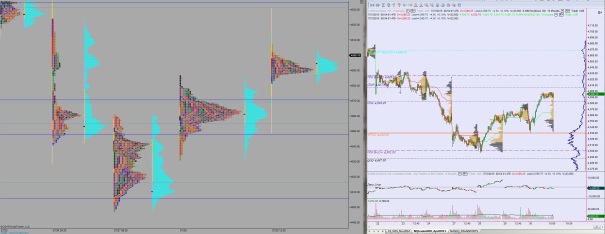

Nasdaq futures are lower heading into Thursday. The overnight session featured balanced price action with all trade occurring inside the range set yesterday. The overnight action reads normal, and heading into cash open we are seeing selling pressure.

At 8:30am we had an economic data dump which included 2ndquarter annualized GDP stats, Personal Consumption figures, and Initial/Continuing jobless claims. The GDP data was lower than expected and showed a bit of inflation. Personal Consumption is on the rise, and jobless claims were mixed. The initial reaction to the news was selling.

Yesterday the market printed a normal variation up day while we heard the latest rate decision from the FOMC. Buyers managed to press nearly halfway up last Friday’s liquidation range before stalling out. The session print has a somewhat blunt looking high (poor high) and a relatively clean looking low (such taper!).

Intermediate term location shows price coming back to the scene of the original breakout—an action referred to as a check back by traders. The idea behind the check back is to test the conviction of the breakout by seeing if a revisit to the prices entices buyers to buck up and bid.

Heading into today, my primary expectation is for sellers to work down through the overnight low 4556.50. Look for buyers to defend around the 4550 region and two-way trade to ensue with a slight upward bias.

Hypo 2 sellers push down through 4450 setting up a test down to 4534.25. If buyers no show here then we continue pushing lower to test our recent value low area 4516 – 4505.25.

Hypo 3 buyers push up through overnight high 4577.75 setting up a run to 4600.

Levels:

Comments »