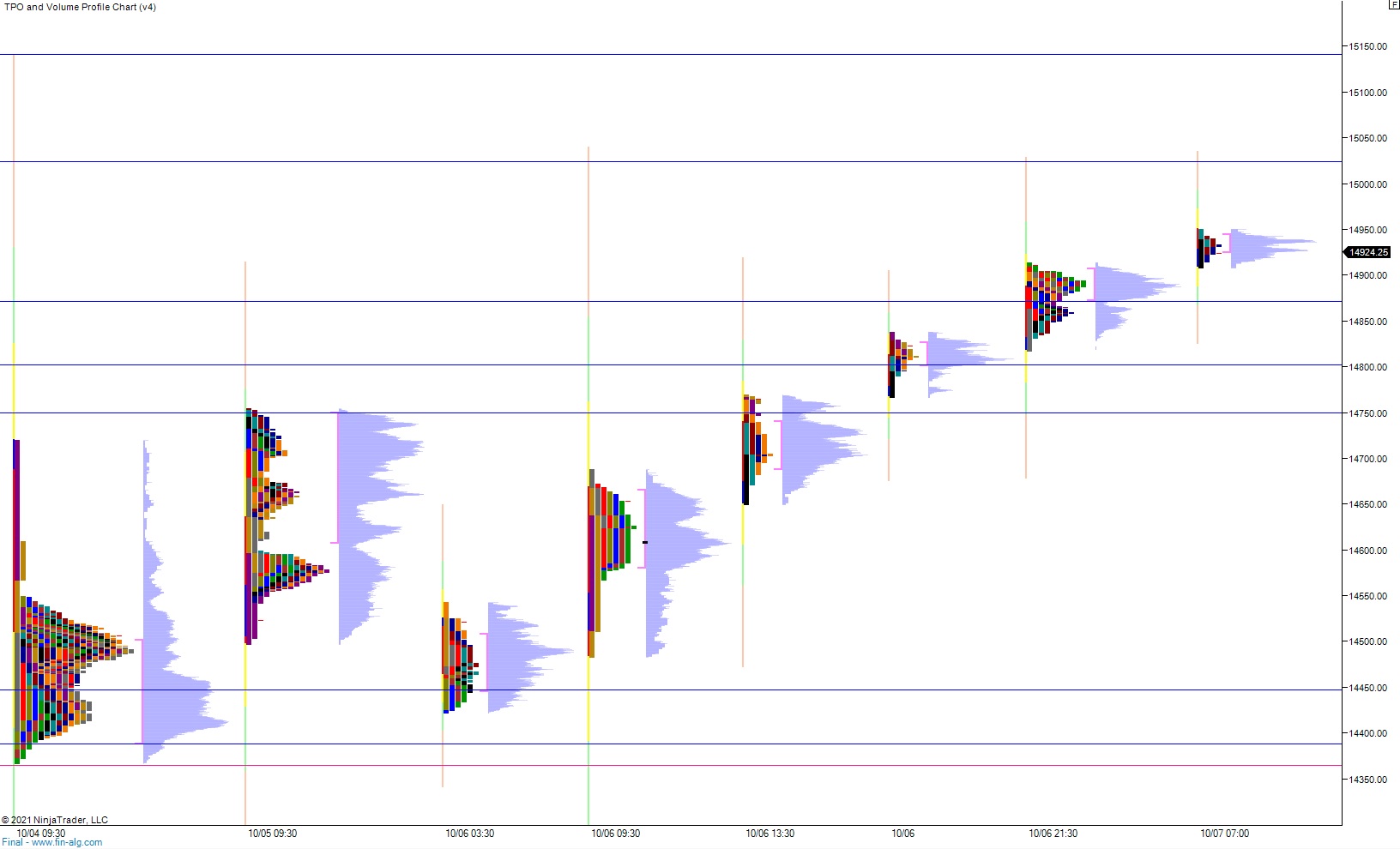

NASDAQ futures are coming into Thursday pro gap up, up beyond the prior six days’ ranges after an overnight session featuring extreme range and volume. Price steadily campaigned higher overnight, pressing up beyond the Wednesday high early into Globex and continuing to advance, balance, then continue throughout the night. At 8:30am jobless claims data came out slightly better than expected, but it seems investors are more keen on tomorrow morning’s employment data. No reaction to this morning’s data. As we approach cash open price is hovering in the upper quadrant of last Tuesday’s liquidation session.

Also on the economic calendar today we have 4- and 8-week T-bill auctions at 11:30am.

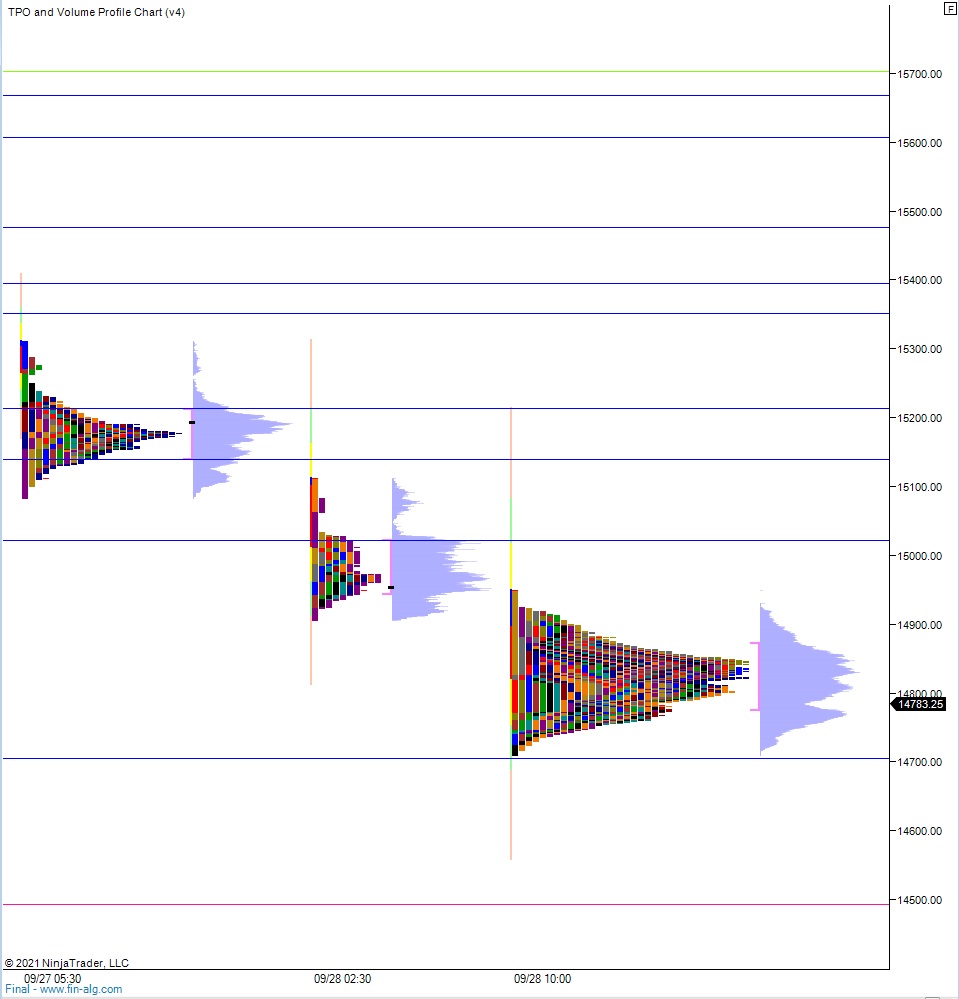

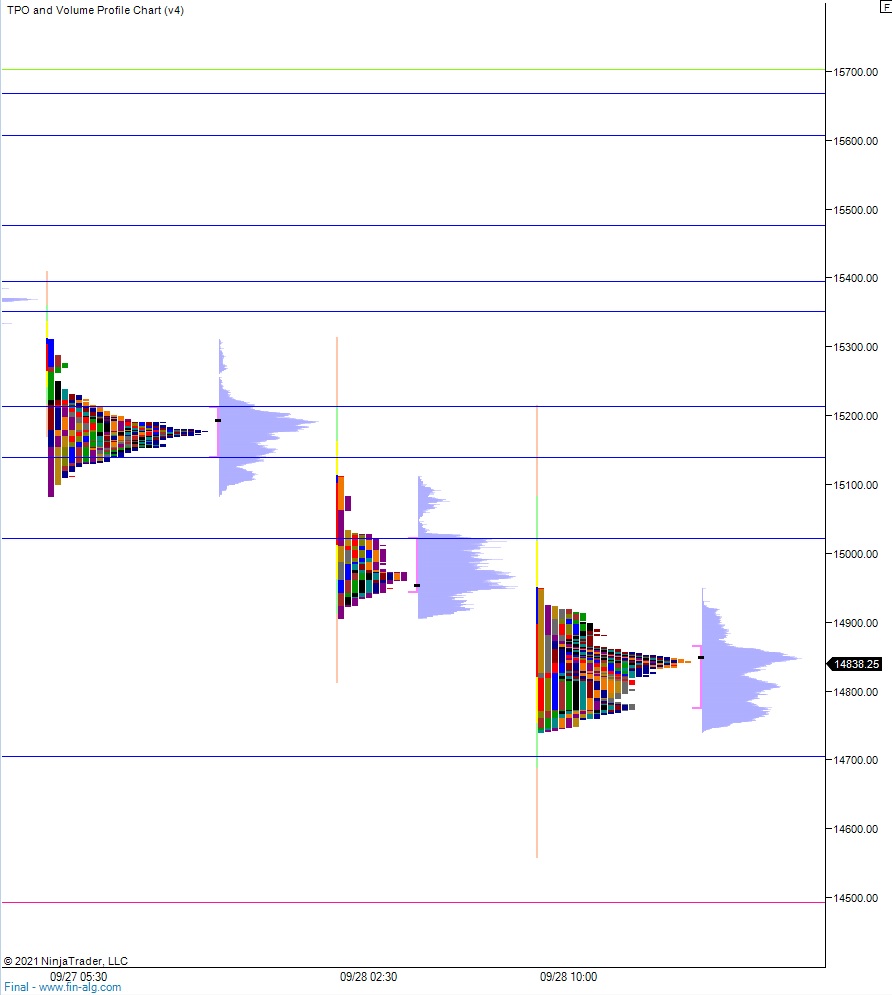

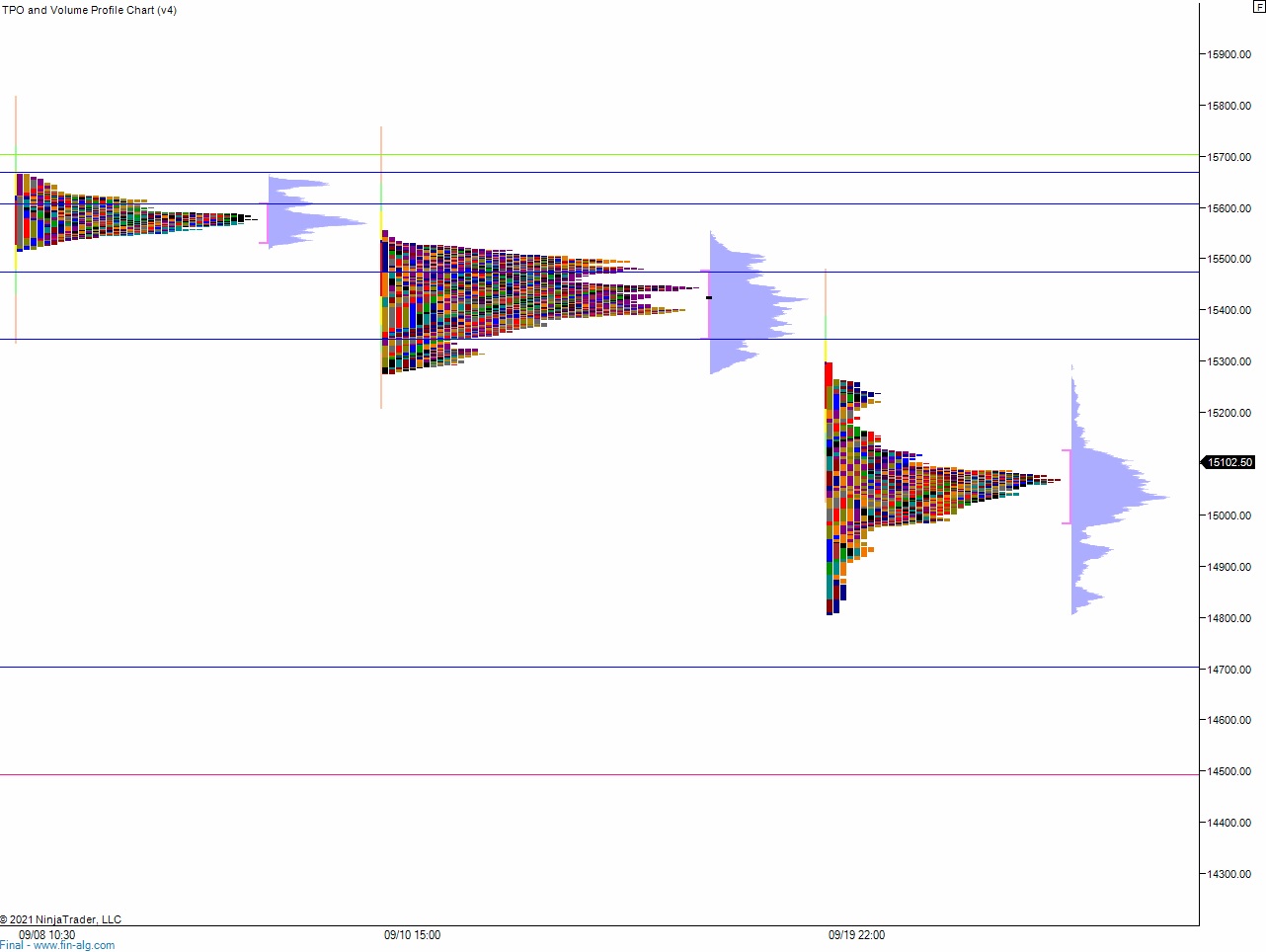

Yesterday we printed a double distribution trend up. The day began with a gap down in range. There was a drive higher at the open. it stalled right along the Tuesday midpoint, before filling the overnight gap and sellers made a sharp move lower, effectively taking out Tuesday low and closing the Monday gap in one fell swoop. Here we formed a sharp excess low, and did so before the first hour of trade was complete. This would be low-of-day. Buyers pressed to an early range extension up, closing the overnight gap. Very methodical. Then we checked back to the midpoint. Methodical. Buyers held the mid for several hours before an afternoon rally saw price work up near the Tuesday high. We balanced along the high for a bit before ultimately taking out the high during settlement.

Heading into today my primary expectation is for a gap-and-go higher, buyers squeeze up to 15,006.25 before two way trade ensues.

Hypo 2 half gap fill. Sellers work into overnight inventory and close a half gap down to 14,870 before two way trade ensues.

Hypo 3 stronger sellers work a full gap fill down to 14,759.75 before two way trade ensues.

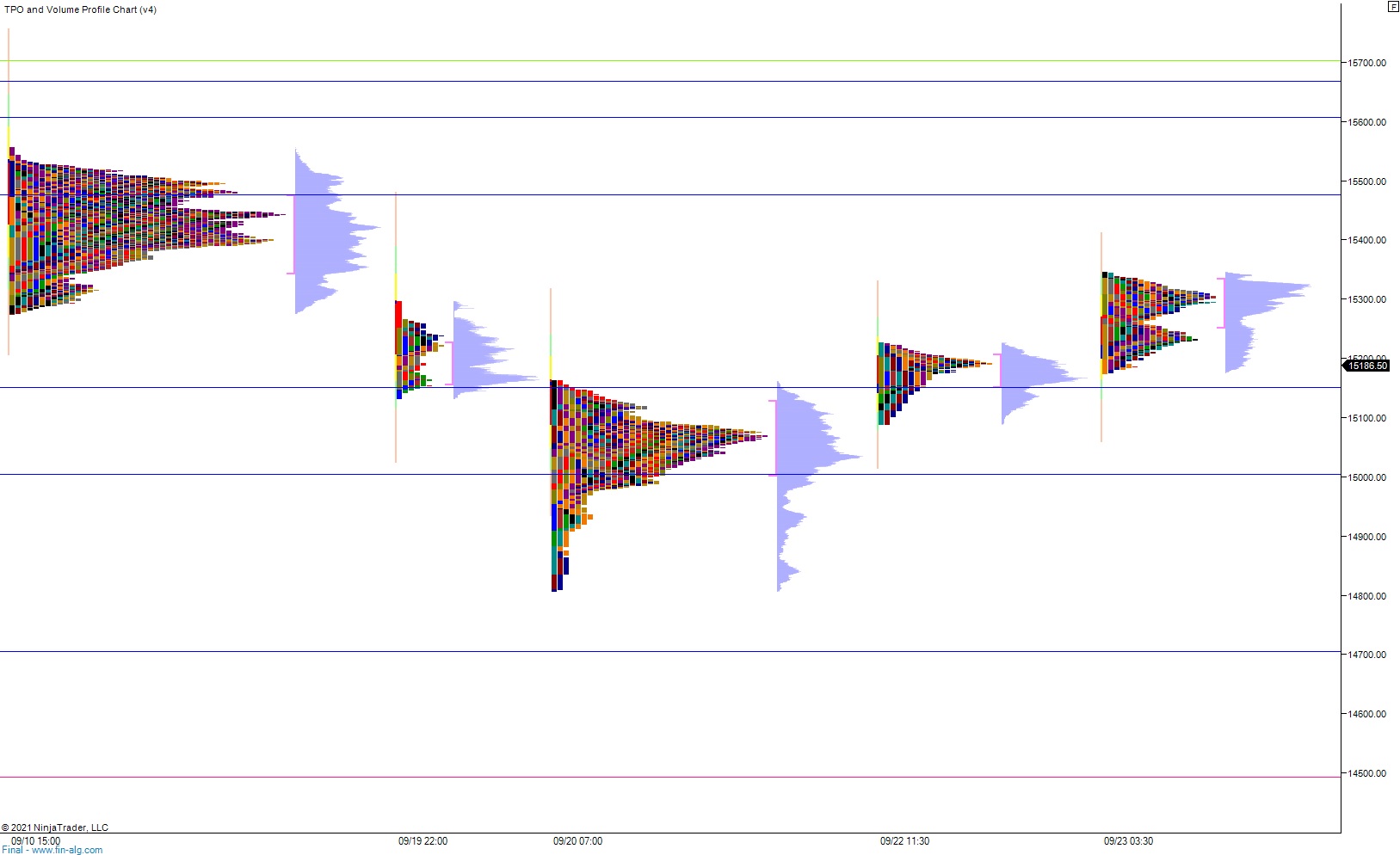

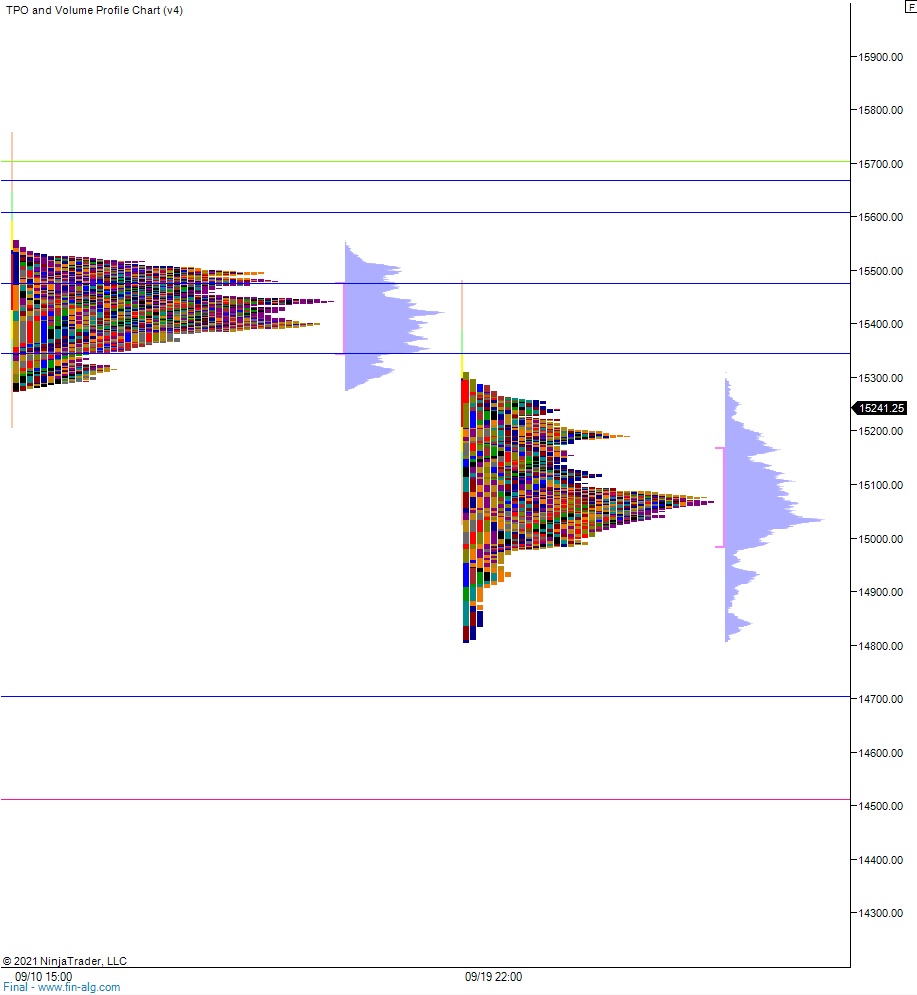

Levels:

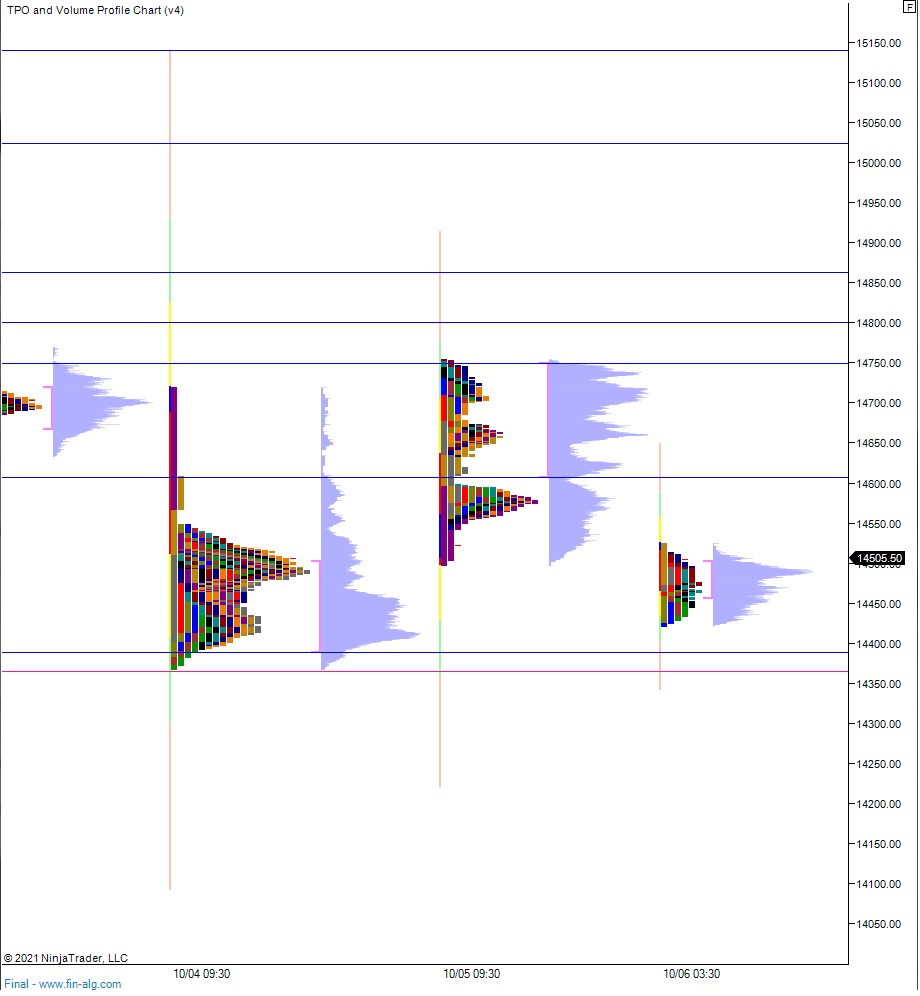

Volume profiles, gaps and measured moves: